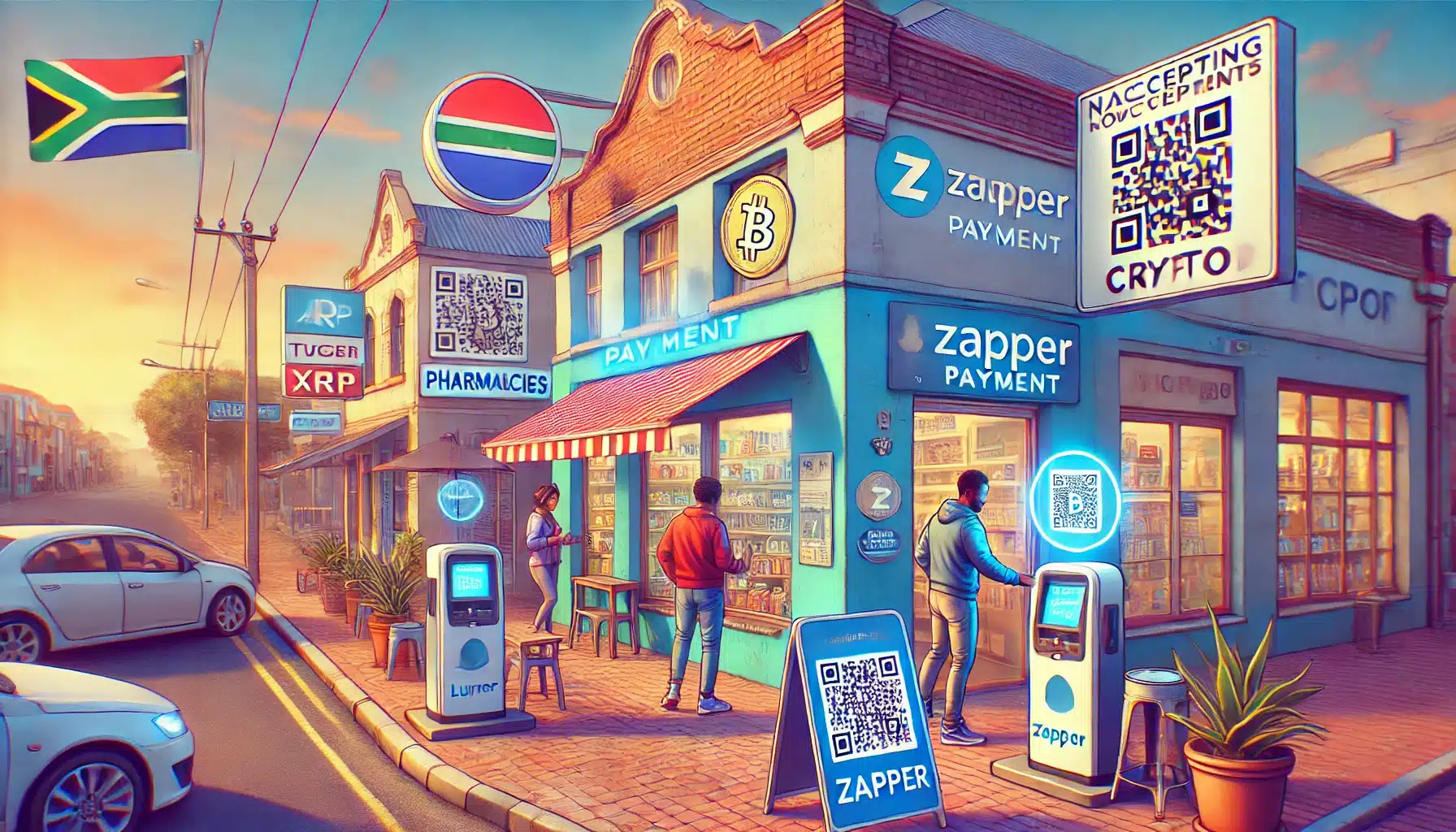

One of South Africa’s largest cryptocurrency exchanges, Luno, has partnered with payment provider Zapper to allow crypto payments at over 31,000 merchants in the country — a significant move for adoption in this highly advanced financial market. This integration represents a key move towards mainstream acceptance of crypto as a means of paying for those everday transactions at places like fuel stations, pharmacies and even airlines such as FlySafair.

Expanding Crypto Use Beyond Investment

Historically, cryptocurrencies such as Bitcoin and Ethereum have most commonly been treated as investment instruments. But that changes everything — as this partnership between Luno and Zapper is transforming the payment of crypto into very real everyday use. With Zapper’s QR codes, South African consumers will be able to scan and easily pay for almost anything both online and at physical merchant locations using their crypto reserves.

Luno business development manager Tarris Arnold says the move gets South Africa closer to the original idea of cryptocurrencies in that they serve as digital currencies for real-world transactions. Being able to pay with that wide a range of merchants using crypto is a great step closer to the original vision of actually being able to pay for goods and services in crypto, said Arnold. This latest functionality, a first-of-its-kind feature, means Luno customers can now transact up to R100 000 (around $5740) per payment.

Zapper’s Network and Merchant Growth

For years, Zapper, an established mobile payments platform in South Africa, allowed merchants to accept payments digitally through the system. The addition of crypto payments integration is in line with Zapper SA’s aim to help businesses open themselves up to more diverse customer opportunities, opening them up now also to Luno’s 5M South African holders. Commenting on the partnership, Zapper CEO Mike Bryer said that he is excited about this collaboration and mentioned that it will help make crypto payments more streamlined for merchants around the nation.

Major categories onboard are pharmacies (such as Dis-Chem), fuel stations, educational institutions and others. Accepting cryptocurrency payments can help these businesses access an increasingly large number of crypto enthusiasts who are keen on using their digital assets beyond speculating.

South Africa’s Broader Crypto Payment Trend

The Luno and Zapper integration comes on the heels of the growing adoption of crypto payments in South Africa. And now other companies are following suit. VALR is another example, having opened up crypto payments on the Geewiz online shopping service more recently. Additionally, South Africa’s biggest retail grocery store chain, Pick n Pay, has been allowing crypto since 2023 and has processed an overall increase in the number of transactions made by using cryptocurrency.

The growing acceptance of crypto payments in South Africa is not happening in isolation. The country’s Financial Sector Conduct Authority (FSCA) began regulating crypto asset service providers (CASPs) earlier in 2024, ensuring that platforms like Luno and Zapper operate within a secure and regulated framework. While the licensing process has been thorough, some have argued that it may hinder innovation. Nonetheless, it has also been welcomed as a necessary step to protect consumers and further integrate digital assets into the mainstream economy.

Conclusion: The Future of Crypto Payments in South Africa

This partnership between Luno and Zapper is a significant step for the crypto in SA region. Luno is making its users buy more of these cryptocurrencies with over 31,000 merchants now accepting payments in BTC, ETH and XRP which further contributes to reshaping the future of digital currencies to be more accessible for transactions at scale. With the growing acceptance of crypto in more sectors, South Africa will become one of the largest markets in this space across Africa.

Ultimately, for those who possess cryptocurrencies, this partnership enables an effortless and secure method to utilize their digital assets at the same time as offering merchants to cater to a more extensive digitally literate audience. Consumers and businesses stand to gain a lot no matter what improvements or changes are made to the increasingly in demand financial technology — crypto payment system. The inquiry still stands: to what extent will digital commerce payments redefine both local and global commerce?

South Africa is in a unique position to address the question as they both have rapidly growing peer-to-peer services, which signifies that policy framework.

Stay in touch with TheBITJournal follow on Twitter and LinkedIn, and join the Telegram channel to be instantly informed about breaking news!