Amid recent market turmoil, over $100 million in Bitcoin has been liquidated, sparking concerns about potential implications for Bitcoin Exchange-Traded Funds (ETFs). Despite Bitcoin’s drop below key support levels, ETF holders have so far refrained from panic selling, suggesting a cautious stance among institutional investors. However, uncertainties loom as the market navigates through significant sell-offs and impending creditor repayments from Mt. Gox.

$100M Bitcoin Liquidated in Market Turbulence

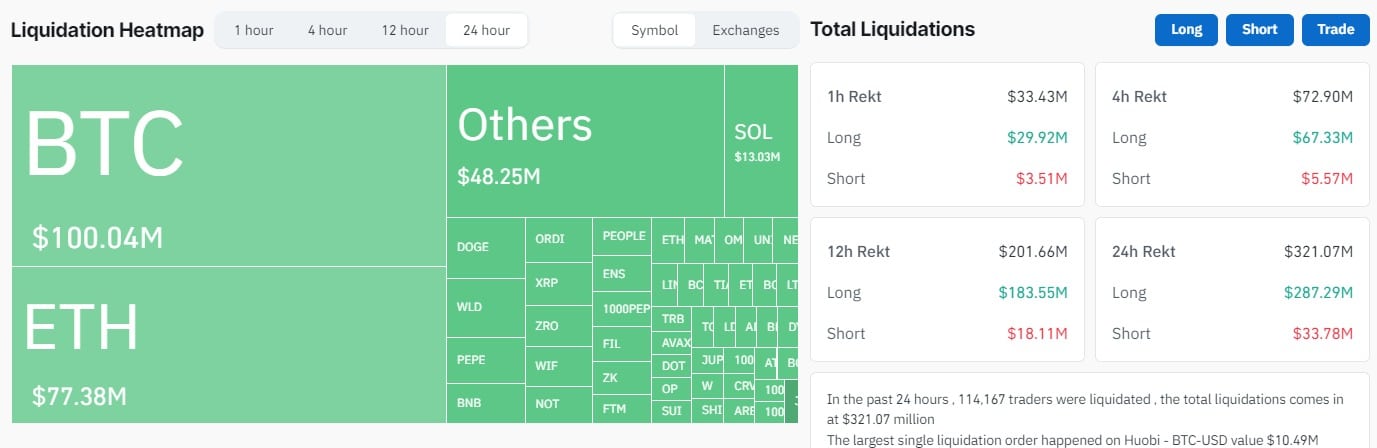

In the past 24 hours, Bitcoin witnessed over $100 million in liquidations, marking a period of intense volatility that pushed prices towards the $57,000 mark. According to CoinGlass data, leveraged long positions accounted for the majority of these liquidations, reflecting widespread investor liquidation amidst a bearish market sentiment.

Bitcoin’s price trajectory saw a decline from highs above $62,000 to lows around $57,043, highlighting three consecutive days of negative price action. Despite a modest recovery to over $57,800, Bitcoin remained down by more than 4.5% on the daily chart, underscoring ongoing market instability and investor caution.

$100M Bitcoin Liquidated,24h, Source: CoinGlass

Bitcoin ETF Resilience and Mt. Gox Repayments

Of particular interest is the reaction from Bitcoin ETF investors, who have seen Bitcoin fall below the average realized buying price of $57,979—a critical support level for market analysts. Despite this, ETF holders have shown resilience, with only $20.5 million in net outflows reported on July 3. According to Farside Investors data, Grayscale’s ETF recorded the largest outflow of $27 million, suggesting a measured response rather than panic selling.

The upcoming Fourth of July holiday in the United States could influence market dynamics, potentially triggering a wave of sell-offs upon investors’ return. Moreover, the imminent Mt. Gox creditor repayments, amounting to over $9.4 billion in Bitcoin, pose additional selling pressure on the market—a factor closely monitored by analysts for its impact on Bitcoin’s price trajectory.

Bitcoin’s 200-Day Trend Break: Market Shakeout Analysis

Technical analysts have noted Bitcoin’s loss of its 200-day trend line for the first time in 10 months, signalling a pivotal moment in the current market cycle. Rekt Capital underscores the significance: “Breakout postponed due to a failed retest of the June Downtrend as new support. This is still the trendline to watch for a shift in the trend going forward nonetheless.”

Conversely, some traders interpret recent market movements as a temporary “shakeout”—a sharp decline followed by a swift recovery, indicative of investor sentiment characterized by uncertainty and rapid market adjustments. Elja Boom, a prominent figure in Bitcoin investment, predicts a potential Bitcoin shakeout based on technical analysis commented in a July 4 X post.

Future Considerations:

Despite current resilience among ETF investors, analysts from 10x Research caution against complacency, citing the possibility of Bitcoin revisiting the $50,000 mark amid accelerated sell orders and market uncertainties. The interplay between institutional investor behaviour, regulatory developments, and macroeconomic factors will likely dictate Bitcoin’s near-term trajectory, shaping investor sentiment and market dynamics in the coming weeks. Maintaining a cautious stance, they emphasize the need for robust risk management strategies amidst evolving market conditions and regulatory scrutiny.

Final Remarks

As Bitcoin continues to navigate through turbulent market conditions, the recent $100 million liquidation event underscores the volatility inherent in cryptocurrency investments. While ETF investors have shown initial resilience, looming factors such as holiday-induced market fluctuations and significant creditor repayments could influence broader market sentiment. Whether Bitcoin consolidates above critical support levels or tests lower price thresholds remains contingent upon ongoing market developments and investor reactions, highlighting the evolving nature of digital asset investments in a dynamic global economy.

In conclusion, while the $100 million liquidation event marks a critical juncture for Bitcoin, the response from ETF investors remains pivotal in shaping future market trends amidst ongoing volatility. The coming weeks will be crucial as stakeholders monitor market reactions and regulatory developments, providing insight into Bitcoin’s resilience and its role in the broader financial landscape. As stakeholders navigate through this period, understanding the implications of Bitcoin’s market behaviour will be essential for informed decision-making in the digital asset space.