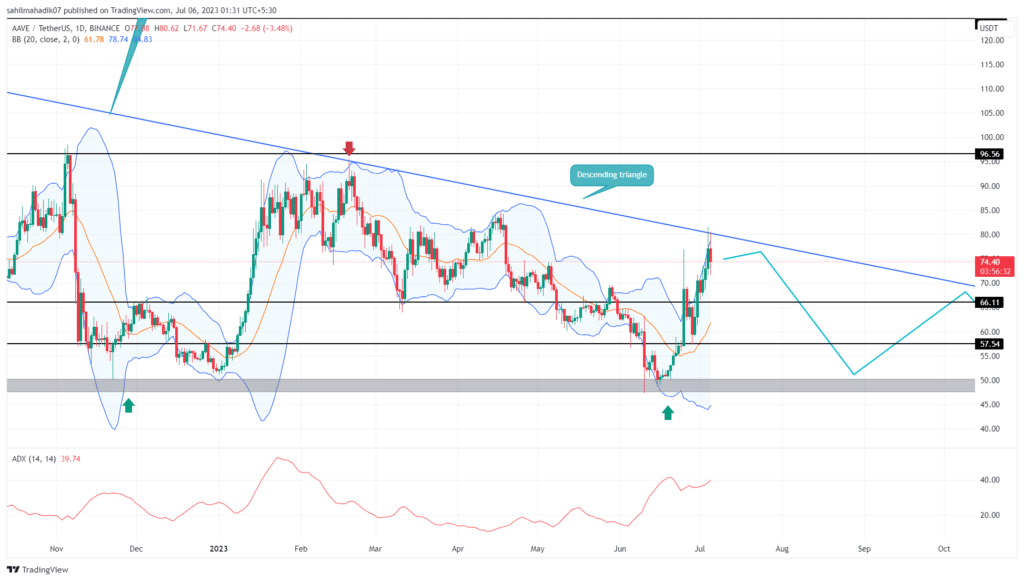

Aave has recently experienced a notable surge in its token price, spurred by increased whale activity and the launch of Aave V3.1. This development marks a significant milestone for the protocol, highlighting its growing influence and the market’s optimistic outlook. Currently, Aave Price and tokens are trading around $111, reflecting a robust 7% increase within just 24 hours. Over the past week, the Aave price has appreciated by 18%, signaling a strong upward trend driven by both market dynamics and recent protocol updates.

Whale Accumulation Fuels Aave’s Momentum

One of the key factors behind recent Aave price surge is heightened whale activity. Reports indicate that significant transfers of AAVE tokens have occurred recently. For instance, prominent whale accounts have moved substantial amounts of AAVE from exchanges, which has significantly impacted the market. Notably, the address 0x9af4 transferred $1.23 million worth of AAVE (11,185 tokens) to Binance, while another address moved 21,619 tokens, totaling over $2.38 million in transfers. Furthermore, the address 0xd7c5 has withdrawn 26,044 AAVE, equivalent to more than $2.83 million, from Binance.

This large-scale accumulation by whales has created considerable buy-side pressure, contributing to the 7% price increase observed in the past 24 hours. Such movements often indicate a bullish sentiment among major investors, suggesting confidence in Aave’s future prospects.

Impact of Aave V3.1 Launch

The launch of Aave V3.1 has also played a crucial role in driving Aave’s recent performance. The protocol’s total value locked (TVL) now stands at approximately $22 billion, with $19.9 billion on Aave V3 and $1.9 billion on the V2 chain, according to DeFiLlama. The latest update, V3.1, introduces several improvements aimed at enhancing the protocol’s security, usability, and operational efficiency. These upgrades, approved by Aave DAO governance, reflect the protocol’s commitment to innovation and long-term growth.

Aave Labs has also outlined a vision for Aave V4, expected by 2030, demonstrating a forward-looking approach and a focus on sustained development. The enhancements brought by V3.1 are designed to address critical aspects of DeFi, including security and user experience, positioning Aave for continued success in a competitive landscape.

Aave Price: Market Position and Strategic Outlook

Recent Aave price movements and protocol upgrades have solidified its position as a leading player in the DeFi sector. The protocol’s ability to attract substantial investments and maintain a high TVL across multiple versions underscores its market dominance. As the DeFi space evolves, Aave’s resilience and strategic initiatives will be crucial in maintaining its competitive edge. The proposed fee swap program, advocated by Aave founder Marc Zeller, could further enhance the token’s appeal. This initiative aims to increase demand for AAVE tokens through a buyback scheme, potentially driving long-term value. Such strategic moves reflect Aave’s proactive approach to market dynamics and investor engagement.

Future Prospects and Roadmap

Aave’s roadmap highlights ambitious plans for future growth and innovation. The development of Aave V4 by 2030, along with ongoing enhancements to the protocol, demonstrates a commitment to maintaining leadership in the DeFi space. The multi-version approach, with significant TVL distributed among V1, V2, and V3, allows for stable upgrades and continuous improvement without forcing users to switch platforms.

The resilience shown by Aave, coupled with strategic initiatives and technological advancements, positions it well for future expansion. The protocol’s ability to adapt and innovate in response to market trends and investor needs will be crucial as the DeFi landscape continues to evolve.

In conclusion, recent Aave price surge, driven by whale activity and the V3.1 launch, underscores its robust position in the DeFi market. The protocol’s ongoing commitment to innovation, coupled with strategic upgrades and investor confidence, suggests a promising future. As Aave price navigates the dynamic DeFi landscape, its ability to maintain a substantial TVL and attract major investors will be key to its long-term success. The market will be watching closely to see how Aave continues to evolve and adapt in the ever-changing world of decentralized finance. TheBITJournal for comprehensive insights into the latest developments shaping the cryptocurrency industry.