With the broader crypto market pulling back from its recent high, seasoned traders are seeing this as an opportunity not a warning. The Altcoin Season Index is almost 40, which means Bitcoin dominance is softening, setting up for an altcoin surge. As capital rotates and technicals reset, several tokens are showing early signs of strength.

Among the top Altcoins to buy today are Arbitrum (ARB), Ondo (ONDO), Stellar (XLM), Hedera (HBAR), and Injective (INJ); all with strong fundamentals and pattern-confirmed setups.

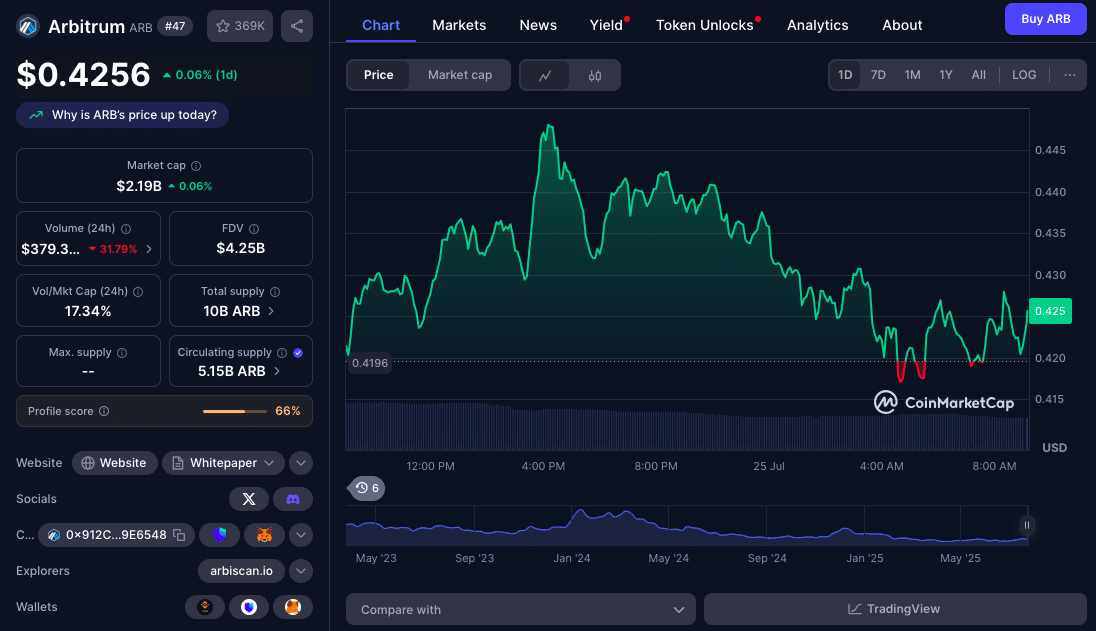

Arbitrum Builds a Base: Bullish Structure Amid DAO-Backed Momentum

Arbitrum (ARB) is one of the cleanest setups among L2 tokens currently forming a textbook Cup and Handle on the daily chart. After absorbing sell pressure from recent token unlocks ARB has rebounded from $0.34 base and is now consolidating just below resistance at $0.5045. ARB price is at $0.4256, RSI is at 53.7 and MACD is slightly bullish.

Volume patterns show accumulation even as short term weakness could push price into the $0.415 zone. Traders are watching for a dip to $0.374 which is considered a “reload zone”. A break above $0.5045 (projected between August 2-5) could target $0.60 or higher especially with Arbitrum DAO’s recent $216 million grant program still energizing the ecosystem.

ARB is one of the few tokens with clear technical validation and an on-chain funding mechanism making it a front runner in the top Altcoins to buy today.

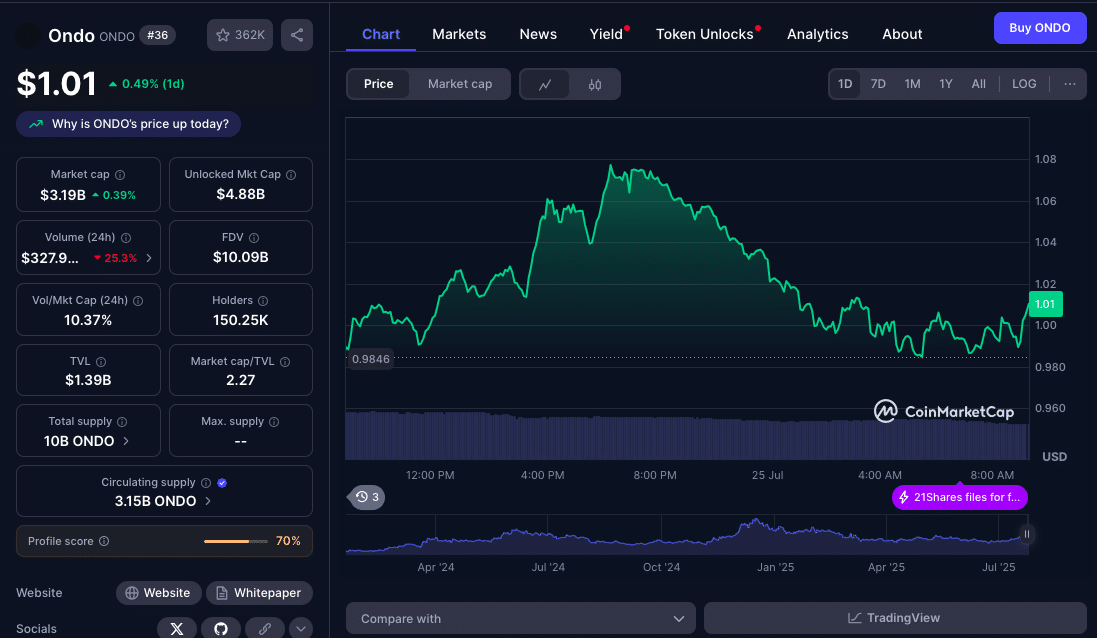

ONDO Flirts with ETF Momentum as Double Bottom Holds Support

ONDO has become a magnet for speculative capital since the SEC approved the 21Shares Ondo Trust S-1 on July 22. This caused immediate interest with ONDO briefly breaking the neckline at $1.13 before pulling back to the support zone.

The technicals are still strong: ONDO is holding the $0.94-$1.01 base and forming a textbook double bottom. This is a post-breakout retest, and bulls are watching for a bounce confirmation. Volume is still high, fueled by renewed interest in real-world asset (RWA) tokenization.

If support holds, a measured move from this structure could take ONDO to $1.30-$1.58 with momentum coming from both technicals and macro narrative. With ETFs back in focus, ONDO’s unique positioning in the RWA space gives it an edge in this lull.

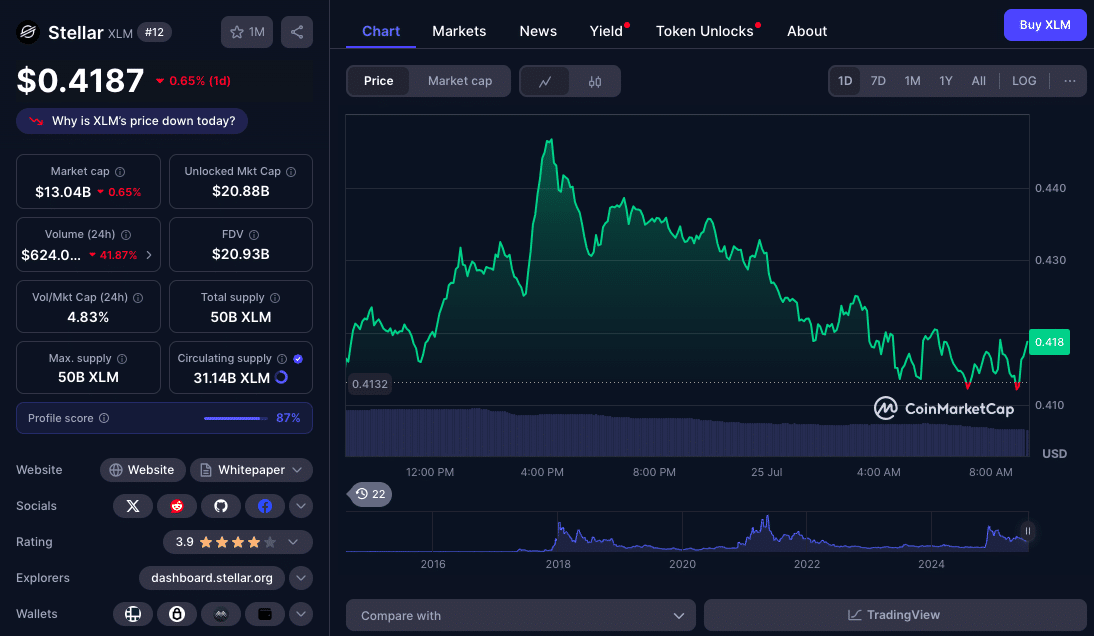

Stellar’s Calm Before the Breakout: XLM Holds Structure After 90% Rally

Stellar (XLM) has rallied 90% in July with RWA tokenization growth, MoneyGram partnerships and sentiment spillover from Ripple’s regulatory clarity. But even after that big move, XLM is consolidating at $0.4187.

The token is forming a bullish flag pattern between $0.33 and $0.44, a classic continuation setup. RSI has cooled from 77.5 to 59 and MACD is neutralizing, giving room to reaccumulate. As long as price holds above $0.37-$0.38, an upside is expected.

With over $450m in tokenized assets, on chain and pilot programs tied to CBDCs Stellar is one of the few altcoins with institutional traction and technical alignment. A break above $0.44 could target $0.60+ aligning with previous resistance and measured move projections.

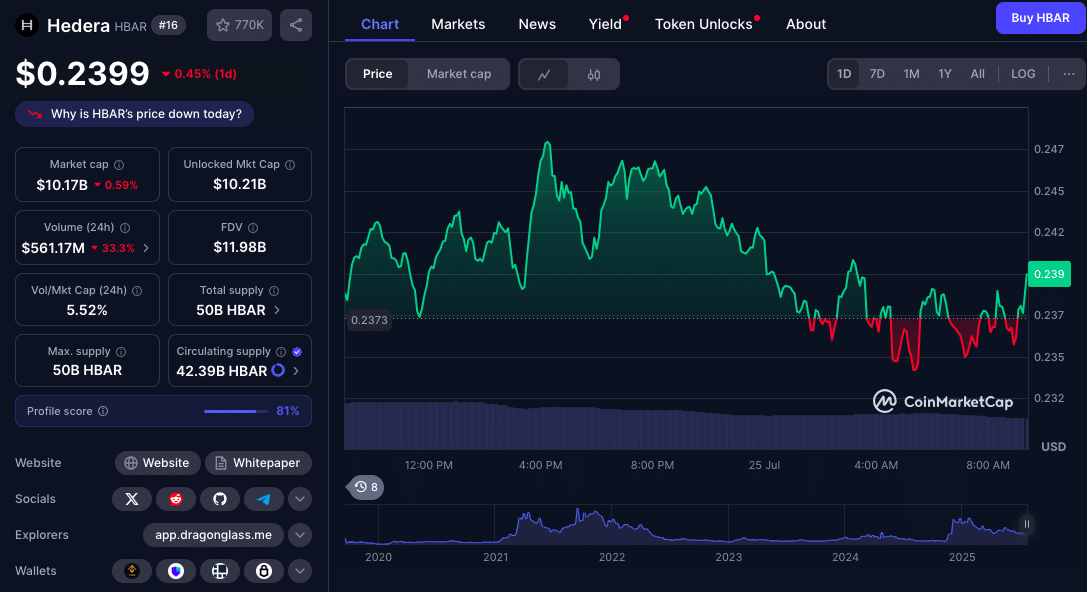

Hedera Quietly Leads Institutional Integration as HBAR Rises from W Base

Hedera (HBAR) has broken out of its multi-month W formation and is rising from its base at $0.13-$0.14 to $0.287 before cooling into the $0.23-$0.24 support zone.

The BBTrend just flipped positive for the first time in months, the trend is getting real. What separates HBAR from others is its growing institutional presence: Grayscale’s Smart Contract Fund and Canary Capital’s trust filing have given investors more confidence.

This institutional credibility combined with a solid technical structure makes HBAR one of the few tokens that bridges market narrative and enterprise utility. With targets above $0.35, the next break could push HBAR into a new multi-month trend.

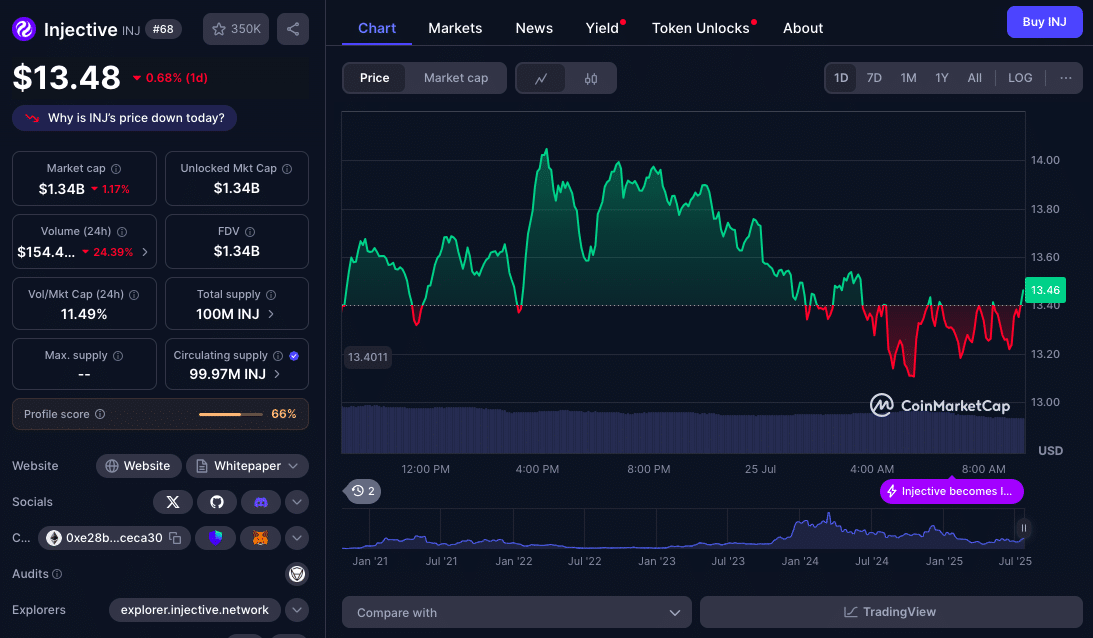

Injective’s On-Chain Explosion Signals Strongest Network Usage Surge

Injective (INJ) has had the biggest on-chain user surge of the year. Daily active users went from 4,500 in early 2025 to over 84,600 by July 19, a 1,770% increase. This is in line with the Nivara upgrade and Injective’s EVM testnet launch which brought Ethereum compatibility to its Layer-1 chain.

The price of INJ has tracked this activity closely and recently hit $14.2 before consolidating at at $13.48. Analysts consider this EMA level as crucial; if bulls hold, a break to $16.5 and possibly $19-$20 is on the cards.

What sets INJ apart isn’t just price momentum, it’s the clear developer interest and growing user numbers. With metrics backing it up, INJ is a proof point that network fundamentals matter again in a narrative-driven market.

What This Cooldown Is Telling the Market

The market isn’t in full altcoin season yet but the signals are aligning. The Altcoin Season Index went from 18 to almost 40 and tokens with strong technicals and narrative are outperforming.

Each of the 5 tokens highlighted: ARB, ONDO, XLM, HBAR, and INJ; represents a different pocket of strength: Layer-2 scaling, real-world asset tokenization, CBDC pilots, institutional DeFi and Layer-1 infrastructure. These are not random pumps but reflections of broader sector momentum within crypto’s evolving market structure.

Conclusion

Based on the latest research, the top altcoins to buy today are tokens with strong technicals and fresh ecosystem catalysts. Each of the tokens discussed has a unique combination of breakout potential and on-chain or institutional validation.

The broader altcoin market is in consolidation phase but the Altcoin Season Index is still rising and the tilt is away from Bitcoin dominance.

Read more about Atcoins.

For in-depth analysis and the latest trends in the crypto space, our team offers expert content regularly.

Summary

The market is entering a consolidation phase but top altcoins like ARB, ONDO, XLM, HBAR and INJ are flashing breakout potential. The Altcoin Season Index is almost at 40. These tokens represent different sectors gaining strength in a broader cooldown.

FAQs

What does the Altcoin Season Index around 40 mean?

It means the market is in a Bitcoin-dominant phase but shifting to altcoins. Above 75 is peak altcoin season.

Why is ARB a strong buy now?

Arbitrum’s Cup and Handle, DAO funding and growing L2 activity all point to a breakout in the next few weeks.

What’s behind ONDO’s price?

ONDO’s rally is due to ETF speculation and real-world asset tokenization momentum after the SEC filing.

How is Injective (INJ) growing?

INJ has seen massive daily active users growth after the EVM testnet launch, making it a Layer-1 network to watch.

Is Stellar (XLM) still a RWA play?

Yes, XLM’s tokenized asset partnerships and bullish consolidation means more upside in RWA and cross-border payments.

Glossary

Altcoin Season Index: A metric showing if capital is flowing into altcoins or Bitcoin. Above 75 is altcoin season.

Cup and Handle Pattern: A bullish pattern indicating a breakout after consolidation.

Double Bottom: A bullish pattern where price hits a low twice before going up.

Real-World Asset (RWA) Tokenization: Bringing traditional assets like bonds or real estate onto blockchains.

BBTrend Indicator: A technical analysis tool that shows trend direction and strength.