Bitcoin finally reached an all-time high of $100,000, putting the other cryptocurrencies far behind. However, this moment of glory sees two contrasting defining forces that come with such a high: the innovative potential on the side of Layer 2 solutions and on the other side, record offloading of Bitcoin from long-term holders.

While Layer 2 technologies promise to reshape BTC’s functionality beyond being “digital gold,” the sell-off of 828,000 BTC by seasoned investors signals possible market turbulence. With questions about sustainability and innovation at the forefront, BTC stands at a crossroads.

Market Under Stress: Long-Term Holder Sell Offs

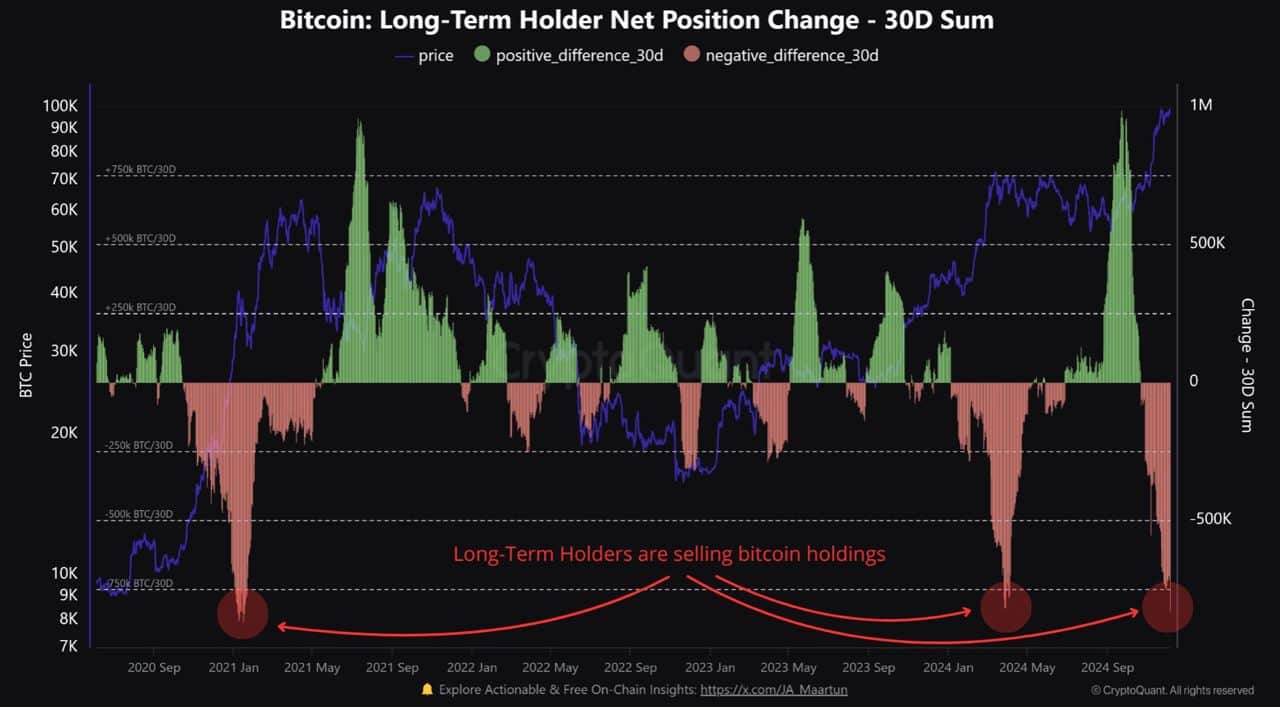

The BTC rally has seen unprecedented sell pressure from long term holders (LTHs) – wallets holding BTC for over 155 days. In 30 days, holders offloaded 828,000 BTC worth $82.6 billion at current prices. This level of activity suggests that some investors are taking advantage of significant unrealized profits.

According to CryptoQuant analyst Maartun, the market is “like a game of musical chairs” as traders put it. The sell-off is rather remarkable when compared with inflows like the purchase by MicroStrategy of 149,800 BTC or Bitcoin ETFs’ allotments of 84,193 BTC. Put together, these inflows add up to no more than 30% of what long-term holders have sold.

Additionally, LTHs’ realized price or average cost of acquisition is $24,481 which means current prices are up 400% on average for these holders. Understandable, perhaps, that some holders are taking profits, but this begs the question of sustainability.

Market Liquidity and Retail Demand

Despite all this, Bitcoin is holding strong. Retail demand is at year highs according to CryptoQuant. Retail futures trading is also up which is helping the market with Bitcoin Open Interest (OI) at $61.2 billion.

However, analysts say deteriorating liquidity may kill the rally. Jamie Coutts, chief crypto analyst at Real Vision says BTC hit new all time highs in a “deteriorating liquidity environment” which means the euphoria may be short lived if things get worse.

Coutts says “Liquidity pressures are a critical factor. If they persist, even the strongest rallies can lose momentum.” Despite the optimism in Bitcoin’s performance, traders should be prepared for possible market corrections.

Layer 2 Solutions Unlock the Potential of Bitcoin

Although the dynamics of the market require alertness, Layer 2 solutions will no doubt pave a more promising way for Bitcoin in the near future. These technologies solve the main limitations of BTC – high transaction cost, low scalability and limited programmability – making it a blockchain for decentralized applications (dApps).

- Lightning Network: Enables fast and cheap micropayments; enables Bitcoin to be used in everyday transactions.

- Stacks and Rootstock (RSK): Introduce smart contracts to Bitcoin; can be used for tokenization, DeFi, and more advanced use cases.

- Emerging Projects: Some of the projects emerging on this include Bitlayer, Botanix Labs, and Rollux, which enhance Bitcoin’s programmability and integrate it better into the larger blockchain ecosystem.

Bitcoin.com also emphasized their support for L2 solutions: “These solutions align with the very essence of Bitcoin when it comes to decentralization and security but fill very real gaps in scalability and functionality.” By upgrading Bitcoin for modern use cases L2 can turn the store of value into an all purpose platform for decentralized innovation.

Bridging Market Challenges and Innovation

Uncertainty and technology go hand in hand, underscoring the complexity of this phase of Bitcoin. L2 solutions show some ways to grow but LTHs are selling. The core strength of BTC as the most secure blockchain provides a solid foundation for L2 adoption. It allows developers and innovators to reshape Bitcoin for its role in the crypto universe using its unmatched security and brand.

However, the sell off also shows the cyclical nature of markets. As Maartuun says “Enjoy the ride, but be prepared when the music stops”. Traders need to be alert and balance optimism with risk management in a fast moving environment.

Conclusion

Beyond the $100,000 journey, both the long term appeal and the emerging problems of BTC are seen. LTHs selling raises questions about the market and L2 solutions show the way forward for growth and innovation.

The community can balance these dynamics through collaboration, tech advancements and responsible market management. Whether through scaling solutions or a trade, the next chapter for Bitcoin will be about its strength and ability to adjust to new situations.

With L2s being integrated and markets managed, BTC can become a corner of decentralized finance and innovation.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.