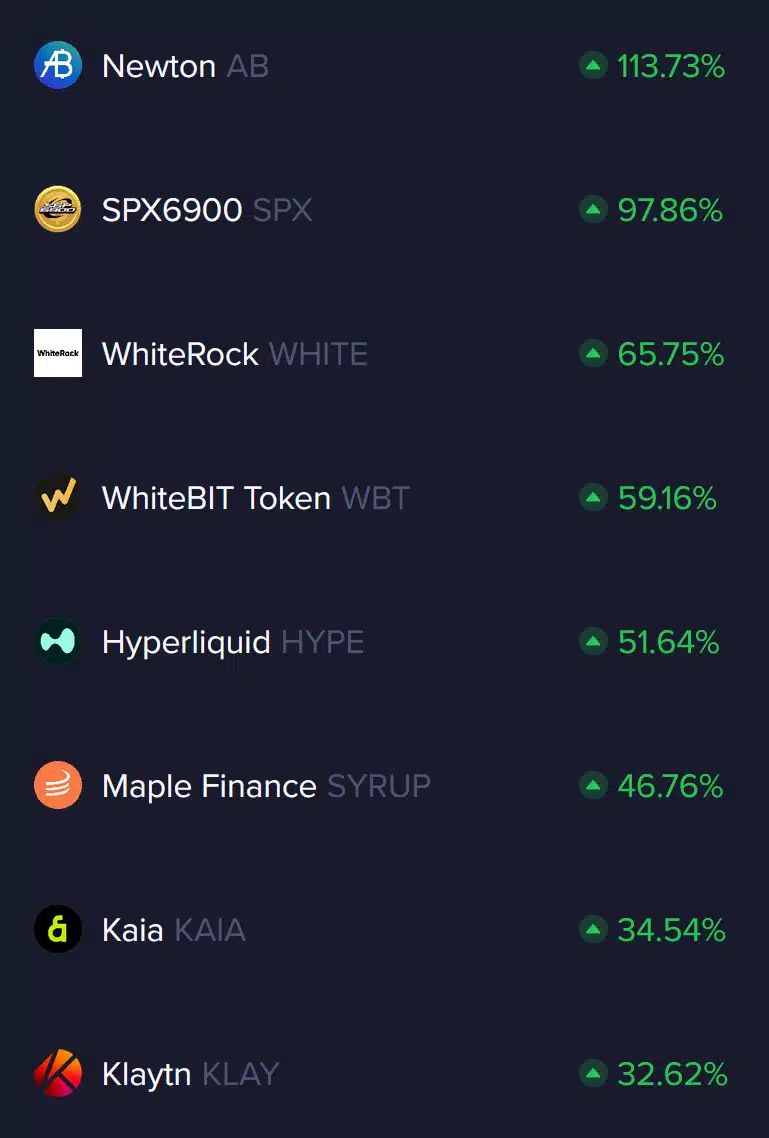

As Bitcoin continues its consolidation phase following its $112,000 high on May 22, select altcoins are defying the broader market lethargy. According to blockchain analytics firm Santiment, coins like Newton (AB), SPX6900 (SPX), and Hyperliquid (HYPE) have recorded impressive gains over the past 30 days, attracting both investor capital and growing social media buzz. The Bit Journal explores what’s behind this trend and what it could mean for the wider crypto landscape.

Newton (AB): Quiet Climb with Understated Buzz

One of the most significant movers is Newton (AB), a DeFi-native project that offers decentralized lending and trading solutions. Over the past month, Newton has surged by 114%, establishing itself as one of the top-performing assets in the current cycle. Despite its strong price action, sentiment on social media remains cautiously neutral, which analysts interpret as a potential indicator of more room for growth. This divergence between price performance and community enthusiasm suggests that Newton may be flying under the radar of the broader retail crowd.

SPX6900 (SPX): A Meme Coin With Real Momentum?

Meme coins are often driven by hype, but SPX6900 (SPX) is showing it has technical chops as well. Built across Ethereum and Solana, SPX has gained 98% in the last 30 days. Although it recently underwent a 19% correction, this pullback is being seen as a potential setup for a fresh rally. Interestingly, SPX has yet to experience the typical meme coin social surge, raising the possibility of a delayed FOMO (fear of missing out) wave. For those tracking meme coin cycles, SPX could be a stealth opportunity waiting to ignite.

Hyperliquid (HYPE): Decentralized Perpetuals Gaining Traction

Hyperliquid (HYPE) continues to be a standout performer in the perpetual trading space. The decentralized platform has gained 52% over the last month, drawing investor interest thanks to its robust trading volumes and refined user interface. Social sentiment is notably positive, with a 3.75:1 ratio of favorable comments. Still, experts from Santiment caution that a slight dip in social engagement could actually set the stage for a healthier, more sustainable price ascent—suggesting that the current attention may only be a prelude to larger moves ahead.

Other Notable Movers: WBT, WhiteRock, and More

Beyond the headline names, other altcoins are also showing resilience. WhiteBIT Token (WBT) soared 61% in the past week alone, reinforcing investor trust in the WhiteBIT exchange ecosystem. WhiteRock (WHITE), while still underappreciated, is re-emerging on investor radars due to its involvement in tokenized securities—a sector poised for long-term disruption. Additional gainers like Maple Finance (SYRUP), Kaia (KAIA), and Klaytn (KLAY) also posted double-digit gains despite the overarching market stagnation.

Market Outlook: Diversification and Sentiment Strategy

This shift in capital flow from Bitcoin to alternative tokens reflects a strategic pivot among crypto investors. As mainstream assets pause, traders and analysts are turning to metrics like social sentiment and on-chain data to identify undervalued opportunities. According to The Bit Journal, this behavior underscores a growing recognition that even in uncertain times, strong fundamentals and community traction can power significant returns.

However, caution remains crucial. Analysts emphasize that short-term rallies do not guarantee long-term viability. Investors are encouraged to conduct their own due diligence and remain aware of both market volatility and evolving regulatory landscapes.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!

References:

Santiment. (2025, June 18). Market Sentiment Analytics Report.

CoinDesk. (2025). DeFi Performance Metrics.

CoinTelegraph. (2025). Altcoin Market Review Q2.