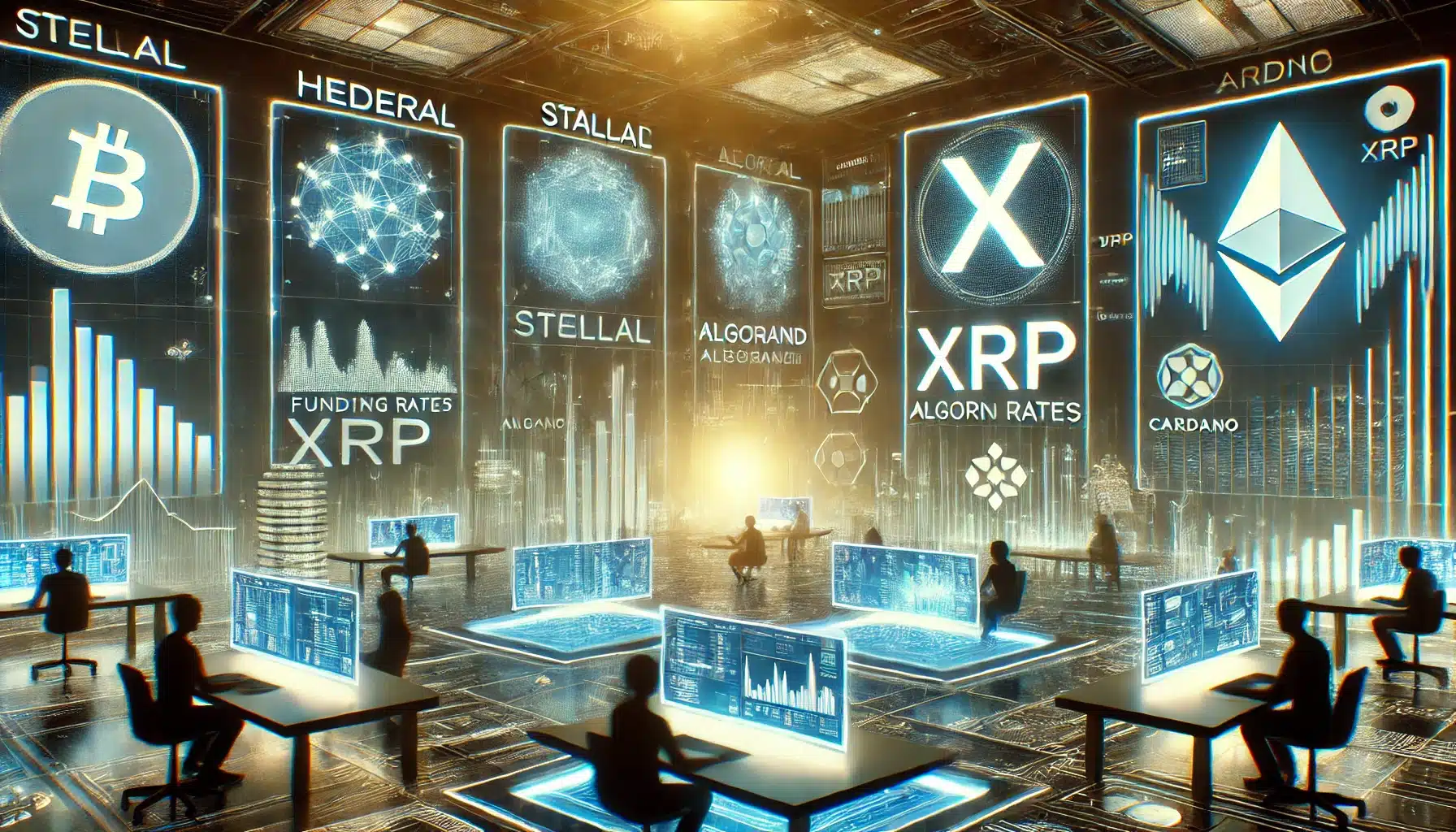

The funding rates of altcoins are at the highest level observed in the past nine months, and there are talks about whether it is an indication of the altseason or the bubble. Such tokens as Hedera, Stellar, Ripple, Algorand, and Cardano have reportedly increased more than two and a half times during the past 30 days, which makes investors both happy and worried. While some people consider it as indicating that more months of the bull market may be anticipated, others predict that a correction is due to occur due to more leveraged buying.

The most current-mentioned data from CoinGlass shows that the 30-day funding rate for perpetual futures on these altcoins has risen to the range of 4% to 6%. This increase, however, can be seen as an indicator of very bullish sentiment and puts a lot of questions regarding sustainability of the market and roles of leverage.

Hedera, Stellar, and XRP top the 250% gainer chart.

The rise in the price of Hedera, Stellar, XRP, Algorand, and Cardano have however been attributed to several factors such as; increased adoption and the growing communities. Experts believe these tokens were at a deeper discount from their highest point, making room for some gain.

However, there are some doubts among the specialists in regard to the sustainability of this rally. “The recent surge is impressive, but unfortunately, to achieve it, institutions used high leverage, which poses a problem if the market changes,” CoinGlass also said in a report.

The funding prompt for perpetual futures, which is an indicator of the price of having long and short positions, has gone up. Although monthly losses between 4% and 6% might not have too sensationalist effects during bullish phases, they could lead to total loss during diagonal moves or consolidations.

To illustrate, funding rates were at 8% in early 2023, which ushered a similar picture to what we are witnessing now. However, after such a rise in the market people tend to get overly optimistic which was found wanting when the market was corrected by 15%. This is a good example of how increasing funding rates are always a result of the bull markets, and not the other way round.

Are Altcoin Leverage Levels a Warning Sign?

Altcoins still have not achieved significant leverage compared to their historically high levels. For some tokens, 30-day funding rates reached 25% during the February 2023 rally. Instead, at those levels, arbitrage desks began going short on perpetual contracts and concurrently buying up the underlying to generate funding profits while having no direct market risk.

This time, the funding rates for both ADA and XRP are relatively higher when compared to the last six months, but still lower than their rates seen one year ago. This suggests there is more upside yet, while the danger that It can leverage itself too highly remains.

Meanwhile, BTC and ETH have below-average funding rates for around 2.5% as they have risen 39% and 49% respectively. This is a great testament to the fact that the speculation of altcurrencies is not equal to other forms of the cryptocurrency market.

“The current uptrend in altcoins is considered a speculative bubble fueled by meme coins, as well as rewarding development-oriented projects,” stated blockchain analyst CryptoMetrics. The likes of NEIRO and Cat in a Dog’s World hit a billion dollars for market cap during this mania and could have also pumped up the prices of other longer-standing altcoins.

Can the Rally Sustain or Is a Correction Looming?

Hedera, Stellar, XRP, Algorand, and Cardano are tokens that have recently delivered spectacular gains, but current market circumstances may call for prudence. Higher funding rates signal a bullish regime but also warn of leverage trading.

Experience has learnt that periodic fluctuations of prices are always marked by high and increasing rates of growth and that their tendency is to suddenly reverse with high corrections as the climax. For instance, a sharp increase in the altcoins’ capitalization in early-2018 prompted a notable reversal as investors shut long-leased trades.

However, according to the analysts, current funding rates are still not high enough that will create systemic risks. The fluctuation of between 4% to 6% remains sustainable in case of another heightened unpredictable gyrations.

Potential losses of stocks are to be sought where liquidity conditions are deteriorating or the rate of trading is slowing down or the incidences of liquidation are on the rise. In the analysis by CoinGlass, the next few weeks are deemed indispensable in understanding whether it is the beginning of the bullish run or merely speculation of such.

Conclusion on Altcoin Surge

Funding rates touching 9 month highs have sparked revived interest in the market with Hedera, Stellar, XRP, Algorand, and Cardano. Nonetheless, using leverage increases the number of risks connected with trading in the stock market.

As history have it, elevated funding rates tends to occur at the later stages of bullish carry and not at the onset of the trend. Despite this, one could say that the rally has room for expansion yet traders should be cautious and manage their risks having seen how some of the big players lost a lot of their margins through excessive leverage.

The next several weeks will indicate whether this altseason is the beginning of the steady growth of the market or a bubble that can collapse at any moment. To date, the altcoin market niche is one of the most significantly risky and potentially profitable areas for trading and investing. Keep following The Bit Journal to keep an eye on altcoins.

Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!