The cryptocurrency market has always been dynamic, with periods when alternative cryptocurrencies, known as altcoins, outperform Bitcoin. These phases, termed “altcoin seasons,” are eagerly anticipated by investors seeking substantial returns. As 2025 unfolds, many are optimistic about the onset of a new altcoin season driven by various market indicators and emerging trends.

Understanding Altcoin Season

An altcoin season refers to a period when the majority of altcoins experience significant price appreciation, often surpassing Bitcoin’s performance. This phenomenon typically occurs when investors diversify their portfolios, seeking higher returns from smaller-cap cryptocurrencies. The Altcoin Season Index, a tool that measures the performance of the top 50 coins relative to Bitcoin over the last 90 days, is often used to identify such periods. If 75% of these coins outperform Bitcoin, it signals the onset of an ALT season.

Indicators Pointing Towards a 2025 Altcoin Season

Several factors suggest that 2025 could usher in a robust altcoin season:

Bitcoin’s Price Stabilization

Historically, Bitcoin’s substantial price rallies are followed by periods of consolidation. During these phases, investors often explore altcoins in search of higher returns, leading to increased capital inflow into the altcoin market. As of early 2025, Bitcoin has experienced significant growth, prompting speculation about an impending shift towards altcoins.

Declining Bitcoin Dominance

Bitcoin dominance refers to Bitcoin’s share of the total cryptocurrency market capitalization. A declining dominance often indicates that altcoins are gaining traction. Recent data shows Bitcoin dominance fluctuations, suggesting a potential altcoin resurgence.

Institutional Interest and ETF Approvals

The approval of cryptocurrency exchange-traded funds (ETFs), especially those targeting altcoins, can significantly boost market confidence and attract institutional investments. The current administration’s favorable stance towards crypto regulations has led to increased filings for altcoin ETFs, indicating a growing institutional interest that could fuel an altcoin season.

Emerging Trends Supporting Altcoin Growth

Beyond traditional market indicators, several emerging trends are poised to bolster the altcoin market in 2025:

Decentralized Finance (DeFi) Expansion

DeFi platforms, primarily built on altcoin networks, have revolutionized financial services by offering decentralized lending, borrowing, and trading. The continuous growth and innovation within the DeFi space are likely to drive demand for related altcoins, contributing to their value appreciation.

Tokenization of Real-World Assets

The process of tokenizing real-world assets, such as real estate and stocks, onto blockchain platforms is gaining momentum. This trend enhances the utility of certain altcoins and attracts investors seeking diversified blockchain-based assets, thereby supporting altcoin market growth.

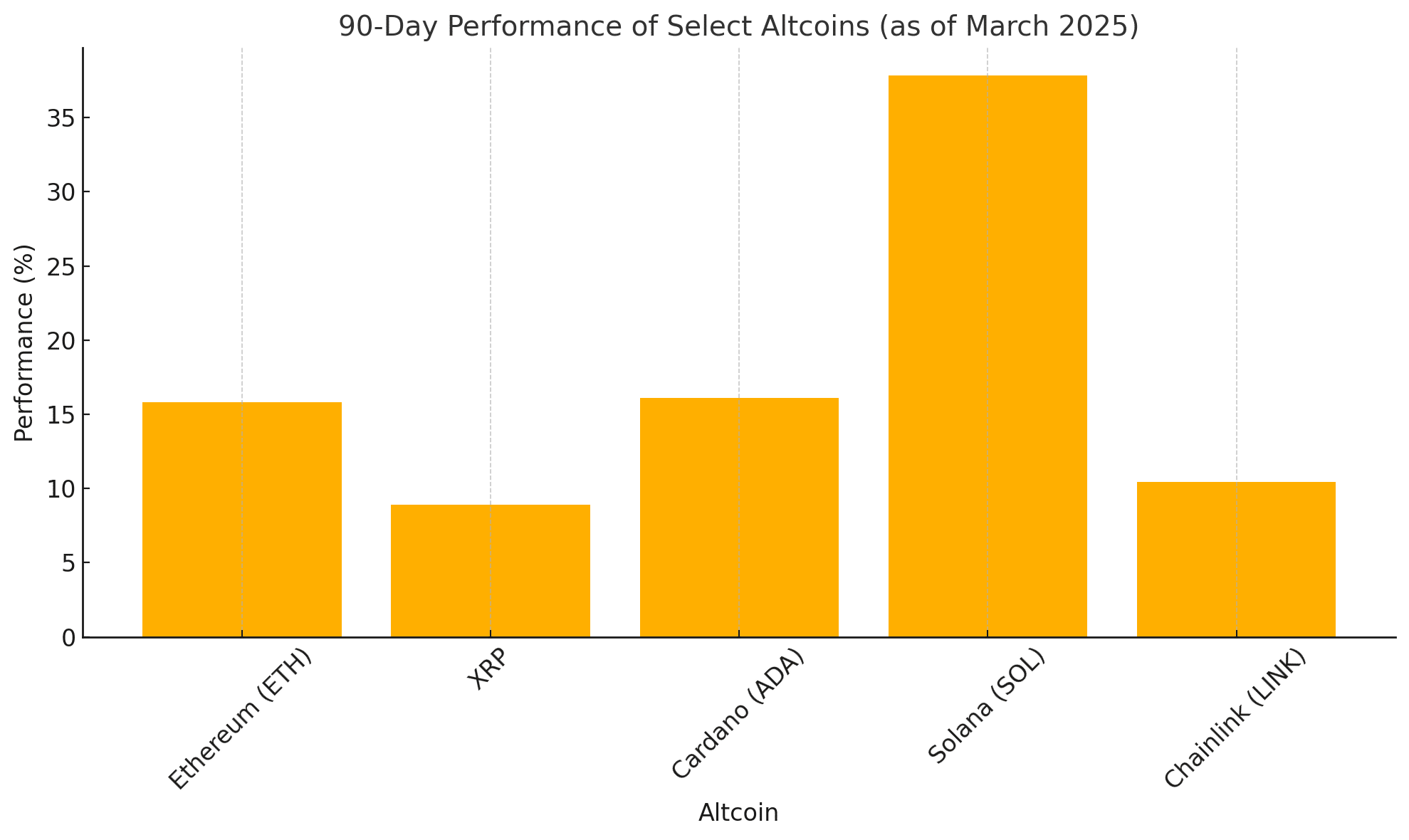

Price Performance of Select Altcoins

To provide a clearer picture of the altcoin market’s potential, here’s a table showcasing recent performance metrics of select altcoins:

| Altcoin | 90-Day Performance | Market Capitalization |

|---|---|---|

| Ethereum (ETH) | +15.83% | $500 billion |

| XRP | +8.93% | $80 billion |

| Cardano (ADA) | +16.09% | $70 billion |

| Solana (SOL) | +37.84% | $60 billion |

| Chainlink (LINK) | +10.45% | $15 billion |

Data sourced from CoinMarketCap as of March 2025.

Expert Insights

Industry experts have weighed in on the prospects of an altcoin season in 2025. Ki Young Ju, CEO of CryptoQuant, predicts a selective altcoin season, emphasizing that projects with strong fundamentals and potential ETF approvals will likely thrive. He cautions that “most altcoins won’t make it” during this cycle.

Conclusion

The convergence of Bitcoin’s price stabilization, declining dominance, institutional interest, and emerging blockchain trends sets a promising stage for an altcoin season in 2025. However, investors should exercise caution, focusing on altcoins with robust fundamentals and real-world applications to navigate the market effectively.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

Frequently Asked Questions (FAQs)

Q1: What is an altcoin season?

An altcoin season is a period when alternative cryptocurrencies outperform Bitcoin in terms of price appreciation, often due to increased investor interest and capital inflow into the altcoin market.

Q2: How can investors identify an upcoming altcoin season?

Indicators such as declining Bitcoin dominance, increased trading volumes in altcoins, and the performance metrics from tools like the Altcoin Season Index can signal the onset of an altcoin season.

Q3: Are all altcoins expected to perform well during an altcoin season?

Not necessarily. While many altcoins may experience price increases, those with strong fundamentals, clear use cases, and active development communities are more likely to sustain growth.

Q4: How long does an altcoin season typically last?

The duration of an altcoin season varies but can range from a few weeks to several months, depending on market dynamics and investor sentiment.

Q5: What risks should investors consider during an altcoin season?

Investors should be cautious of market volatility, potential regulatory changes, and the inherent risks associated with investing in lower-cap cryptocurrencies.

Glossary of Key Terms

Altcoin: Any cryptocurrency other than Bitcoin.

Bitcoin Dominance: The ratio of Bitcoin’s market capitalization to the total cryptocurrency market capitalization.

Decentralized Finance (DeFi): Financial services that operate without central authorities, utilizing blockchain technology.

Exchange-Traded Fund (ETF): A type of investment fund that is traded on stock exchanges, holding assets such as stocks, commodities, or cryptocurrencies.