Donald Trump’s media company has just thrown down the gauntlet on one of the most solid beliefs in crypto which is that Bitcoin’s bull market peaks a year after each halving. With a reported $2 billion Trump Media Bitcoin purchase, the Trump Media and Technology Group (TMTG) is possibly recalibrating how macro factors like US interest rates and policy impact Bitcoin.

Beyond the Halving: Is the Four-Year Cycle Still Relevant?

Bitcoin’s four-year halving cycle has been the timing compass for investors since day one. Since its inception, the asset has always rallied 12-18 months after each halving and then corrected for a long time. This was last seen in 2021 when Bitcoin went to nearly $69,000 and then dropped into a bear market.

But this cycle is different. After the April 2024 halving which reduced miner rewards to 3.125 BTC per block, BTC has gone from $65,000 to nearly $120,000. And now, with the $2 billion Trump Media Bitcoin acquisition, people are asking: Is the traditional halving framework obsolete?

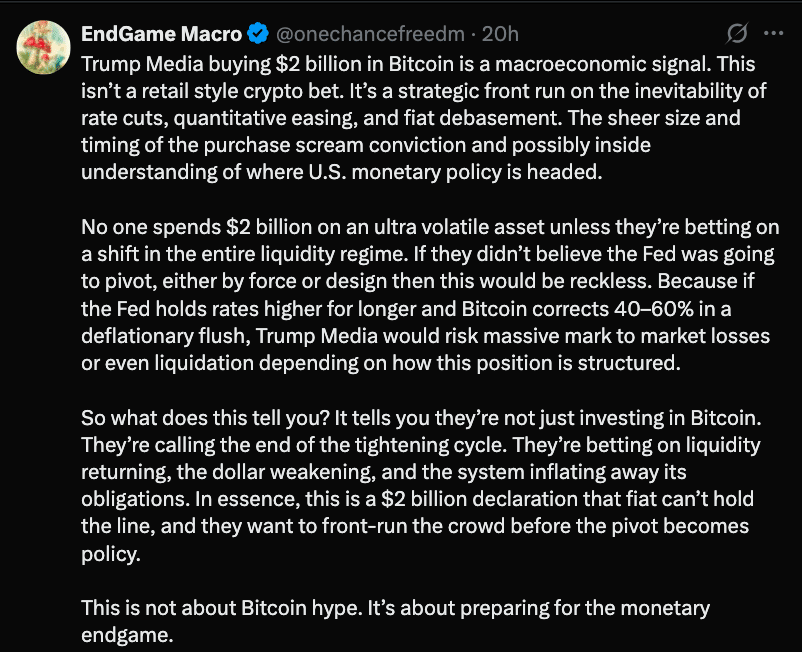

Analyst EndGame Macro noted on X:

“No one spends $2 billion on an ultra-volatile asset unless they’re betting on a shift in the entire liquidity regime. If they didn’t believe the Fed was going to pivot, either by force or design, then this would be reckless.

Because if the Fed holds rates higher for longer and Bitcoin corrects 40-60% in a deflationary flush, Trump Media would risk massive mark-to-market losses or even liquidation.”

Liquidity, Rates, and BTC

This comes as expectations of monetary easing in the US are growing. Goldman Sachs just reiterated their forecast of three 0.25% rate cuts this year starting in September if inflation continues to decline.

Those rate cuts would lower borrowing costs and inject liquidity into the system; a scenario that always favors speculative assets like Bitcoin. For investors, it’s simple: as the cost of capital goes down, risk assets go up. And Trump Media may just be getting set to surf that liquidity wave.

Trump’s repeated attacks on Fed Chair Jerome Powell and 4.25% interest rate signal his frustration. According to recent interviews, he thinks high rates are costing Americans billions.

In short, the Trump Media Bitcoin purchase may be a bet on a bigger monetary shift.

Bitcoin Price Table: Halving vs. Market Events

| Date | Event | BTC Price (Approx.) | Outcome |

| Nov 2012 | 1st Halving | $12 | Surged to $1,200 in 1 year |

| July 2016 | 2nd Halving | $650 | Surged to $20,000 in Dec 2017 |

| May 2020 | 3rd Halving | $8,500 | Surged to $69,000 by Nov 2021 |

| Apr 2024 | 4th Halving | $65,000 | around $119,000 by July 2025 |

| July 2025 | Trump Media’s $2B BTC Purchase | $119,019 | Ongoing market re-evaluation |

This table shows that halving events usually precede bull markets, but Trump Media’s buy has added a new macro catalyst that may change that entirely.

Conclusion

Based on latest research, the Trump Media Bitcoin purchase has opened up a debate about whether the crypto space is seeing the start of a new kind of Bitcoin cycle; one driven not just by internal blockchain mechanics but external political and fiscal dynamics.

Even if Bitcoin cools off later this year, some think 2025-2026 could still be bullish especially if the Fed eases rates and crypto-friendly policy gains traction in Washington.

For in-depth analysis and the latest trends in the crypto space, our team offers expert content regularly.

Summary

Trump Media Bitcoin purchase challenges the long-held belief that BTC always peaks a year after halving. BTC follows a 4-year cycle, but the company’s massive investment may be signaling a new macro-driven market regime. Analysts think this could accelerate BTC’s gains especially with rate cuts and growing pro-crypto sentiment.

FAQs

What is the Trump Media Bitcoin purchase?

Trump Media and Technology Group announced a $2 billion investment in Bitcoin in July 2025.

How will this affect Bitcoin’s price cycle?

The buy may disrupt the traditional halving cycle as political and monetary policy now matter.

Why is this important for crypto investors?

It means increased political acceptance of crypto and may reflect rate cuts, more liquidity.

Glossary

Halving: A scheduled reduction in miner rewards, every 4 years.

Perpetual Futures: Derivatives with no expiration, used for crypto speculation.

Liquidity Regime: The overall amount of capital in the financial system, influenced by interest rates and central bank policy.

Rate Cut: A reduction in a central bank’s interest rate, used to stimulate the economy.

Stablecoin Act: US legislation to regulate stablecoins, could legitimize them.