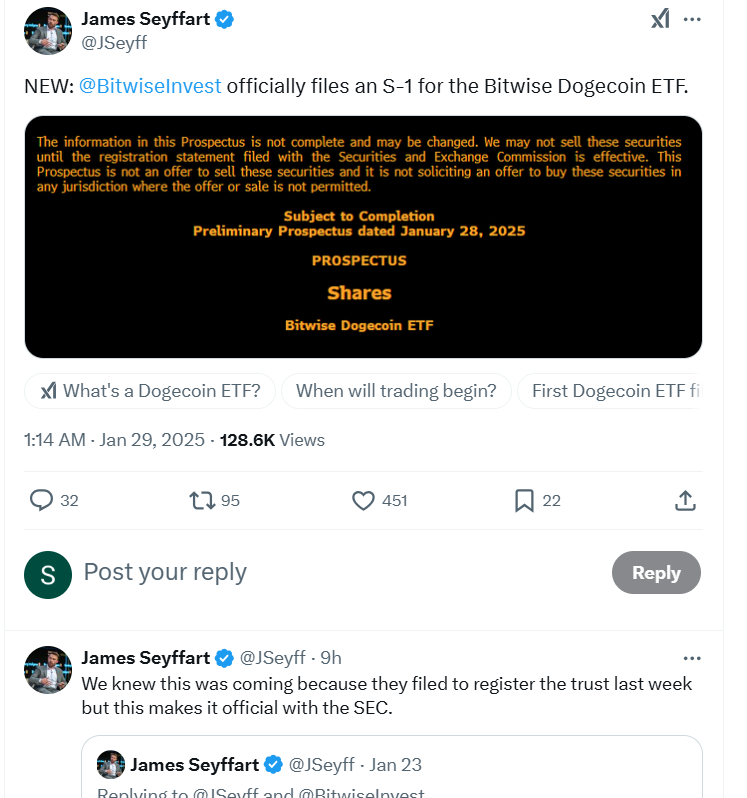

Bitwise Asset Management has officially filed an S-1 registration with the U.S. Securities and Exchange Commission (SEC) to launch a spot Dogecoin exchange-traded fund (ETF). This initiative aims to provide investors with direct exposure to Dogecoin, the eighth-largest cryptocurrency by market capitalization. If approved, it would mark the first ETF of its kind, offering a regulated avenue for investing in this popular meme coin.

Bitwise’s Bold Step into Meme Coin ETFs

Bitwise’s filing distinguishes itself from previous attempts by other asset managers. While firms like Rex Shares and Osprey Funds have also shown interest in launching Dogecoin ETFs, Bitwise’s application under the ’33 Act sets it apart. This act is typically used for commodity-based ETFs, suggesting a physically backed structure. In contrast, filings under the ’40 Act, like those from Rex Shares, involve different regulatory frameworks and investor protections.

Matt Hougan, Chief Investment Officer at Bitwise, emphasized the demand for such a product:

“The reality is that there are a lot of people that want to invest in Dogecoin. It’s the sixth-largest crypto asset in the world by market cap and it trades over $1bn a day.”

Dogecoin’s Market Dynamics

As of January 29, 2025, Dogecoin is trading at approximately $0.32, with a market capitalization exceeding $48 billion. The cryptocurrency has experienced significant volatility, with a 6.85% decline in the last 24 hours.

Technical analysis indicates that Dogecoin is forming a descending triangle pattern on the daily chart, which often precedes a bearish breakout. Traders closely monitor the $0.30 support level; a breach below this could lead to further declines.

Regulatory Climate and Industry Implications

The filing comes at a time when the regulatory environment in the U.S. is becoming more receptive to cryptocurrency-based financial products. The recent appointment of Paul Atkins, a pro-crypto businessman and former SEC commissioner, to lead the SEC under President Trump’s administration has fueled optimism about the approval of such innovative financial instruments.

However, the introduction of meme coin ETFs has sparked debate within the financial community. Bryan Armour, director of passive strategies research at Morningstar, expressed concerns:

“We are moving away from the purpose of capital markets. This type of speculative instrument might make more sense in a casino than in a stock market.”

Looking Ahead

Bitwise’s move to file for a spot in Dogecoin ETF represents a significant development in the intersection of traditional finance and the burgeoning world of cryptocurrencies. If approved, it could pave the way for more mainstream acceptance and investment in digital assets that originated as internet memes. As the SEC reviews this application, the financial industry will be watching closely, as the outcome could set a precedent for future cryptocurrency-based ETFs.

In conclusion, Bitwise’s initiative underscores the evolving landscape of financial products and the increasing integration of cryptocurrencies into traditional investment vehicles. While the potential rewards are enticing, it’s essential for investors to remain cognizant of the inherent risks associated with such speculative assets.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

FAQs

1. What is Bitwise’s Spot Dogecoin ETF?

Bitwise has filed for a physically backed Dogecoin ETF, allowing investors to gain direct exposure to DOGE without holding the asset themselves.

2. How is Bitwise’s filing different from other Dogecoin ETFs?

Unlike previous filings under the ’40 Act, Bitwise’s ETF is registered under the ’33 Act, meaning it follows a commodity-based structure similar to Bitcoin spot ETFs.

3. Will the SEC approve Bitwise’s Spot Dogecoin ETF?

Approval is uncertain, but the pro-crypto shift in the U.S. administration increases the chances of acceptance compared to previous regulatory climates.

4. How would a Dogecoin ETF impact the crypto market?

If approved, it could drive institutional adoption, increase DOGE’s legitimacy, and potentially boost its price due to increased demand.