As per the source, a significant development that has caught the attention of the cryptocurrency community, Mt. Gox, the now-defunct Bitcoin exchange, has transferred approximately 11,834 BTC, valued at around $931 million, to new wallet addresses. This move has reignited discussions about the potential impact on the Bitcoin market, especially concerning sell-off pressures and market stability.

Background: The Fall of Mt. Gox

Established in 2010, Mt. Gox rapidly became the world’s leading Bitcoin exchange, handling over 70% of global Bitcoin transactions at its peak. However, in 2014, the exchange filed for bankruptcy after losing approximately 850,000 BTC, a combination of customer and company funds, due to security breaches and alleged internal malpractices. This event marked one of the most significant crises in cryptocurrency history, leading to increased scrutiny and the eventual establishment of regulatory frameworks for digital assets.

Recent Bitcoin Transfers: Details and Implications

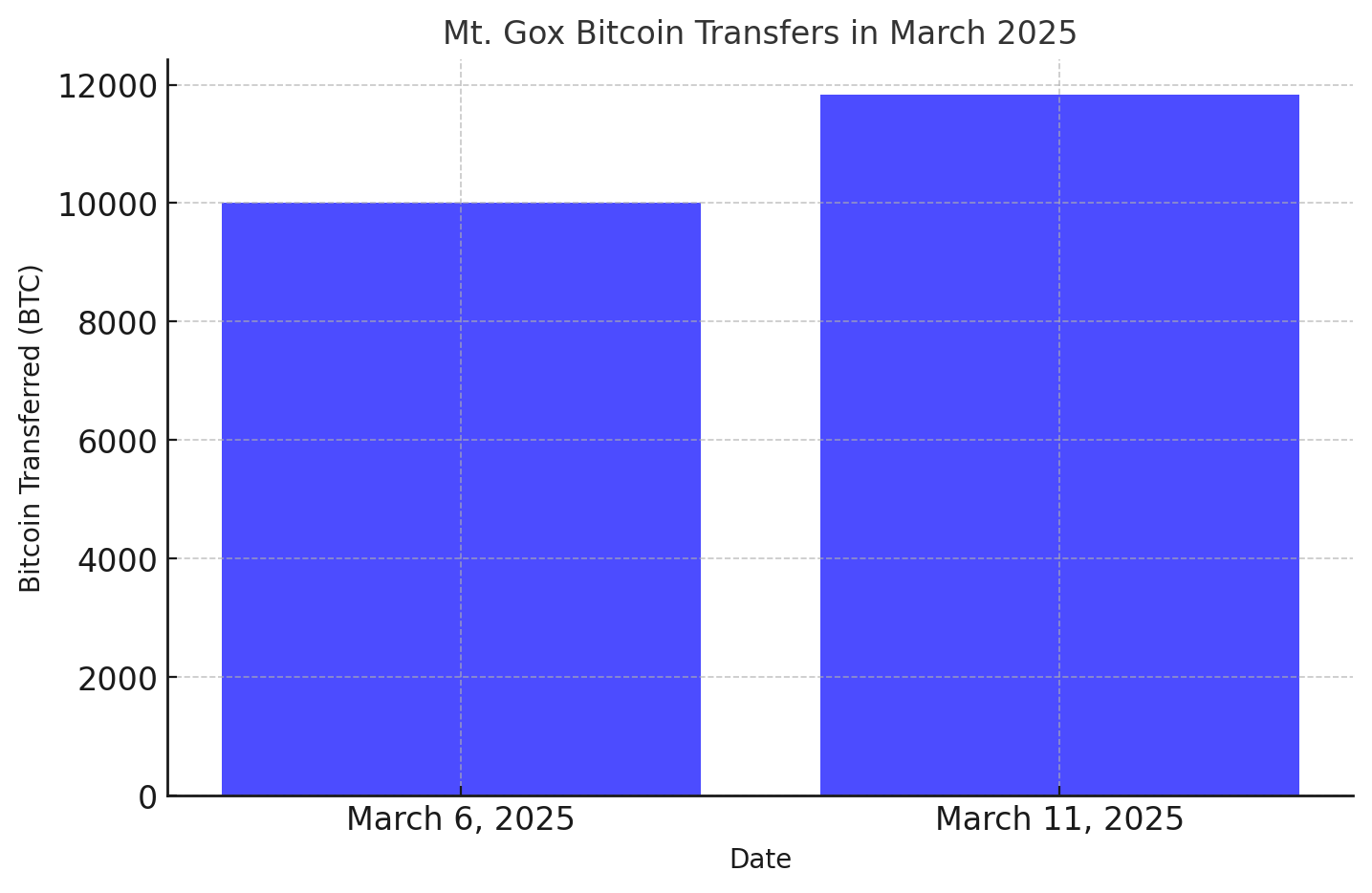

On March 11, 2025, blockchain analysis revealed that Mt. Gox executed two substantial Bitcoin transfers:

- 11,501.58 BTC (approximately $905 million) moved to an unidentified wallet.

- 332 BTC (approximately $26.1 million) transferred to a warm wallet.

These transactions follow a previous movement of over $1 billion in Bitcoin to a wallet labeled “1Mo1n” on March 6, 2025. The recent transfers originated from this wallet, now recognized as an official Mt. Gox address. Post these transactions, Mt. Gox retains approximately 35,915 BTC, valued at around $2.85 billion.

Market Reactions and Concerns

Historically, large-scale Bitcoin movements from Mt. Gox have elicited apprehension among investors, primarily due to fears of increased sell-off pressure that could depress Bitcoin prices. While the immediate market reaction to the recent transfers has been muted, the looming possibility of these Bitcoins entering circulation continues to be a point of concern. Market participants are closely monitoring these developments, aware that any substantial liquidation could introduce volatility.

Ongoing Bankruptcy Proceedings and Creditor Repayments

The bankruptcy proceedings of Mt. Gox have been protracted, with creditors awaiting reimbursement for over a decade. In July 2024, the exchange commenced repayments to its creditors in Bitcoin and Bitcoin Cash, marking a pivotal moment in the rehabilitation process. Out of the 850,000 BTC lost, approximately 200,000 BTC were recovered, with 60,000 BTC sold by the trustee to secure funds. The remaining Bitcoins are being distributed to creditors, with the process expected to continue through 2025.

Potential Impact on Bitcoin’s Price

The reintroduction of a significant volume of Bitcoin into the market poses questions about supply dynamics and price stability. If a substantial portion of the transferred BTC is liquidated, it could temporarily increase supply, exerting downward pressure on prices. Conversely, if creditors choose to hold their reclaimed assets, the impact on the market could be minimal. Investors and analysts are advised to remain vigilant, considering both scenarios in their strategic planning.

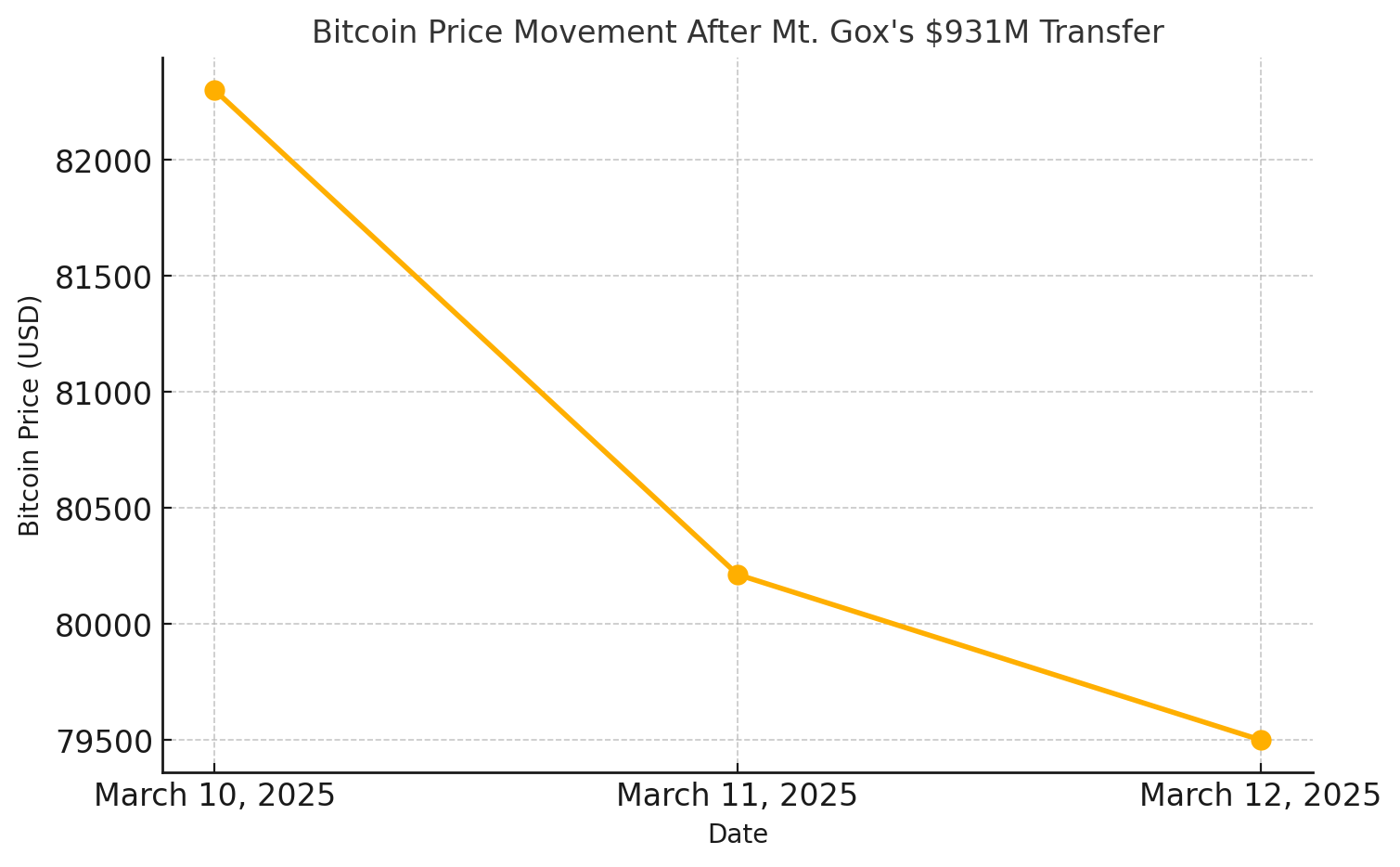

Bitcoin Price Table:

| Date | Bitcoin Price (USD) | Change (%) |

|---|---|---|

| March 10, 2025 | $82,300 | +1.2% |

| March 11, 2025 | $80,213 | -2.65% |

| March 12, 2025 | TBD | TBD |

Current Bitcoin Price

As of March 11, 2025, the price of Bitcoin is approximately $80,213, reflecting a 2.65% decrease over the past 24 hours.

Conclusion

The recent Bitcoin transfers by Mt. Gox have rekindled discussions about market stability and the potential implications of large-scale asset movements. While the immediate effects have been subdued, the situation underscores the importance of monitoring such developments. Investors are advised to stay informed and exercise caution, considering both the historical context and future possibilities as the Mt. Gox rehabilitation process unfolds.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

1. What is Mt. Gox?

Mt. Gox was a Tokyo-based Bitcoin exchange that operated from 2010 until its bankruptcy in 2014. At its peak, it handled over 70% of global Bitcoin transactions. The exchange collapsed after losing approximately 850,000 BTC due to security breaches and alleged internal issues.

2. Why are the recent Bitcoin transfers by Mt. Gox significant?

The transfers are significant due to their substantial volume, totaling approximately $931 million. Such large movements can influence market dynamics, potentially leading to increased volatility if the Bitcoins are liquidated.

3. How might these transfers affect the Bitcoin market?

If the transferred Bitcoins are sold in large quantities, it could increase supply in the market, potentially driving prices down. However, if creditors opt to hold their assets, the immediate impact on the market may be limited.

Glossary of Key Terms

Bitcoin (BTC): A decentralized digital currency without a central bank or single administrator, allowing peer-to-peer transactions.

Wallet: A digital tool (software or hardware) that allows users to store and manage their cryptocurrencies securely.

Warm Wallet: A type of cryptocurrency wallet that is connected to the internet, offering more convenience but less security compared to cold wallets.

Cold Wallet: An offline cryptocurrency wallet, providing enhanced security by keeping private keys away from internet access.

Sell-off Pressure: A market condition where a large number of assets are sold in a short period, potentially leading to a decline in prices.