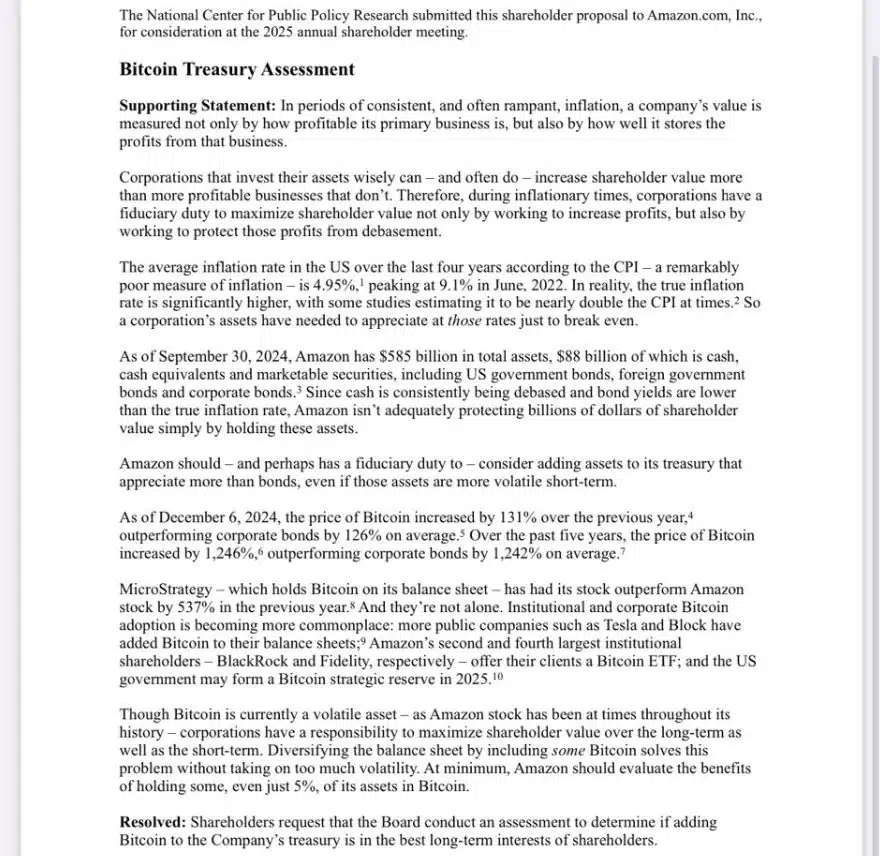

A group of Amazon shareholders, led by the National Center for Public Policy Research (NCPPR), has proposed that the e-commerce giant allocate at least 5% of its treasury to Bitcoin (BTC). The proposal argues that Bitcoin can serve as a hedge against inflation and a diversification strategy for the company’s assets.

Bitcoin Proposal Gains Momentum at Amazon

The proposal, shared by Tim Kotzman, highlights Bitcoin’s performance compared to traditional assets like corporate bonds. Citing examples such as MicroStrategy and Tesla, the NCPPR underscored Bitcoin’s potential to outpace traditional investment options. The proposal stated:

“MicroStrategy, which holds Bitcoin on its balance sheet, outperformed Amazon stock by 537% in the previous year. Corporate adoption of Bitcoin is growing, with companies like Tesla and Block adding Bitcoin to their reserves. Additionally, Amazon’s major institutional shareholders, BlackRock and Fidelity, offer Bitcoin ETFs to their clients, while the U.S. government may consider a Bitcoin strategic reserve by 2025.”

Amazon’s Silence and Blockchain Interest

While Amazon has not publicly responded to the proposal, the company has previously shown interest in blockchain technology, particularly in supply chain management. The NCPPR’s push for Bitcoin adoption aligns with broader corporate efforts to integrate cryptocurrency into their financial strategies. In a similar move, the organization sent a letter to Microsoft, urging the company to evaluate Bitcoin investments. Microsoft’s board recommended shareholders vote against the proposal, stating that they already assess “a wide range of investable assets,” including Bitcoin.

The NCPPR warned Microsoft that rejecting Bitcoin investments could expose the company to shareholder lawsuits if the asset’s value appreciates significantly in the future. Microsoft shareholders are set to vote on the proposal on December 10.

What Comes Next for Amazon?

Following the submission of the shareholder proposal, Amazon’s board will review it to determine if it will be included in the proxy statement for the upcoming annual shareholder meeting. If included, shareholders will vote on the proposal during the meeting, slated for April 2025. The outcome will depend on the number of votes cast in favor or against the proposal.

Amazon’s board, much like Microsoft’s, is expected to provide voting recommendations for shareholders. Among Amazon’s largest shareholders are major financial institutions, including Vanguard Group, BlackRock, State Street, Fidelity Management & Research, and JPMorgan.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!