21Shares has announced a 3-for-1 share split for the ARK 21Shares Bitcoin ETF (ARKB), effective June 16. This move aims to increase accessibility and improve trading efficiency for retail investors. The Bitcoin ETF will continue tracking Bitcoin’s price, with no changes to its strategy or total net asset value.

21Shares Splits Bitcoin ETF Three Ways

The issuer 21Shares confirmed the ARKB share split will occur on June 16 and follow a 3-for-1 ratio. This will triple the number of shares while reducing the price per share to a third of its previous value. The total value of investors’ holdings and the ETF’s overall market value will remain unchanged.

This adjustment aims to make shares more affordable for smaller investors who may find high prices restrictive. ARKB closed on June 2 at $104.25, which would drop to around $34.75 post-split. Despite the split, all fund operations and tracking of Bitcoin prices will remain the same.

21Shares also stated that the fund’s structure and Bitcoin holdings will not be affected. The ETF will continue normal trading throughout the transition. The investment strategy tied to the Bitcoin ETF will also stay intact.

ARKB Sees Outflows Despite Strategic Position

While the split targets better retail engagement, ARKB has faced recent performance challenges. The fund has seen six consecutive days of outflows, totaling $430 million by June 2. That day alone saw $74 million leave the Bitcoin ETF, according to CoinGlass data.

Despite recent outflows, ARKB remains among the top Bitcoin ETFs by total inflows since launch. It has recorded aggregate inflows of $2.37 billion, ranking behind only BlackRock and Fidelity’s offerings. ARKB currently holds $4.8 billion in assets under management.

Year-to-date, the Bitcoin ETF has returned 7.35%, reflecting moderate performance amid broader market volatility. The recent trend of outflows aligns with falling Bitcoin prices. As prices dropped 4%, many investors exited Bitcoin ETFs in response.

Bitcoin Price Drop Triggers ETF Outflows

A sharp decline in Bitcoin price has influenced investor behavior across all spot Bitcoin ETFs in the US. Bitcoin fell from over $108,000 to below $104,000 on June 2, prompting widespread redemptions. This led to a total net outflow of $1.2 billion over the past three trading days.

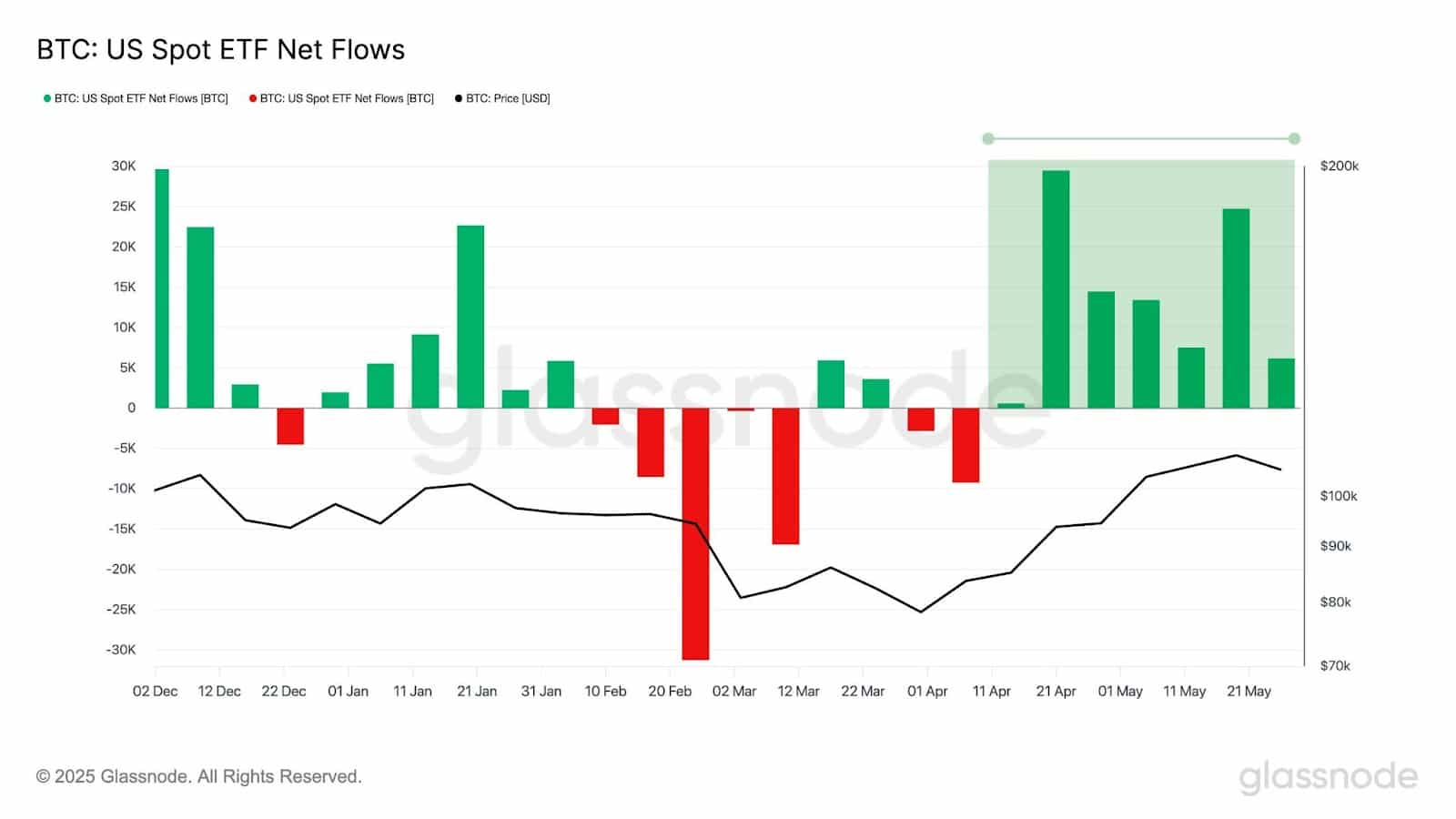

Despite these outflows, data from Glassnode highlights ongoing institutional demand. Over 6,100 BTC flowed into ETFs last week, marking seven consecutive weeks of net inflows. This indicates steady investor interest even during temporary market declines.

The recent price drop has introduced volatility but has not disrupted the structural strategies of major Bitcoin ETFs. ARKB and its peers continue to maintain Bitcoin exposure as per their original frameworks. Market watchers expect fluctuations to persist amid uncertain macroeconomic signals.

FAQs

What is a share split?

A share split increases the number of shares and reduces the price per share without changing the company’s market value.

Why is ARKB undergoing a share split?

The share split aims to make the Bitcoin ETF more affordable for retail investors and improve trading efficiency.

Will the fund’s investment strategy change?

No, the fund’s strategy to track the price of Bitcoin will remain exactly the same post-split.

How does a 3-for-1 split affect shareholders?

Each shareholder will receive three shares for every one owned, while the total value of holdings stays the same.

Will the split impact Bitcoin ETF trading?

No, the ETF will continue trading as usual during and after the share split process.

Glossary of Key Terms

Bitcoin ETF: An exchange-traded fund that tracks the price of Bitcoin and allows investors to gain exposure without owning it directly.

Share Split: A corporate action where a company increases the number of shares while reducing the price proportionally.

Assets Under Management (AUM): The total market value of the investments that a fund or company manages.

Net Asset Value (NAV): The total value of a fund’s assets minus its liabilities, divided by the number of shares.

Spot ETF: A fund that holds the actual asset, such as Bitcoin, rather than derivatives or futures contracts.

References: