The crypto market has entered a turbulent phase as a Pepe Coin whale makes a significant move, selling off billions of PEPE tokens to invest heavily in EigenLayer (EIGEN) tokens. This large-scale portfolio shift has sparked discussions across the market, particularly as it coincides with price drops for PEPE and gains for EIGEN.

Whale Dumps 130 Billion PEPE Whale for EigenLayer

On November 25, on-chain data from Spot On Chain revealed that a massive whale offloaded 74.07 billion PEPE tokens worth $1.53 million, receiving 448.1 ETH in return. Over the past three days, the same whale sold a total of 130.2 billion PEPE for approximately $2.71 million (891 ETH).

Despite this significant sell-off, the whale still holds an impressive 3.241 trillion PEPE tokens, having realized $68.3 million in profits—a remarkable 12.6x return on investment.

Simultaneously, the whale has shifted focus to EigenLayer, purchasing 217,348 EIGEN tokens for 181.3 ETH over the last two days. This investment now totals 1.608 million EigenLayer tokens, valued at $4.31 million, with the whale already sitting on an 11% profit.

Impact on PEPE and EIGEN Prices

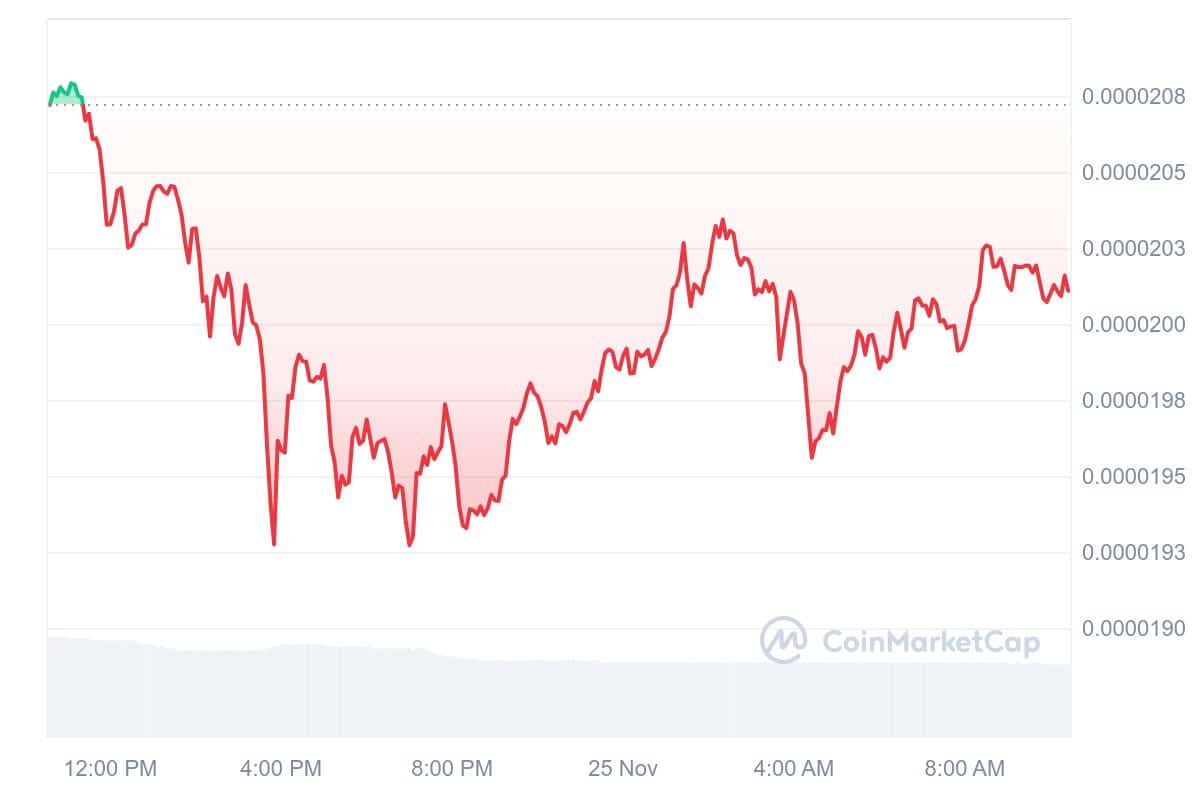

The whale’s large PEPE sales aligned with a dip in the token’s price. PEPE dropped 2% daily and 5% weekly, trading at $0.00002026, with a 24-hour low of $0.00001918 and a high of $0.00002086.

On the other hand, EIGEN saw notable gains, bolstered by buying pressure from the Ethereum-based ecosystem. EIGEN’s price rose by 7% daily and 23% weekly, reaching $3.06, with a 24-hour range of $2.56 to $3.07.

Market Outlook: PEPE’s Potential and EIGEN’s Growth

Despite the dip, analysts remain optimistic about PEPE, projecting a potential rally toward the $0.000025 level due to bullish chart patterns. This contrasts with EigenLayer’s strong upward trajectory, driven by its expanding ecosystem and growing investor interest.

Both tokens remain under close watch as market participants assess their future movements. The Bit Journal will continue to provide updates on this evolving story, offering insights into the shifting dynamics of the crypto market.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!