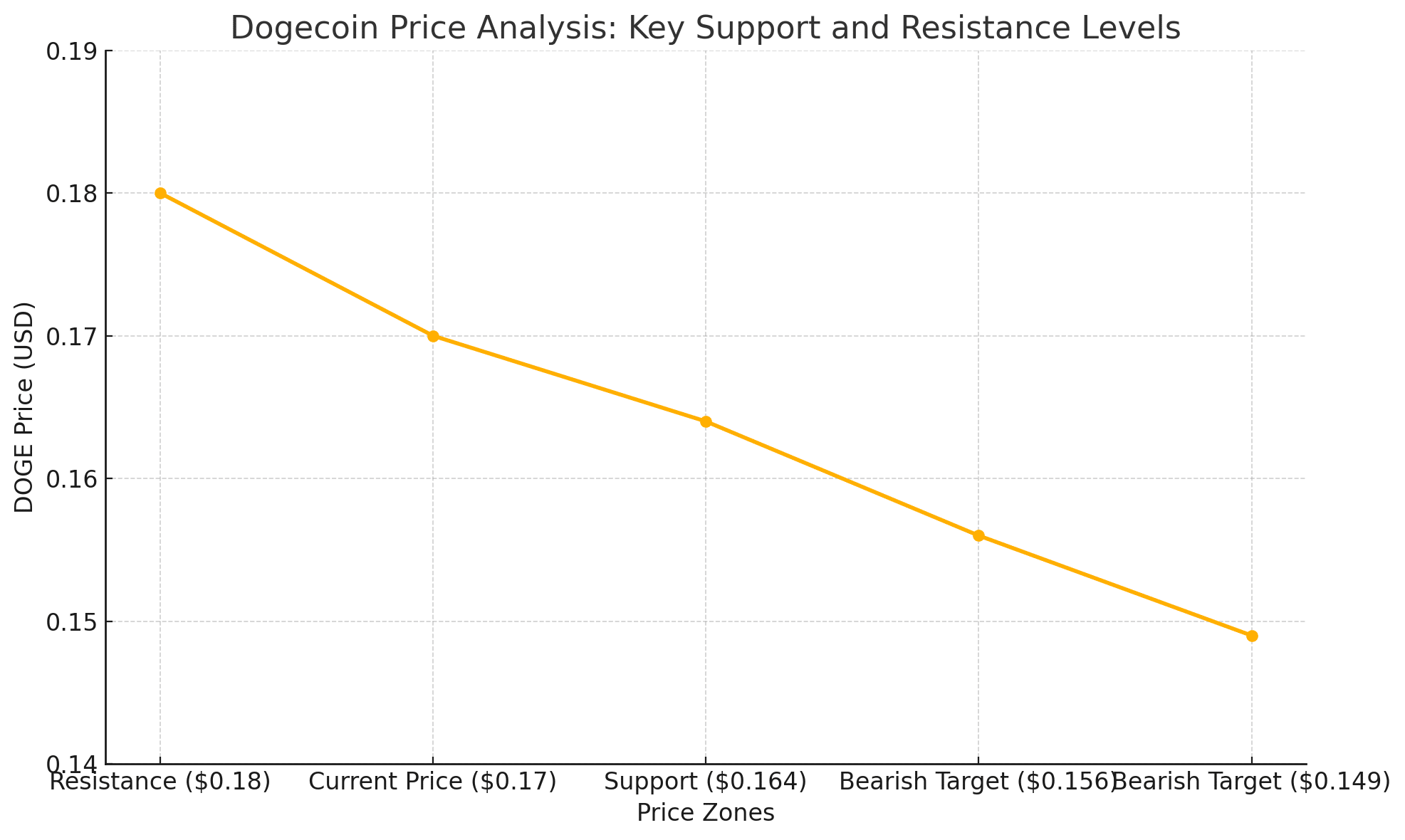

Dogecoin dalls 7% as traders shy away from risk, in the latest Dogecoin price analysis, the meme-fueled cryptocurrency saw a sharp 7% correction, tumbling from $0.176 to as low as $0.164 within 24 hours. This decline is largely attributed to worsening global sentiment, risk-off trading across digital assets, and technical exhaustion after recent rallies.

According to CoinDesk and supporting reports from FXLeaders and TokenPost, the fall in Dogecoin mirrors a broader cooling of investor appetite across high-volatility altcoins and meme coins. With rising geopolitical tensions and hawkish tones from the Federal Reserve, traders are pulling back from speculative assets, DOGE included.

Technical Breakdown: DOGE at a Crossroads

Here’s a closer look at the Dogecoin price analysis based on current chart signals:

| Indicator | Value | Interpretation |

|---|---|---|

| Support Zone | $0.164–$0.17 | Strong buying seen historically at this level |

| Resistance Level | $0.171–$0.18 | Must break above to resume upward trend |

| RSI | ~41 (4H chart) | Near oversold, room for bounce |

| MACD | Neutral | Awaiting momentum confirmation |

| Volume | Declining | Signals hesitation among bulls |

The current dip appears to be a standard retracement after DOGE rallied earlier this month. However, failure to hold $0.164 could expose DOGE to deeper losses toward $0.156 or even $0.149.

Market Sentiment: Fear Overcomes FOMO

One of the key forces behind the downturn is the broader shift to low-risk trading behavior. Bitcoin, Ethereum, and large-cap altcoins have also seen slowing momentum, with BTC failing to reclaim $69K and ETH hovering indecisively near $3,500. Meme coins, traditionally more volatile, are bearing the brunt of the retreat.

In this context, Dogecoin’s 7% drop is not isolated. Shiba Inu (SHIB) also fell nearly 4%, and FLOKI and BONK reported similar slumps. Crypto sentiment indicators on platforms like Alternative.me’s Fear & Greed Index have shifted from “Greed” to “Neutral,” underscoring caution across the board.

Utility Angle: DeFi Integration Could Rescue DOGE

Despite the bearish short-term action, Dogecoin price analysis shows underlying developments that may support future recovery. One notable evolution is the emergence of cbDOGE, a wrapped version of DOGE launched on Coinbase’s Base network.

This enables DOGE to be used within decentralized finance (DeFi) protocols, an important step for a coin historically criticized for its lack of utility. The new integration could expose DOGE to yield farming, liquidity provision, and staking mechanisms, boosting demand beyond speculative use.

According to TronWeekly, the introduction of cbDOGE could “offer the meme coin real-world usage within DeFi, which it has sorely lacked.”

Dogecoin Price Analysis: What Comes Next?

Based on current market behavior, the next few days are pivotal. Here are two possible scenarios from this Dogecoin price analysis:

Bullish Case:

DOGE defends the $0.164 support

RSI bounces from oversold

cbDOGE adoption increases

Price retests $0.176, then $0.1836

Bearish Case:

DOGE breaks $0.164 on strong volume

Meme coin market sentiment weakens

Next supports: $0.156 and $0.149

Final Thoughts: Is It Time to Buy the Dip?

The 7% decline in Dogecoin has rattled retail traders, but it’s not all doom and gloom. The meme coin still holds key structural support and is beginning to pivot toward utility via DeFi integration.

Still, caution is warranted. Until DOGE reclaims $0.171 with strong volume, upside remains speculative. Investors eyeing accumulation should watch $0.164 closely while tracking Bitcoin’s direction and general crypto sentiment.

In short, the current retracement may be an opportunity, a warning. As with any volatile asset, managing risk is key.

FAQs on Dogecoin Price Analysis Drop

1. Why did Dogecoin drop 7% today?

Dogecoin fell due to a combination of low risk-on sentiment, declining trading volume, and bearish technical indicators across the crypto market.

2. What is the key support level for Dogecoin now?

The key support zone for DOGE is between $0.164 and $0.17. A break below this range could signal further downside.

3. Can Dogecoin recover from this dip?

Yes, if it holds above support and benefits from DeFi adoption via cbDOGE, it could rebound. However, recovery depends on broader market sentiment.

4. What is cbDOGE and why is it important?

cbDOGE is a wrapped version of Dogecoin launched on Coinbase’s Base chain, allowing DOGE to be used in DeFi protocols for added utility.

Glossary of Key Terms

Dogecoin (DOGE)

A meme-based cryptocurrency originally created as a joke, now with a large following and real market influence.

cbDOGE

A wrapped version of DOGE token compatible with Coinbase’s Base blockchain, enabling DeFi functionalities.

DeFi (Decentralized Finance)

Financial applications built on blockchain technology that operate without centralized intermediaries, such as banks or brokers.

Support Level

A price level where an asset tends to find buying interest, preventing further declines.

Resistance Level

A price zone where selling pressure typically emerges, limiting upward movement.

MACD (Moving Average Convergence Divergence)

A trend-following momentum indicator used to assess market direction.

RSI (Relative Strength Index)

A momentum indicator measuring the speed and change of price movements, often used to spot overbought or oversold conditions.

Risk-Off Sentiment

A market condition where investors reduce exposure to volatile assets in favor of safer investments due to uncertainty.