The cryptocurrency market is buzzing with discussions about Bitcoin’s growing adoption within traditional finance. Analysts are closely watching the impact of Bitcoin spot ETFs and corporate purchases, such as those by MicroStrategy, on the overall ecosystem. However, these developments might bring unexpected challenges to the altcoin market. According to experts, this altcoin season will not follow the familiar patterns of the past. Let’s dive into the details.

Bitcoin’s Integration into Traditional Finance

Ki Young Ju, a prominent analyst, emphasizes that Bitcoin is now firmly on the radar of traditional financial institutions. This transition is reshaping the entire crypto ecosystem. He notes:

“This alt season will be unlike any other. It will be complex and unpredictable, favoring only a select few. Bitcoin is building its own Layer-2 ecosystem, bridging the gap between traditional finance through ETFs and institutional funds. However, this shift is constraining liquidity flows into altcoins, making the altcoin market more independent than ever before.”

Bitcoin’s growing detachment from altcoins underscores its evolving role as a financial instrument rather than merely a digital currency.

Weakening Bitcoin-Altcoin Correlation

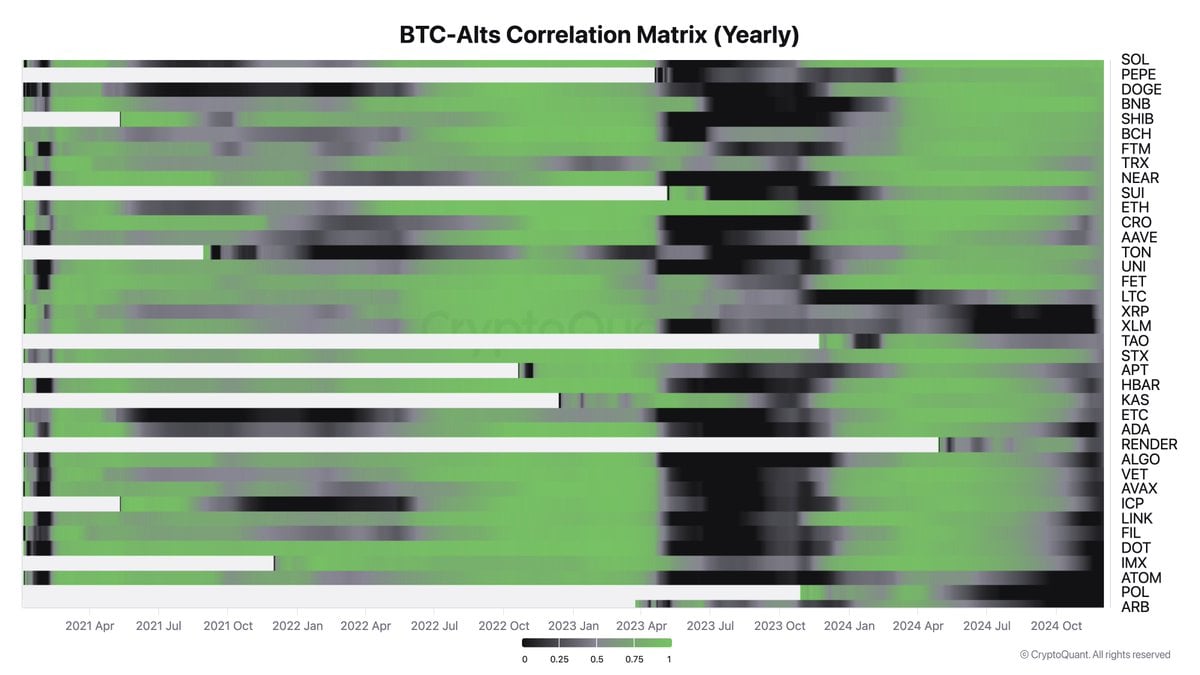

Historically, altcoins closely mirrored Bitcoin’s price movements, but that connection is weakening. Analysts highlight that only a handful of altcoins now demonstrate independent trends. A recently shared chart illustrates a significant decline in the correlation between Bitcoin and altcoins.

“In the past, altcoins moved in tandem with Bitcoin. Today, only a select few altcoins, backed by unique liquidity sources, exhibit standalone trends. This shift demands a more strategic approach to altcoin investments.”

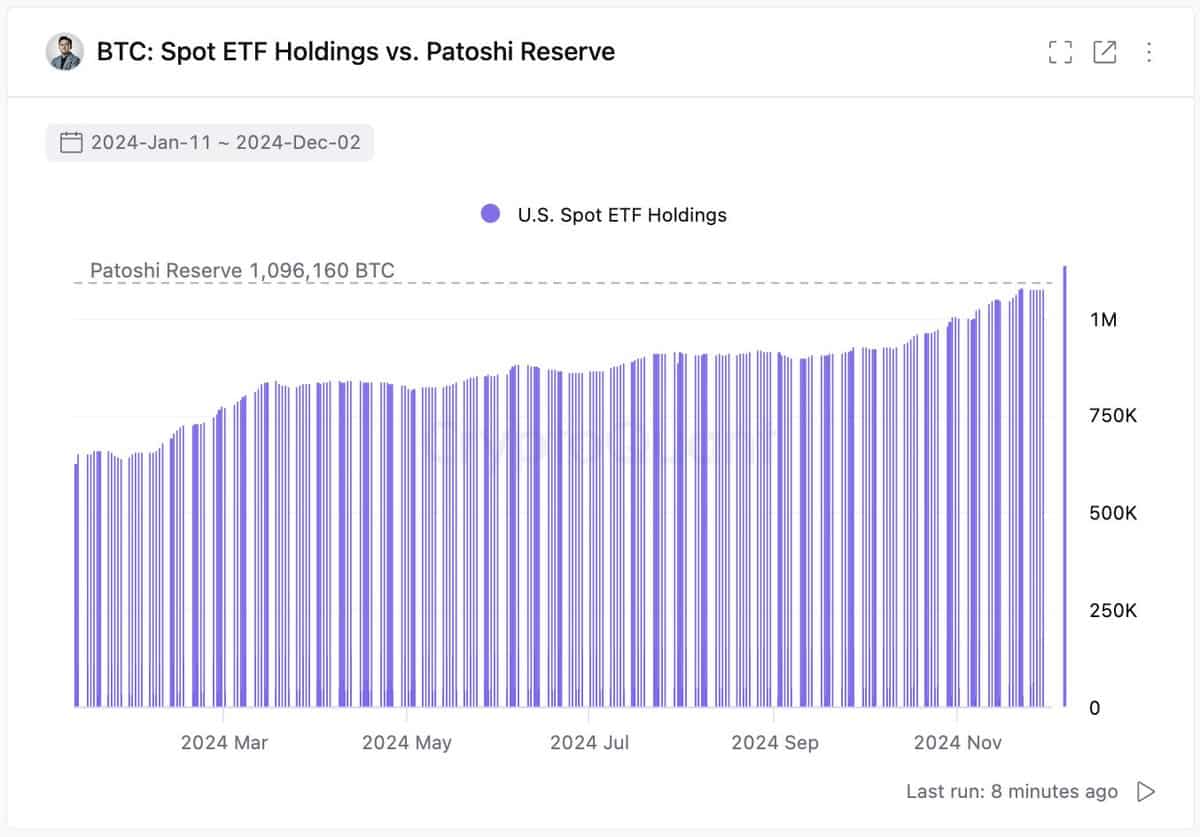

Additionally, Bitcoin’s spot ETFs have amassed holdings comparable to the estimated amount mined by Bitcoin’s creator, Satoshi Nakamoto, highlighting the increasing trust in Bitcoin among institutional investors.

Institutional Demand for Bitcoin on the Rise

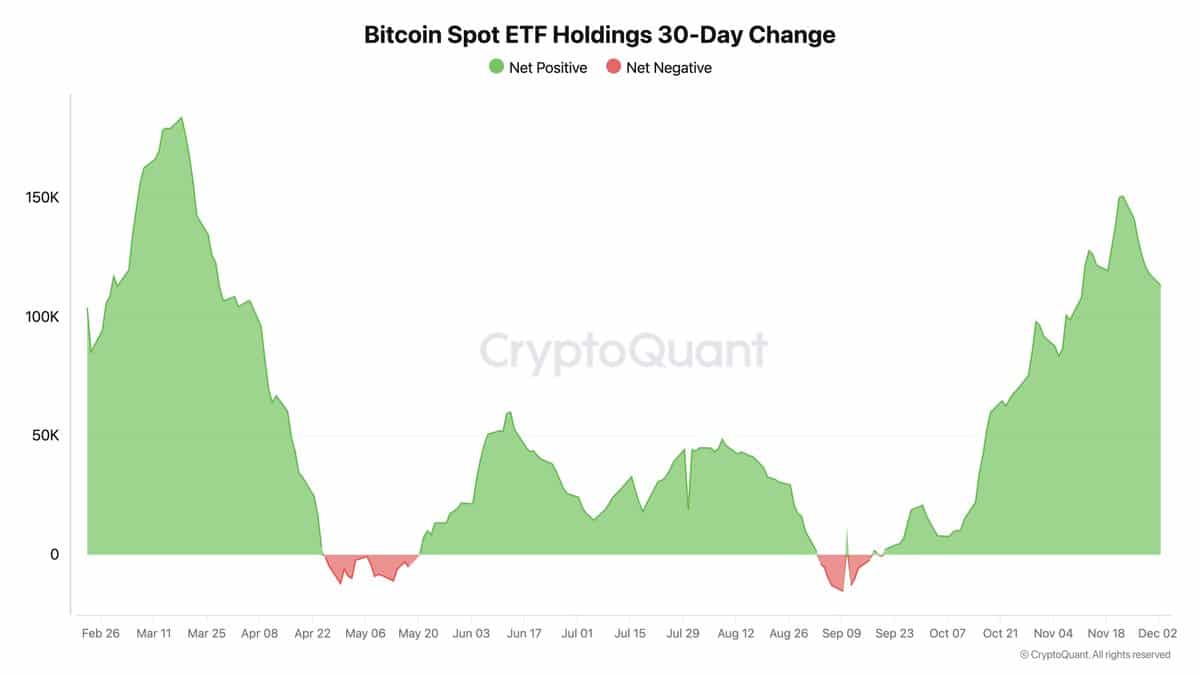

The demand for Bitcoin ETFs mirrors the fervor seen during their initial approval phase earlier this year. This trend signals a robust confidence among institutional investors, significantly contributing to market growth. Analysts say:

“The demand for Bitcoin spot ETFs remains as strong as ever. This reflects the growing appeal of Bitcoin as a stable and reliable asset in the financial sector.”

New Strategies Needed for Altcoin Investors

As Bitcoin carves out its place in traditional finance, altcoin investors face the challenge of developing innovative strategies. The era of riding on Bitcoin’s coattails is over, and careful selection is critical in this fragmented market landscape.

Key Takeaway

Bitcoin’s integration with traditional finance heralds a new chapter for the crypto market, shifting dynamics in ways that demand adaptability from investors. The The Bit Journal will continue to bring you insights and updates on this evolving space. As always, remember that cryptocurrency markets are volatile and carry inherent risks. Conduct thorough research before making investment decisions.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!