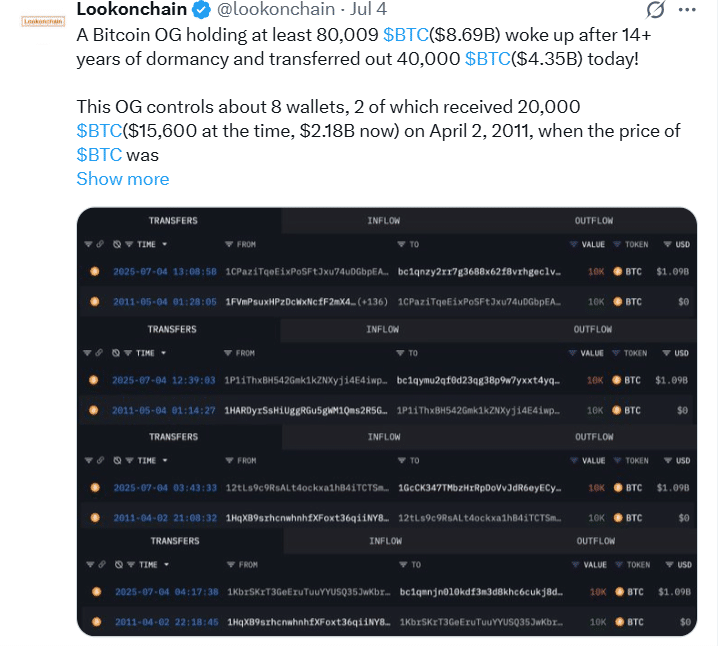

A startling $9.5 billion in Bitcoin whale transactions just shattered a 14-year sleep, triggering anxiety, speculation, and a dramatic price reaction across the crypto market. The wallet in issue, which purportedly goes back to the early Satoshi era, had not transferred a single currency until last week. With almost 80,000 BTC exchanged, the community is wondering if this is the beginning of a big sell-off or simply a smart repositioning.

According to blockchain analytics firm Lookonchain, two batches of 40,000 BTC each were transferred to new wallets, one of which purportedly went to Galaxy Digital, a renowned institutional crypto business. While the cause remains unknown, traders and experts are keeping a tight eye on this historic whale waking, which coincides with other negative macro indications.

Satoshi-Era Bitcoin Comes Alive

The Bitcoin whale transactions were from coins produced in early 2011, when Bitcoin was still less than $1 and mining incentives were substantial. These assets, which had been unused for over a decade, were long thought to be “lost” or the property of inactive early adopters.

“This kind of movement from a Satoshi-era wallet is incredibly rare,” said CryptoQuant’s market analyst, Ali Martinez. “When these coins move, it shakes confidence, not because of fundamentals, but because of psychology and scale.”

Such events frequently have symbolic and market-altering implications, as they indicate probable large-volume selling pressure or a shift in long-term investor behavior. In this scenario, the whale’s abrupt activation occurred just days before a larger 5.7% drop in Bitcoin’s price, fueling suspicion.

Price Impact and Bitcoin Whale Behavior Analysis

As the trades occurred, Bitcoin’s price fell from around $123,000 to below $116,000, wiping billions off the market capitalization. On-chain data revealed an 18% drop in trading volume, indicating that traders were cautious.

Crypto intelligence from AInvest and CoinGabbar revealed that, although some BTC may be moving to custodial solutions or OTC desks, others may be ready for exchange entrance, indicating sell pressure.

A transaction table below outlines the key wallet activities associated with this event:

| Date | BTC Moved | USD Value (Est.) | Destination |

|---|---|---|---|

| July 14 | 40,000 | $4.7 Billion | Unknown (Cold Wallet) |

| July 16 | 40,192 | $4.8 Billion | Galaxy Digital Wallet |

| Total | 80,192 | $9.5 Billion | Traced to 2 wallets |

If this BTC lands on major exchanges like Binance or Coinbase, additional downward volatility could follow. But if held in custodial cold wallets, the market could interpret it as non-threatening repositioning.

Related Developments and Expert Viewpoints

This huge transfer occurs together with macro-crypto changes. An upcoming Bitcoin option expiry worth $9.5 billion, as reported by CryptoPotato, adds to market volatility. When combined with limited liquidity during the summer trading season, significant moves like this tend to magnify price fluctuations.

Analysts are split. According to Michaël van de Poppe, CEO of MN Trading, this does not always indicate a negative trend. “What matters most is where the coins go next, OTC or exchanges.”

Furthermore, stablecoin reserves on exchanges have increased, indicating that purchasing power may soon match any sell pressure. The combination of whale movement and accumulating stablecoin liquidity makes this a critical time for trend reversal observers.

Conclusion: Whale Moves May Trigger a Chain Reaction

Based on the latest research, the Bitcoin whale transactions, totaling more than $9.5 billion, are currently among the most significant in blockchain history. It is unclear if this action is a forerunner to dumping or simply legacy money returning to the current market.

For long-term investors, this highlights the importance of understanding on-chain behavior, whale activity, and macroeconomic relationships. As the market adjusts, it may be prudent to take a cautious yet opportunistic approach.

For more news and crypto insights, visit our platform.

FAQs

1. Why are Bitcoin whale transactions significant?

Because they can influence market sentiment and lead to price volatility due to their size and visibility.

2. Is the $9.5B whale movement a sign of a sell-off?

Not necessarily. It depends on whether the BTC is moved to exchanges or custodial services.

3. What are Satoshi-era coins?

Coins mined in Bitcoin’s earliest years (2009–2011), often associated with early adopters or the mysterious creator.

4. How did the market react to the whale movement?

Bitcoin fell 5.7% and volume dropped 18%, suggesting cautious trader sentiment.

Glossary of Key Terms

Bitcoin whale transactions – Large BTC transfers typically involving early adopters or institutional holders.

Satoshi-era wallet – A Bitcoin wallet that has held coins since the early years of the blockchain.

Custodial wallet – A storage solution where a third party holds private keys on behalf of the user.

Options expiry – A financial event where derivatives contracts mature, often causing price volatility.

OTC desk – Over-the-counter platform for large crypto trades, often avoiding public exchanges.