According to the source, the 21Shares ONDO ETF filing with the U.S. Securities and Exchange Commission (SEC) marks a bold step in integrating crypto with mainstream finance. Designed to hold ONDO tokens directly, the proposed spot ETF opens the door for broader institutional access to tokenized real-world assets.

Understanding the 21Shares ONDO ETF Structure

The 21Shares ONDO ETF, formally named the 21Shares Ondo Trust, is structured to hold ONDO tokens and track the CME CF Ondo Finance–Dollar Reference Rate. The product will not utilize leverage or derivatives and will permit creation and redemption in both cash and in-kind forms.

Coinbase Custody will serve as the official asset custodian, ensuring secure management of the underlying ONDO tokens. This structure mirrors the model used by recently approved spot Bitcoin ETFs, adding confidence in the product’s regulatory direction.

| Feature | Details |

|---|---|

| Issuer | 21Shares |

| Custodian | Coinbase Custody |

| Asset Held | ONDO Tokens |

| Fund Structure | Spot ETF (no leverage) |

| Redemption Mechanism | Cash or in-kind |

| Reference Rate | CME CF ONDO–USD Rate |

Why the 21Shares ONDO ETF Could Matter

Real-world asset tokenization is gaining momentum, and Ondo Finance has positioned itself as a leader in this space. It focuses on bringing U.S. treasuries, bonds, and institutional funds onto the blockchain. The 21Shares ONDO ETF filing highlights the next stage: making these tokenized assets tradable through traditional market infrastructure.

As Ondo CEO Nathan Allman stated, “We’re building a foundational layer for tokenized securities that can interoperate globally.” With 21Shares backing this ETF proposal, the stage is set for a regulated pathway to exposure.

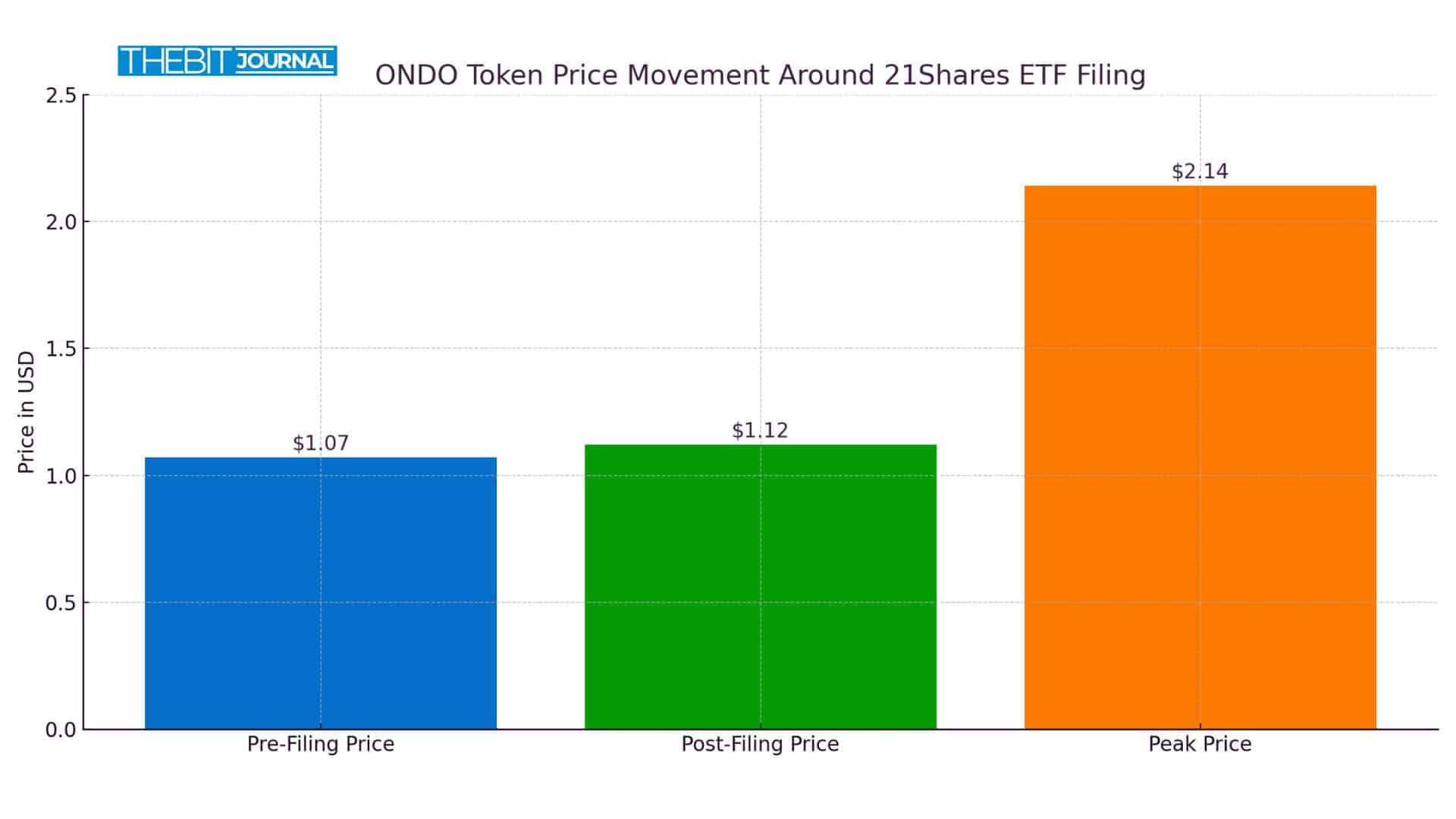

Market reaction was swift. Following the ETF filing, ONDO rose by about 5% and received a listing on Binance US. At the time, the token was trading at $1.12; a modest rebound from its previous high of $2.14. Analysts noted that ONDO’s chart displayed a falling wedge, a formation often associated with bullish reversals.

Institutional Moves Fuel the Momentum

The ETF isn’t 21Shares’ first step into spot crypto offerings. The firm recently filed applications for spot Solana and XRP ETFs, signaling broader ambitions to create regulated investment pathways for digital assets.

Meanwhile, Ondo Finance continues to solidify its infrastructure. The company acquired Oasis Pro, a registered broker-dealer, to streamline tokenized security offerings; a move aimed at aligning with both SEC compliance and institutional standards.

Conclusion

Based on the latest research, 21Shares ONDO ETF represents a strategic advancement in linking regulated investment products with blockchain-based real-world assets. Still on the SEC’s desk for decision-making, the filing represents rising managerial confidence in tokenized finance.

The approval might arguably provide investors with a new access mechanism into the ONDO ecosystem through a familiar financial structure. It thus might help promote the acceptance of crypto-native asset classes further.

Summary

In a regulated spot ETF designed to enhance ONDO token exposure for traditional investors, the 21Shares ONDO ETF filing exemplifies the institutional interest emerging in blockchain finance. CoinBase custody-backed and focused on real-world asset tokenization, the proposal is signaling interest in the institutional community in finance involving blockchain technologies. With Ondo infrastructure maturing and some market reactions already observable, the ETF may provide new avenues for securely, transparently, and compliantly accessing crypto assets.

Also read more about ONDO Finance.

1. What is the 21Shares ONDO ETF?

It’s a proposed spot ETF that will directly hold ONDO tokens and offer exposure to the Ondo ecosystem through public markets.

2. Who will hold the assets?

Coinbase Custody will securely manage the fund’s ONDO tokens.

3. Is this the first tokenized asset ETF?

Yes, it would be among the first ETFs specifically focused on tokenized real-world asset protocols.

4. What is Ondo Finance?

A blockchain platform that tokenizes U.S. treasuries and bonds for institutional-grade investment use.

5. What could this mean for crypto investors?

It opens a regulated way to invest in real-world asset tokens without directly holding them.

Glossary

Spot ETF: An exchange-traded fund that holds the underlying asset (not a futures contract).

Tokenized Assets: Physical or traditional financial assets represented on a blockchain.

Custodian: A third-party entity that safely stores digital assets on behalf of a fund.

CME CF Index: A benchmark pricing system used to track crypto tokens.

In-Kind Redemption: A mechanism allowing investors to exchange ETF shares for actual tokens.

Sources and References