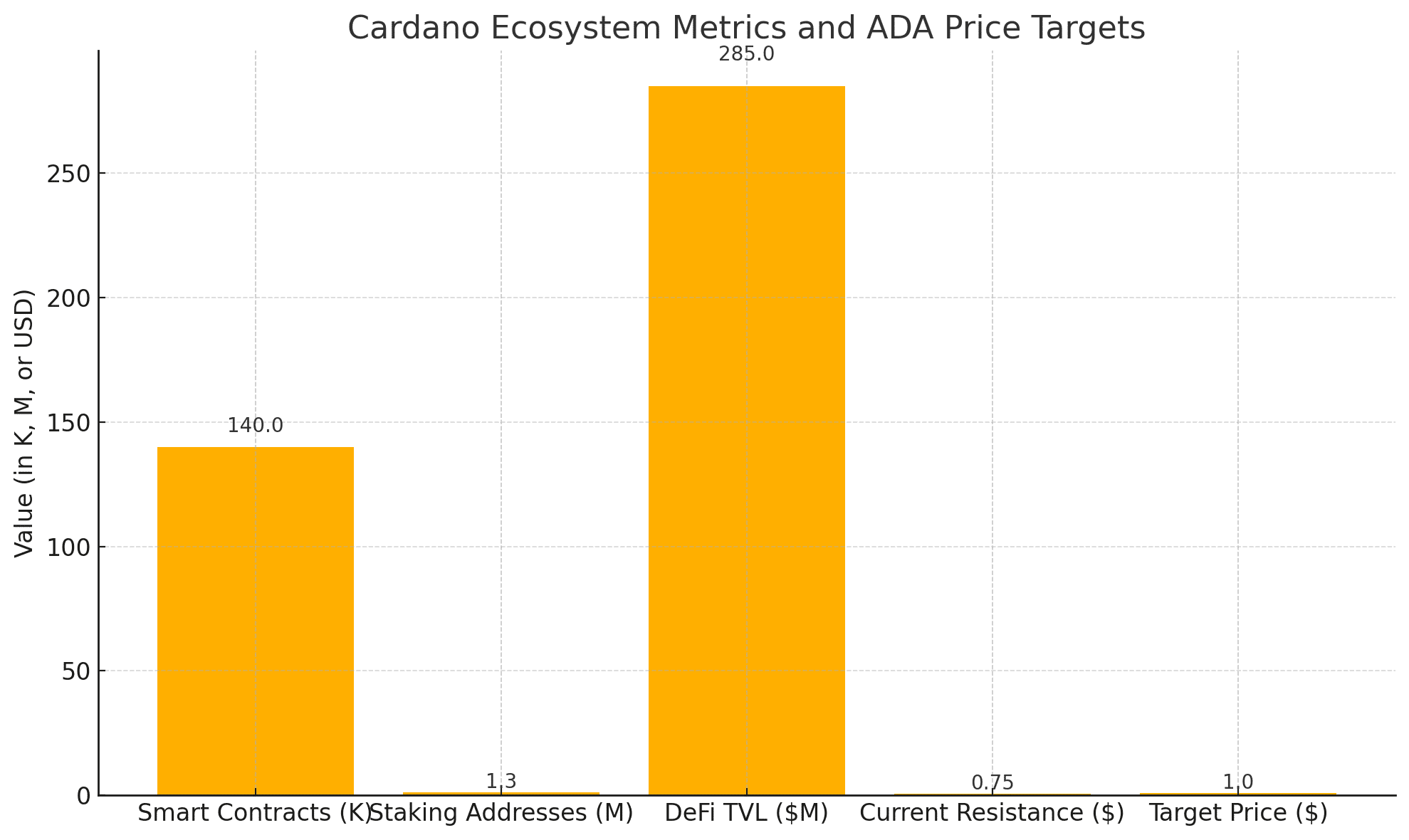

Cardano is quietly rebuilding its fundamentals, and the numbers tell a story few are noticing. As of June 13, the network supports 2,004 dApps, with over 140,000 Plutus and Aiken scripts live on-chain. Though total DeFi TVL (total value locked) stands at a modest $285M, it’s enough to place Cardano on the radar for serious developers, especially with Minswap leading DEX trading at $79M volume and Liqwid managing $80.9M in lending TVL.

Meanwhile, Cardano boasts over 1.3 million staking addresses, reinforcing its reputation as one of the most actively staked blockchains globally—a testament to actual user engagement and real community trust.

Governance Innovation and Strategic Boosts

Cardano’s evolution isn’t just technical; it’s structural. In Q1 2025, Cardano finalized its on-chain constitution, empowering over 1,220 Delegated Representatives to steer network direction. Now, founder Charles Hoskinson is proposing a bold next step: deploying $100M from the treasury to mint stablecoins and accumulate Bitcoin, fueling DeFi liquidity and cross-chain synergies.

This isn’t just capital deployment; it’s a statement: Cardano is stepping into sovereign wealth fund territory, leveraging its treasury for strategic growth rather than letting ADA sit idly.

Charting the Technical Landscape: $1 Is Realistic

Technically, ADA is coiling for a breakout. CryptoNews spotlights bullish setups: consolidation near $0.60 support, price action testing overhead resistance around $0.73–$0.75, and key RSI and moving-average cross signals. Coindesk reports today’s 3% rally past $0.635, with support holding strong above $0.635—a trend mirrored by staking milestones.

FXStreet and BraveNewCoin highlight triangle/bull-flag patterns, showing signals building toward a breakout, potentially pushing ADA between $0.90 and $1.10 if confirmed.

CryptoTicker adds another layer: ADA is developing price compression below $0.70, aligning short-term MAs and setting up for a breakout to $0.80, and possibly $0.85–$0.90, if momentum holds.

Institutional and Macro Drivers in Play

Mainstream sentiment is turning bullish. Indiatimes recently listed ADA alongside Ethereum as a top investment for 2025, citing a continuation breakout pattern and a projected 50% upside to $1.50–$1.80. On the political front, Trump’s idea to include Cardano in a US “Crypto Strategic Reserve” triggered a 60% spike in early March, and although speculative, it’s a powerful nod to institutional relevance.

Furthermore, experts at Cryptopolitan are now calling ADA a cornerstone of “Bitcoin DeFi,” forecasting ADA could surpass $5 if on-chain integrations gain traction. If true, this marks a paradigm shift: Cardano evolving past DeFi into interchain utility.

Why Smart Investors Are Accumulating ADA Now

Cardano isn’t chasing headlines; it’s building a decentralized foundation brick by brick. For long-term investors focused on utility, governance maturity, and real-world application, ADA presents one of the most undervalued opportunities in the crypto space.

With over 140,000 active smart contracts, a growing DeFi stack, and over 1.3 million ADA stakers, Cardano is establishing itself as a serious blockchain for institutional-grade use cases, not just speculative trading. When combined with the upcoming $100 million treasury deployment into stablecoins and Bitcoin, ADA is quietly shifting from passive infrastructure to an active financial force.

For risk-adjusted portfolios seeking sustainable exposure beyond Ethereum or Solana, Cardano checks all the boxes: technical strength, community resilience, and strategic evolution.

Human Side: Stories Behind the Numbers

Imagine active developers building real-world solutions, identity systems, supply chain traceability, even central-bank-grade stablecoins. Visualize millions of users engaging through staking and governance, reaching a network-level maturity few proof-of-stake chains can match.

That’s the energy you won’t see from a quick Ethereum or Solana pump, but it’s the core infrastructure of long-term utility. And most crucially, it could flip investor sentiment from speculative to strategic.

Final Word: ADA’s Quiet Comeback Is Just Starting

Cardano’s journey has never been about hype, it’s been about building. And now, after years of foundational development, governance upgrades, and ecosystem traction, the numbers are beginning to speak. As ADA hovers near a technical breakout, supported by smart contract growth, staking momentum, and high-level strategic moves, the path to $1 and beyond feels less speculative and more probable.

For investors seeking more than just quick pumps, Cardano offers a long-term bet on trust, technology, and time. The market may be slow to catch on—but the smart money is already moving.

Cardano’s transformation is layered and compelling:

Robust on-chain growth, dApps, staking, smart contracts

Structural evolution — treasury deployment, governance decentralization

Technical trigger — breakout patterns converging amid growing volume

Macro tailwinds — institutional interest and “Bitcoin DeFi” narrative

Frequently Asked Questions (FAQs)

What is driving Cardano’s current growth?

Cardano’s growth is fueled by a surge in smart contract activity, rising DeFi adoption, and a robust staking ecosystem supported by over 1.3 million addresses.

Why is $1 a key target for ADA?

The $1 level is a psychological and technical resistance. Breaking it could signal strong bullish sentiment and open room for more upside.

How many smart contracts does Cardano currently support?

As of June 2025, Cardano hosts over 140,000 smart contracts across Plutus and Aiken, showing rapid ecosystem maturity.

What is the significance of Cardano’s $100M treasury plan?

The plan to deploy $100M for stablecoin minting and Bitcoin acquisition could significantly increase ADA’s DeFi liquidity and institutional relevance.

Is Cardano a good long-term investment?

For risk-managed portfolios, Cardano offers a strong value proposition through decentralization, staking, and real-world use cases—not just speculation.

Glossary of Key Terms

ADA – The native cryptocurrency of the Cardano blockchain used for transactions, staking, and governance.

Plutus/Aiken – Cardano’s smart contract languages, enabling the development of decentralized applications (dApps).

TVL (Total Value Locked) – The total amount of assets held in a blockchain’s DeFi protocols, indicating ecosystem strength.

Staking – The process of locking ADA to help secure the network and earn rewards, contributing to decentralization.

DeFi (Decentralized Finance) – Financial applications built on blockchain technology, allowing peer-to-peer lending, trading, and borrowing without intermediaries.

Breakout – A price movement above a defined resistance level, often indicating a bullish trend continuation.

RSI (Relative Strength Index) – A technical indicator used to measure market momentum and potential overbought or oversold conditions.

On-Chain Governance – A system where token holders can vote on protocol upgrades and ecosystem decisions directly on the blockchain.

Treasury – A reserve of funds held by a blockchain’s protocol for development, incentives, or strategic deployment.