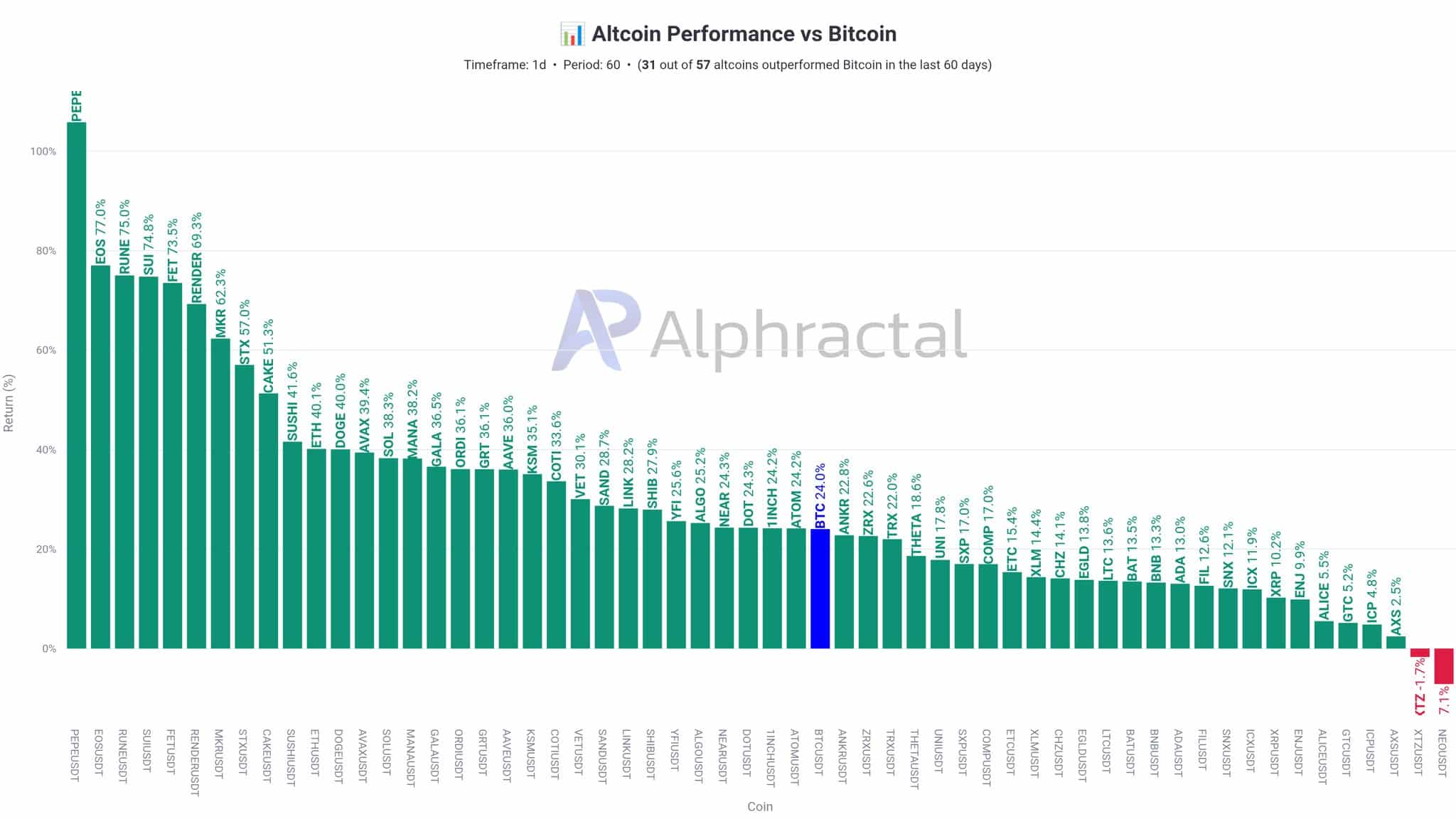

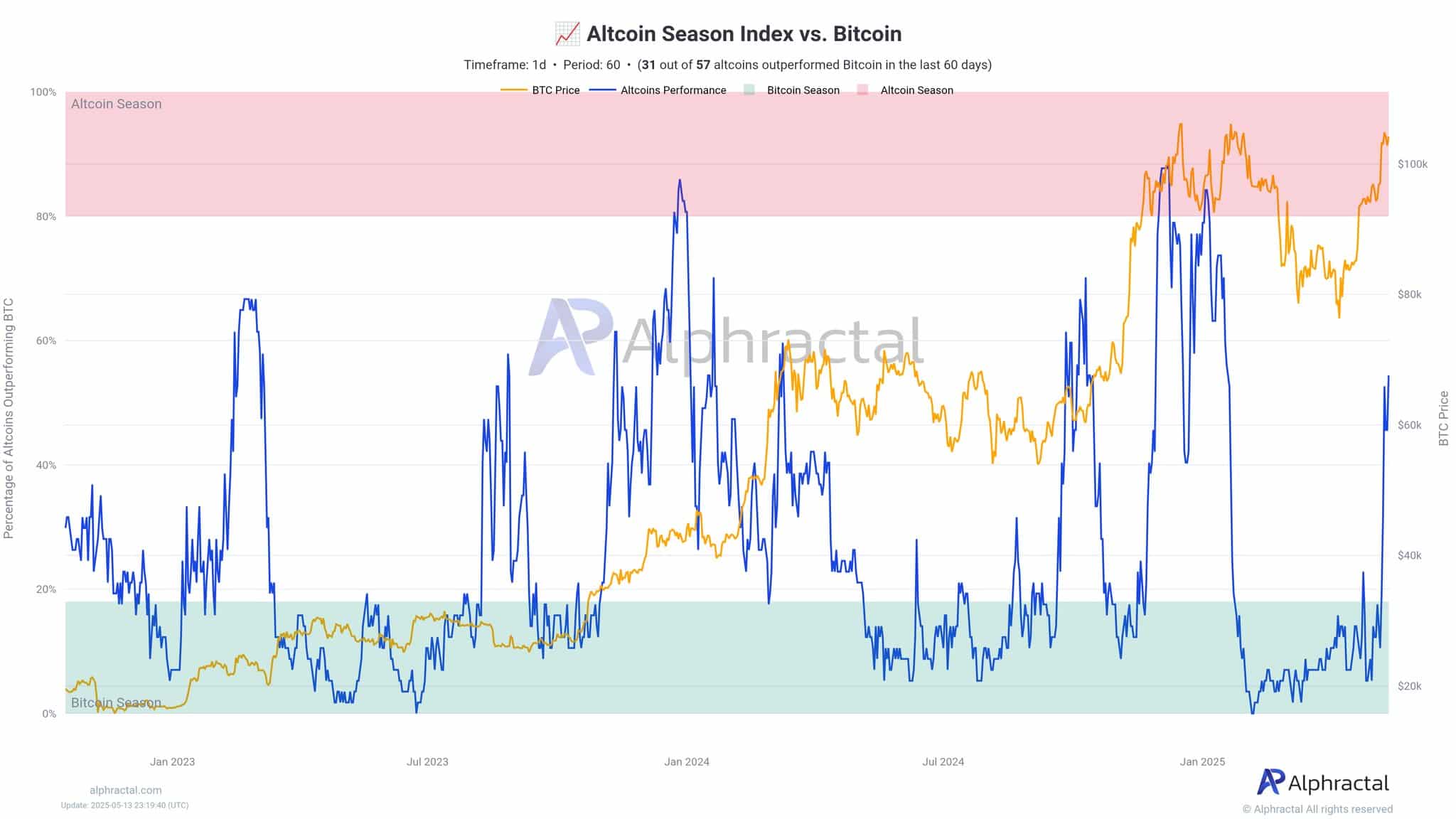

Bitcoin’s (BTC) lead in the market could be about to fade as more traders move into altcoins. For the last two months, more than half of the top altcoins 31 out of 57 have done better than BTC, suggesting “altseason” could be starting.

The clearest signal? Bitcoin’s control over the crypto market has gone down substantially, from 65% to 62%, while the altcoin market cap gained $300 billion in a short period.

🔥We're already in an Altcoin Season — and it’s likely to intensify even more starting in June.

There’s no point in denying it. The crypto market is cyclical, and Altcoin Season is a phase that must be speculated on strategically.

Back in April, I warned: it was time to buy… https://t.co/vwuBlvRM7G pic.twitter.com/EK6XZd9aST

— Joao Wedson (@joao_wedson) May 13, 2025

Altcoins Outshine Bitcoin, Led by PEPE

The biggest gainer over this time has been memecoin Pepe (PEPE), which added 117% to its value. EOS (EOS) and THORChain (RUNE) were also among the non-Bitcoin coins that advanced well. Ethereum widely watched as a gauge of altcoin health, has risen 40%, far better than BTC’s 24% gain. Tracy Jin, Chief Operating Officer at crypto exchange MEXC, said:

“The usual early signals are flashing: declining USDT dominance, improving price structure on altcoin charts, and rising interest in sector leaders like Monero, Sui, and Bittensor. It’s still technically BTC season,’ but the groundwork for altcoin rotation is clearly forming.”

Bitcoin Stalls, Altcoins Start Gaining Ground

BTC seems to have hit a pause near its highest levels and is now trading sideways. Now that BTC is not rising as fast, investors are turning to riskier, smaller coins with more growth potential.

In the past, when BTC and altcoins act this way, it’s usually a sign of a coming altcoin rally. With BTC’s momentum easing, trader attention tends to shift toward high-risk altcoins with big growth potential.

According to a market analyst, BTC dominance fell while altcoins increased in strength. Something like this usually has important underlying causes.

Capital Flows Shift Toward Emerging Altcoins

The current rise in prices is not only technical but is also fueled by the rise of intriguing new talking points around multiple altcoins. Both retail and institutional investors are now looking at sectors such as privacy coins, AI-focused tokens, and Layer 1 alternatives with a lot of interest.

According to Jin, investors are going after higher returns now that BTC seems overpriced. Jin said:

“If capital continues flowing this way, the first wave of altcoin season could arrive sooner than expected. Traders are seeking outsized returns, especially now that BTC appears overextended.”

Volume and Sentiment Support Altcoin Rebound

With more liquidity coming into the market, experienced traders are getting ready for a boost in altcoin prices. This isn’t just random buying it’s a planned reallocation based on facts, investor sentiments, and what’s happened before.

A portfolio manager at a digital asset fund said that altcoins are gaining ground because of rising narratives, boosted volumes, and positives on many charts.

Bitcoin is still the biggest player in crypto, yet with its strength declining, other altcoins are quickly gaining traction. Right now, attention is focused on altcoins, and from past trends, there could be significant rallies away from BTC soon.

Conclusion

Bitcoin’s appearance of fatigue and its declining dominance are causing a fast shift toward altcoins in the market. A large number of key altcoins, including Pepe and Ethereum, have outperformed BTC in the last days. Stronger investor interest is making it clear that an alt season could start soon, suggesting big profit opportunities.

Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

FAQs

Q1: Why are investors shifting from Bitcoin to altcoins?

A1: BTC’s dominance is weakening, prompting investors to seek higher returns in altcoins with strong growth potential.

Q2: Which altcoins are outperforming Bitcoin?

A2: Over half of tracked altcoins have outperformed BTC, with Pepe [PEPE], EOS, THORChain, Sui, and Ethereum leading gains.

Q3: What signals indicate an altseason is coming?

A3: Declining USDT dominance, better altcoin charts, falling BTC dominance, and rising altcoin market cap suggest altseason is near.

Q4: How should investors act now?

A4: Investors should consider positioning in high-potential altcoins as Bitcoin shows signs of exhaustion and altcoin momentum builds.

Glossary Of Key Terms

Bitcoin (BTC)

The largest and original cryptocurrency.

Bitcoin Dominance

Bitcoin’s share of the total crypto market.

Altseason

The period when altcoins outperform Bitcoin.

Altcoins

All cryptocurrencies other than Bitcoin.

Memecoin

Meme-inspired, often volatile cryptocurrencies like Pepe.

USDT Dominance

Market share held by stablecoin Tether (USDT).

Market Momentum

Strength and direction of price trends.

Capital Rotation

Moving funds from one asset to another.