As we enter October 2024, the anticipated crypto market rally has failed to materialize, and uncertain market conditions are causing investors to exercise caution. The ongoing Israel-Iran conflict and the prevailing downward trend have heightened concerns among investors. In light of this, some altcoins may be worth offloading to avoid potential losses. According to The Bit Journal, here are five cryptocurrencies showing signs of a prolonged decline.

Altcoins to Sell in October: Toncoin (TON) and Cardano (ADA)

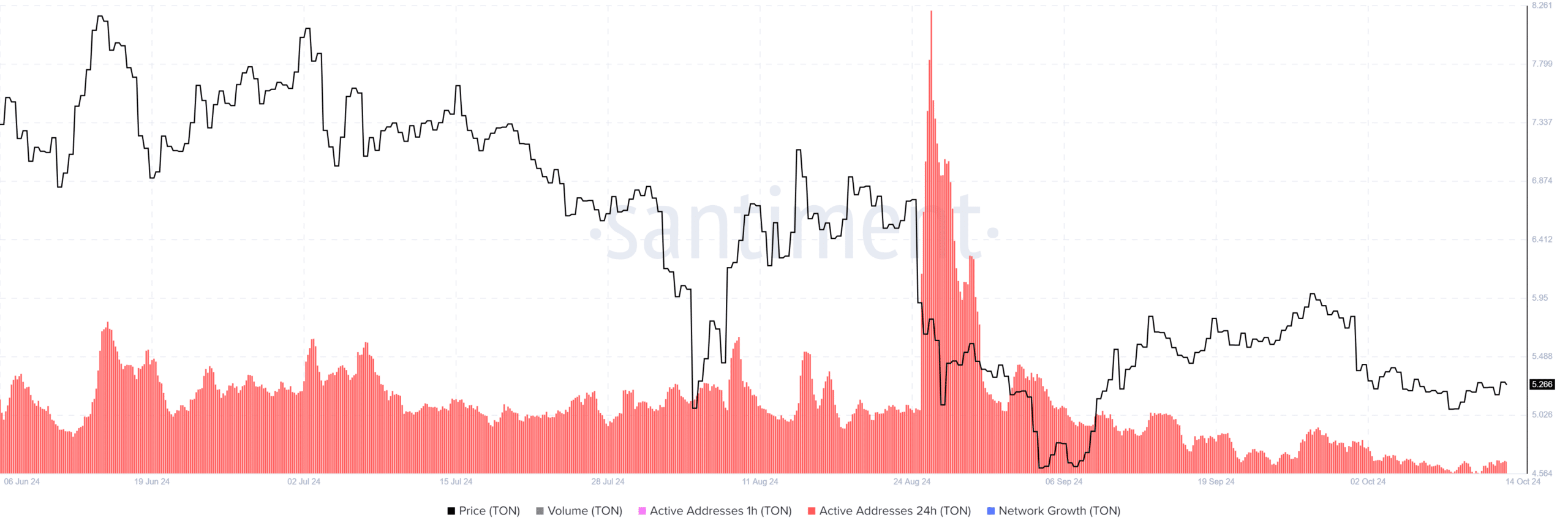

Toncoin (TON), which is associated with Telegram, has seen a significant price drop over the last 100 days, falling from $8.17 to $5.28, a staggering 35% decrease. Since August, the number of active addresses on the Toncoin network has also plummeted from 1,978 to just 207. This decrease in network activity signals that the price may continue to decline, potentially testing the $4.6 support level, which would imply a further 13% drop.

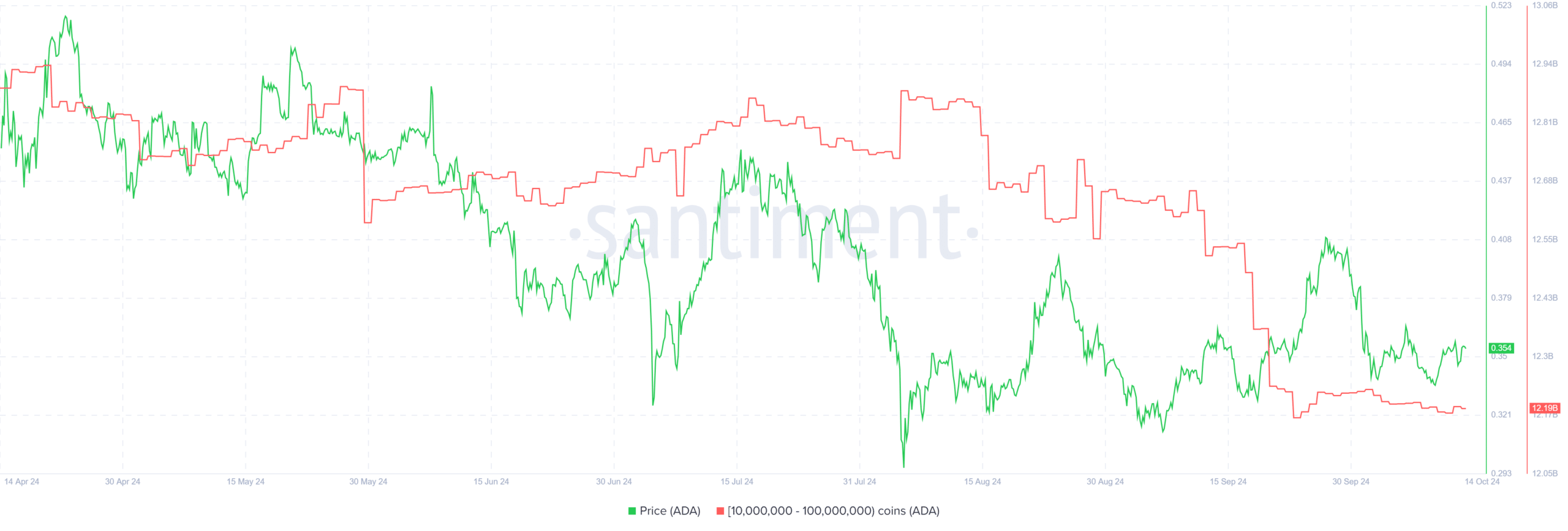

Cardano (ADA), another popular altcoin, has been trading sideways above the $3 support level for the past two months. However, a symmetrical triangle pattern suggests that the current bearish trend may persist. Additionally, large investors, often referred to as “whales,” have reduced their ADA holdings, with wallets holding between 1 million and 10 million ADA dropping by 5%, from 12.86 billion to 12.19 billion ADA. This indicates that further price decreases could be on the horizon for Cardano.

Shiba Inu (SHIB) and Litecoin (LTC) Showing Weakness

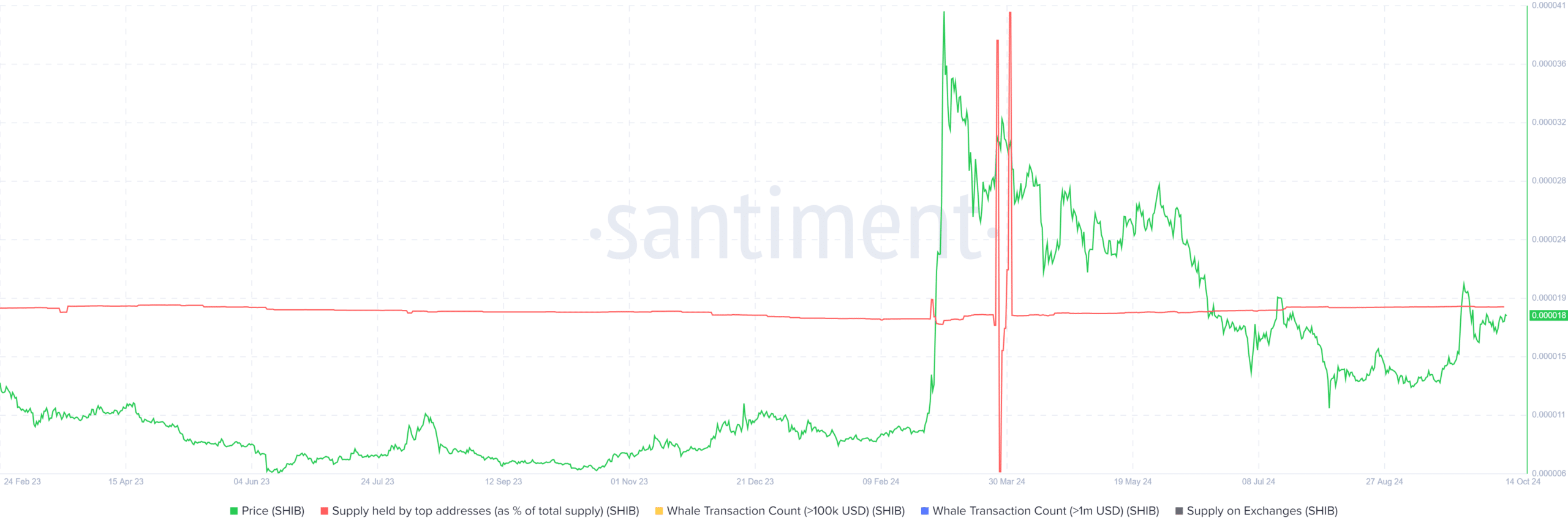

Shiba Inu (SHIB) has struggled to break past the $0.00002 level since June 2024. The high supply of SHIB at this resistance level has kept the price under pressure. Currently trading at $0.000018, SHIB may retest this key resistance, but without significant whale accumulation, its upside potential remains limited.

Litecoin (LTC) has been trading sideways since March 2022. The 30-day Market Value to Realized Value (MVRV) ratio has risen to 27%, signaling that short-term investors have been taking profits. Litecoin could drop below $60, testing the $52 support level in the near future.

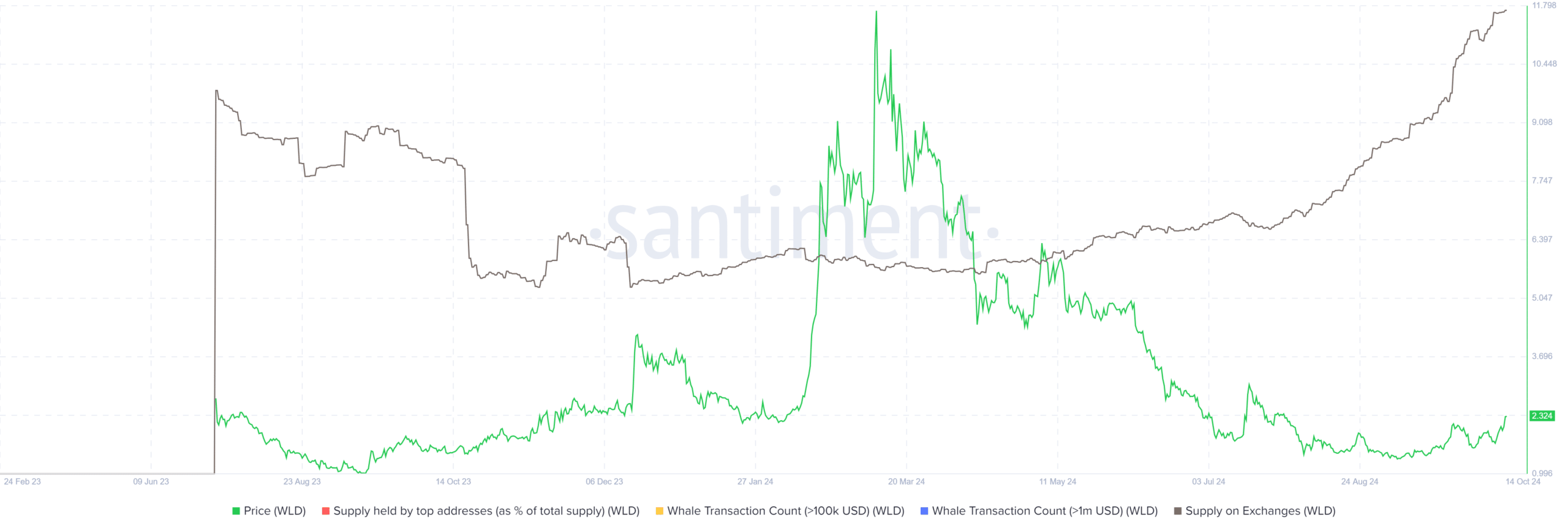

Worldcoin (WLD) Faces Potential Selling Pressure

Lastly, Worldcoin (WLD) has seen a brief rise from $1.27 to $2.385, following a recent breakout. However, the circulating supply of WLD on exchanges has doubled, reaching 72.9 million coins. This surge in exchange supply could lead to increased selling pressure, limiting further price increases. Investors should closely monitor Worldcoin and adjust their strategies based on evolving market conditions.

As the crypto market continues to fluctuate, it’s crucial for investors to stay informed and cautious. Keeping a close eye on these underperforming altcoins and adjusting portfolios accordingly can help minimize potential losses in uncertain times.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!