According to on-chain data, Aave’s DAO treasury has hit a record $125 million. This is a whooping 123% year-over-year increase which shows better revenue performance and protocol stability. However, will Aave’s token price move outstandingly in correlation with this Aave treasury milestone? As ETH goes up, will Aave ride its coattails or remain dependent on broader market flows?

Behind the Numbers: Aave’s Treasury Hits a New High

Just recently, Aave’s DAO treasury surpassed $125 million in non-native assets. That is excluding the AAVE token itself, giving a more accurate representation of actual reserves. According to DeFiLlama, the treasury is currently composed of 44% stablecoins, 41% ETH and 15% other DeFi tokens like BAL, CRV and MKR.

This treasury structure is a dual approach to risk management and growth. The stablecoins provide insulation during market downturns and the ETH and DeFi token holdings keep Aave set for yield generation and DeFi integrations.

Surge in Active Addresses: Early Signal or Short-Term Blip?

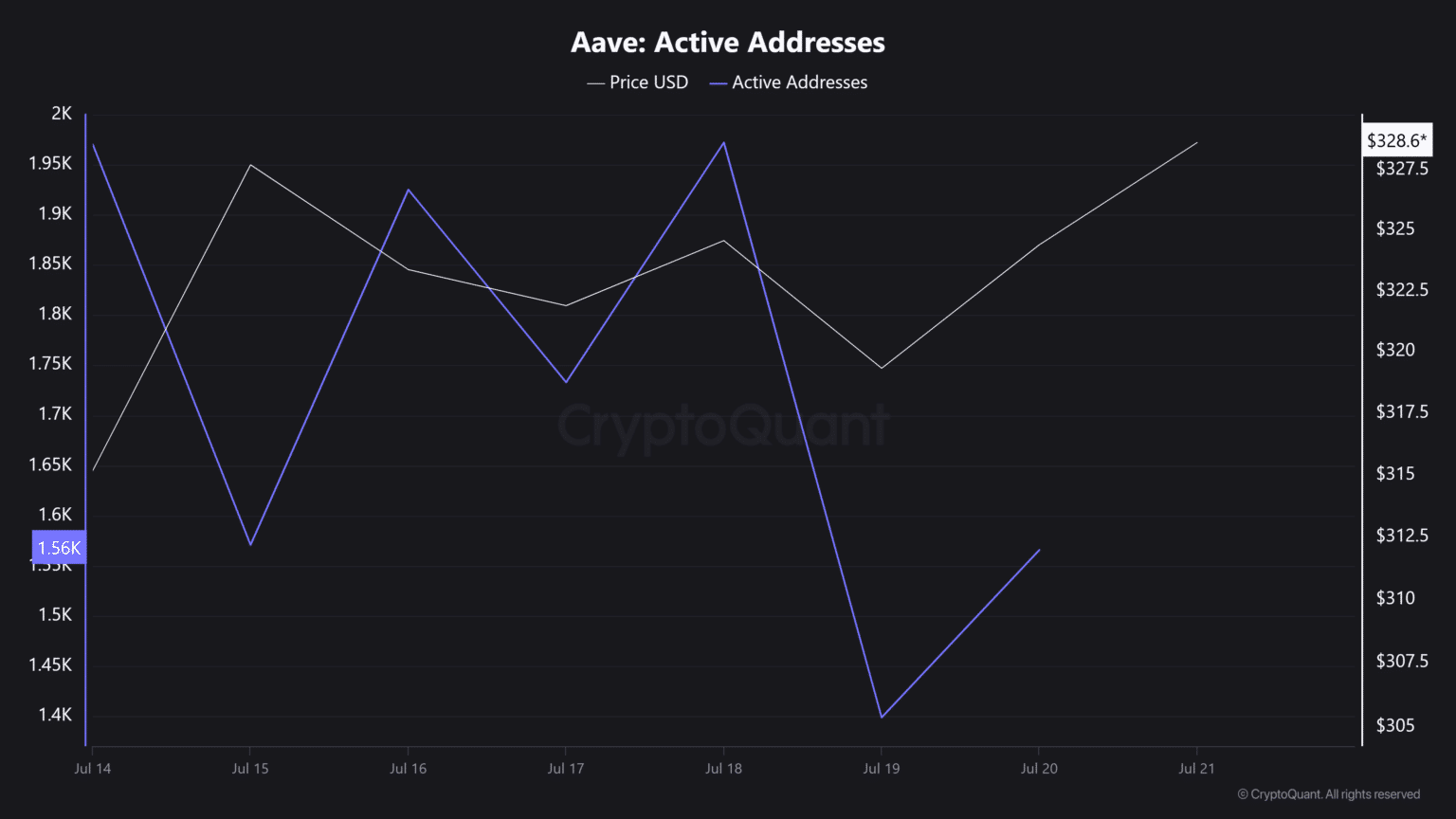

According to Santiment, AAVE’s daily active addresses surged 30% after the treasury milestone was announced. While address spikes don’t always correlate with price increases, they often do when sustained over several days.

In Aave’s case, the rise could be retail and institutional interest as confidence returns to DeFi. This is especially relevant given the recent trend of capital rotation from Bitcoin into altcoins and DeFi assets.

A further boost may come if Ethereum continues to rise, especially as Aave deploys on Layer 2s like Base and zkSync Era.

Ethereum’s Performance Will Define Aave’s Path

While Aave’s treasury numbers are impressive, market watchers say AAVE’s token price still depends heavily on Ethereum’s momentum. ETH’s price moves often trigger cascading effects across DeFi protocols, especially lending protocols.

In previous times, when ETH goes up, borrowing activity increases as users seek leverage. Aave, which allows users to deposit ETH and borrow against it, benefits directly from this.

Data from Token Terminal shows 12.6% increase in Aave’s 7 day active users since ETH broke above $3,700 last week. Borrowing volume also went up 10% week over week, with ETH loans accounting for most of it.

So far, Ethereum’s fundamentals, such as growing validator count, EIP-4844 progress, and deflationary pressure from base fees, are good for DeFi participants. This is good for protocols like Aave that are deeply integrated into the Ethereum ecosystem.

Treasury Diversification: Smart Hedge or Overcaution?

One of the unique features of Aave’s treasury is its diversification. While some DAOs hold their native tokens almost exclusively, Aave has allocated its reserves to a broader set of assets.

As of July 2025, the reserve composition includes:

| Asset Class | % of Treasury | Approx. Value ($) |

| Stablecoins (USDC, USDT, DAI) | 44% | $55M |

| Ethereum (ETH) | 41% | $51.25M |

| Other DeFi tokens | 15% | $18.75M |

This diversification reduces volatility, improves liquidity management and allows treasury assets to be deployed for future incentives, upgrades or risk buffers.

But some say too much allocation to stablecoins limits upside during bull runs. However Aave’s consistent yield generation and protocol upgrades suggests something more.

Conclusion: Can Treasury Strength Translate to Price Momentum?

Based on the latest research, Aave Treasury strength alone isn’t enough to move AAVE’s price but it’s a good base for future growth. Ethereum’s performance is the biggest external driver. If ETH holds, AAVE could see increased borrowing and rising protocol revenue. For now, DeFi investors are advised to watch Aave not just what it has accumulated but how it will deploy it.

Stay up to date with expert analysis and price predictions by visiting our crypto news platform.

Summary

Aave’s DAO treasury has hit $125 million, up 123% year-over-year, mostly due to revenue growth and Ethereum’s recent price rise. The treasury is 44% stablecoins, 41% ETH and 15% DeFi tokens. AAVE’s price is tied to Ethereum’s trajectory. Increased ETH borrowing activity means more revenue for the protocol and potentially more value for AAVE.

FAQs

What’s in the Aave treasury?

As of July 2025, 44% stablecoins, 41% ETH and 15% other DeFi tokens. Diversification means risk balance and operational flexibility.

How does Ethereum impact Aave?

Aave’s performance is tied to Ethereum’s price. As ETH goes up, borrowing demand increases on the protocol and revenues go up and potentially AAVE’s value.

What is the significance of the $125 million treasury?

The treasury milestone means Aave has financial maturity and can grow through cycles. It’s long term sustainability and user confidence in the protocol.

Glossary

DAO (Decentralized Autonomous Organization): A governance model where decisions are made by token holders not centralised leadership.

Treasury: A protocol’s fund reserve, often used for development, liquidity or incentive programs.

Stablecoins: Cryptocurrencies pegged to stable assets like USD to reduce price volatility.

Borrowing demand: Number of users looking to take out loans using deposited assets as collateral.