The cryptocurrency market is currently experiencing significant turbulence, highlighted by a record-setting outflow from U.S. spot Bitcoin ETFs (exchange-traded funds). On February 25, 2025, these ETFs collectively witnessed a net outflow of approximately $937.9 million, marking the largest single-day withdrawal since their inception in January 2024. This event also extends a six-day streak of negative flows, during which over $2.4 billion has exited these investment vehicles.

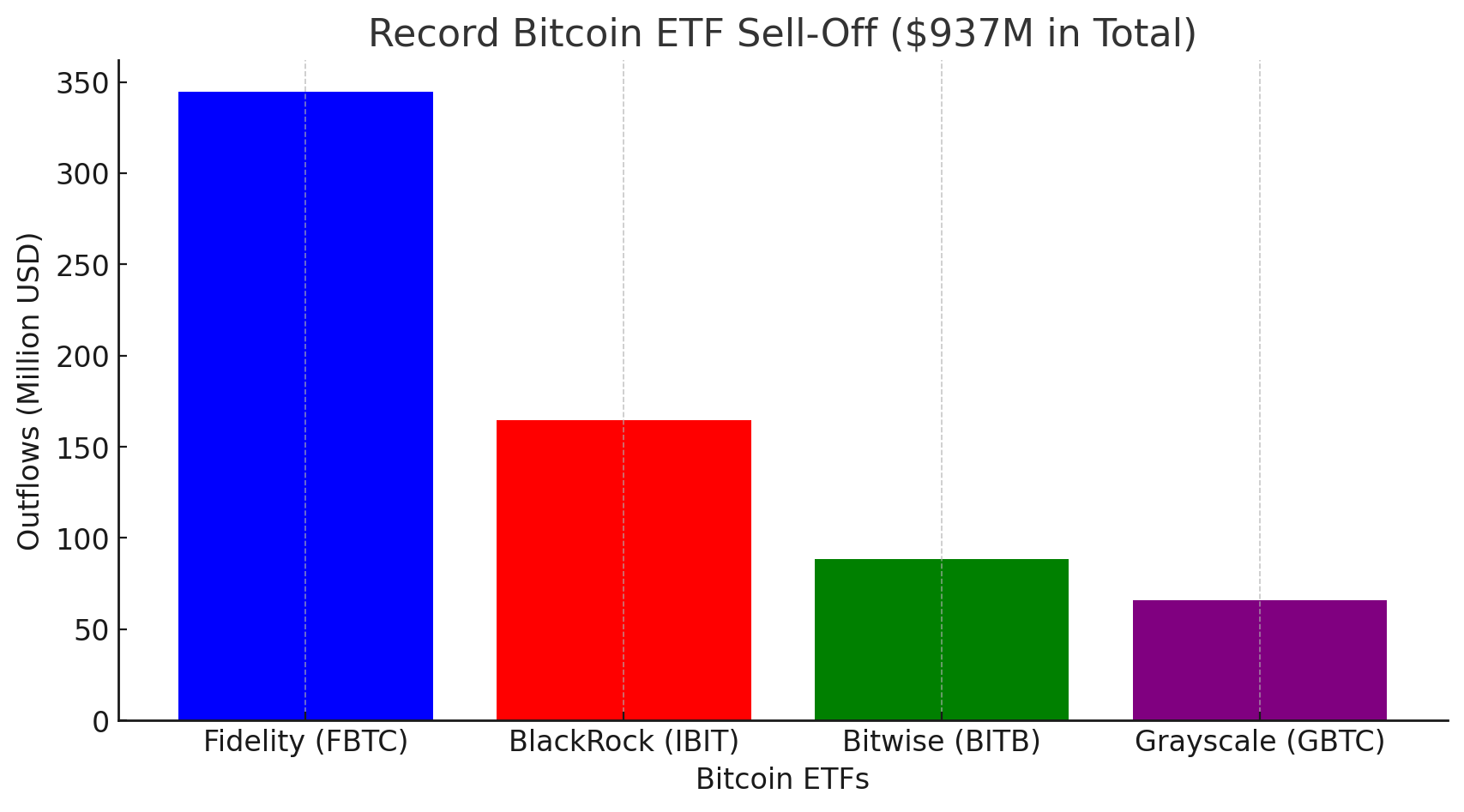

Breakdown of Major Outflows

Fidelity’s Wise Origin Bitcoin Trust (FBTC) led the exodus, which saw an outflow of $344.7 million. BlackRock’s iShares Bitcoin Trust (IBIT) followed closely, with investors pulling out $164.4 million. Other notable outflows included Bitwise’s Bitcoin ETF (BITB) at $88.3 million and Grayscale’s Bitcoin Trust (GBTC) with $66.1 million in redemptions. These substantial withdrawals have raised concerns about the stability and future trajectory of Bitcoin-focused investment products.

Market Factors Contributing to the Sell-Off

Several macroeconomic and market-specific factors have converged to precipitate this significant sell-off:

Macroeconomic Uncertainty: Recent policy announcements, particularly President Trump’s confirmation of impending tariffs on imports from Mexico and Canada, have heightened fears of escalating inflation and potential economic slowdown. Such uncertainties often prompt investors to retreat from riskier assets, including cryptocurrencies.

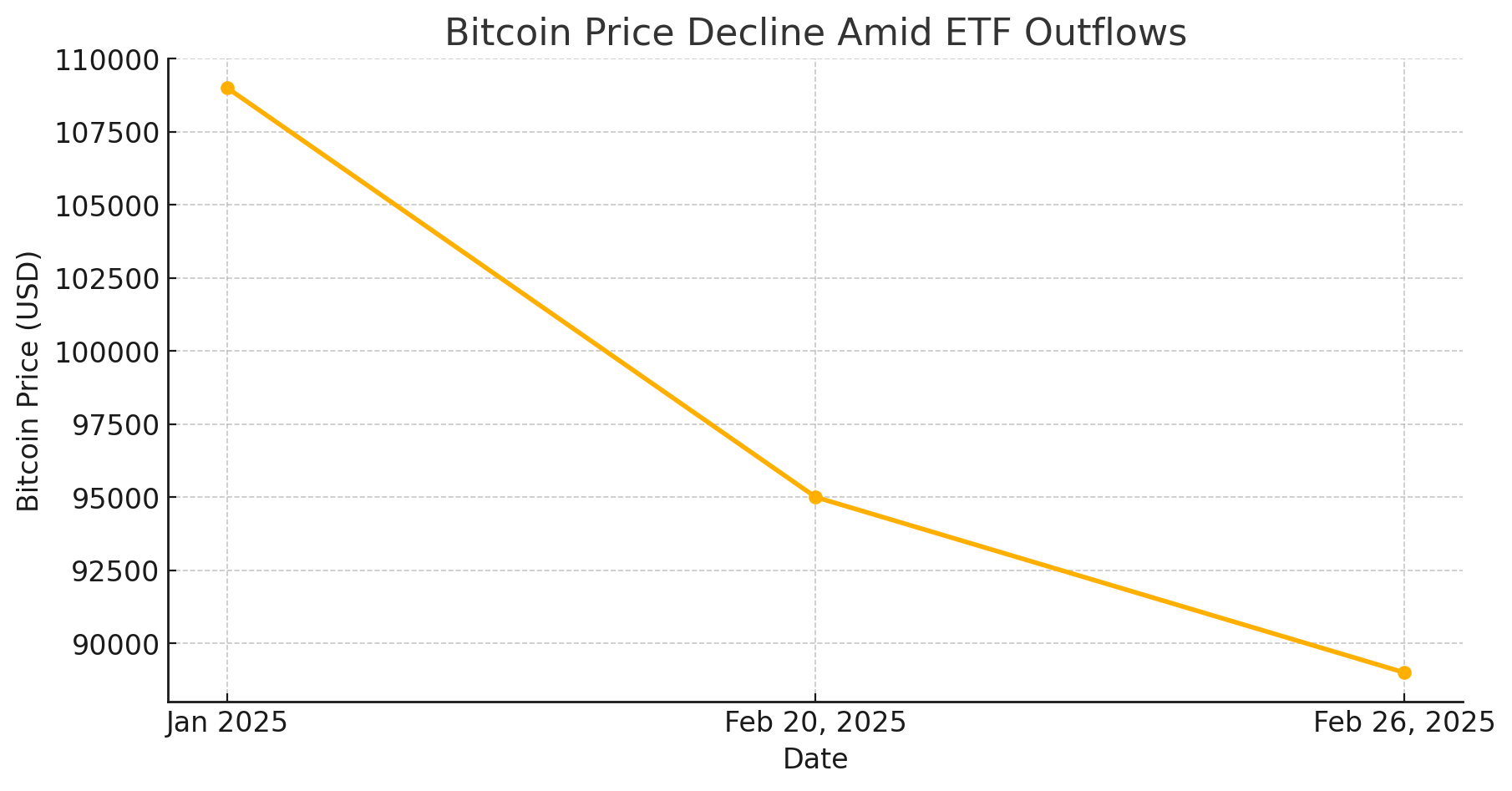

Profit-Taking by Investors: Bitcoin’s impressive rally over the past year, which saw prices soar to an all-time high of $109,000 in January 2025, has led some investors to lock in profits. Analysts have observed that recent selling pressure predominantly originates from individuals who entered the market during the peak, aiming to capitalize on their gains amidst the current market volatility.

Diminished Appeal of Carry Trades: The yield from cash and carry arbitrage strategies, which involve exploiting the price difference between spot and futures markets, has diminished. The annualized premium in CME Bitcoin futures has declined to 4%, making these trades less attractive, especially when compared to the 10-year U.S. Treasury note yielding 4.32%. This shift has prompted institutional investors to reassess their positions in Bitcoin ETFs.

Impact on Bitcoin’s Price and Broader Market Sentiment

The substantial outflows from Bitcoin ETFs have exerted downward pressure on Bitcoin’s price. As of February 26, 2025, Bitcoin is trading below the $90,000 threshold, a significant drop from its peak earlier in the year. This decline has not only affected individual investors but has also led to a broader reassessment of risk within the cryptocurrency market. The Crypto Fear and Greed Index, a metric that gauges market sentiment, has shifted towards “extreme fear,” indicating heightened investor anxiety.

Potential Long-Term Implications

While the immediate outlook appears challenging, it’s essential to consider the potential long-term implications:

Regulatory Developments: The current market volatility may accelerate efforts by regulatory bodies to establish clearer guidelines for cryptocurrency investments, potentially leading to increased institutional adoption once a more stable framework is in place.

Market Maturation: Episodes of heightened volatility and significant outflows can serve as catalysts for the maturation of the cryptocurrency market, prompting the development of more robust financial products and risk management strategies.

Investor Education: The recent events underscore the importance of investor education regarding the inherent risks and volatility associated with cryptocurrency investments, potentially leading to more informed and resilient market participants.

Conclusion on Bitcoin ETFs

The record-setting outflows from U.S. spot Bitcoin ETFs reflect a confluence of macroeconomic uncertainties, strategic profit-taking, and shifts in institutional investment strategies. While the immediate impact has been a notable decline in Bitcoin’s price and increased market trepidation, these events may also pave the way for a more resilient and mature cryptocurrency ecosystem in the long term. As the market continues to evolve, stakeholders must remain vigilant, adaptive, and informed to navigate the complexities of this dynamic financial landscape.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

1. Why did Bitcoin ETFs experience a record $937M outflow?

Bitcoin ETFs saw massive outflows due to macroeconomic uncertainty, investors’ profit-taking after Bitcoin’s recent rally, and a decline in the attractiveness of arbitrage strategies.

2. How has the outflow affected Bitcoin’s price?

The significant withdrawal from Bitcoin ETFs has contributed to downward pressure on BTC’s price, pushing it below $90,000 and increasing market volatility.

3. Should investors be worried about the Bitcoin ETF outflows?

While short-term sentiment is bearish, outflows are part of normal market cycles. Long-term investors should assess macroeconomic trends and regulatory developments before making decisions.

4. What does this mean for the future of Bitcoin ETFs?

Despite the current downturn, Bitcoin ETFs remain a key investment vehicle for institutional adoption. Regulatory clarity and improved market stability could help them recover.

Glossary of Key Terms

Bitcoin ETF (Exchange-Traded Fund) – A financial product that allows investors to gain exposure to Bitcoin without directly owning it, traded on traditional stock exchanges.

Outflows – The movement of capital out of an investment fund, indicating investors are withdrawing their money.

Profit-Taking – The act of selling assets to lock in gains after a price increase.

Macroeconomic Uncertainty – Economic instability caused by factors like inflation, trade policies, or geopolitical events.

Carry Trade Arbitrage – A trading strategy that exploits price differences between spot and futures markets to generate profit.

Crypto Fear and Greed Index – A metric that measures investor sentiment in the cryptocurrency market, ranging from extreme fear (bearish) to extreme greed (bullish).

Sources