Gold has recently reached record levels, fueled by the Federal Reserve’s rate cuts and heightened tensions in the Middle East. With U.S. PCE inflation rising by 2.2%, gold’s allure has strengthened in this era of continued monetary easing. In August, global ETFs added 28.5 tons of gold, reversing years of outflows and driving a rally that analysts believe could push prices even higher.

Rate Cuts and Economic Data Boost Gold

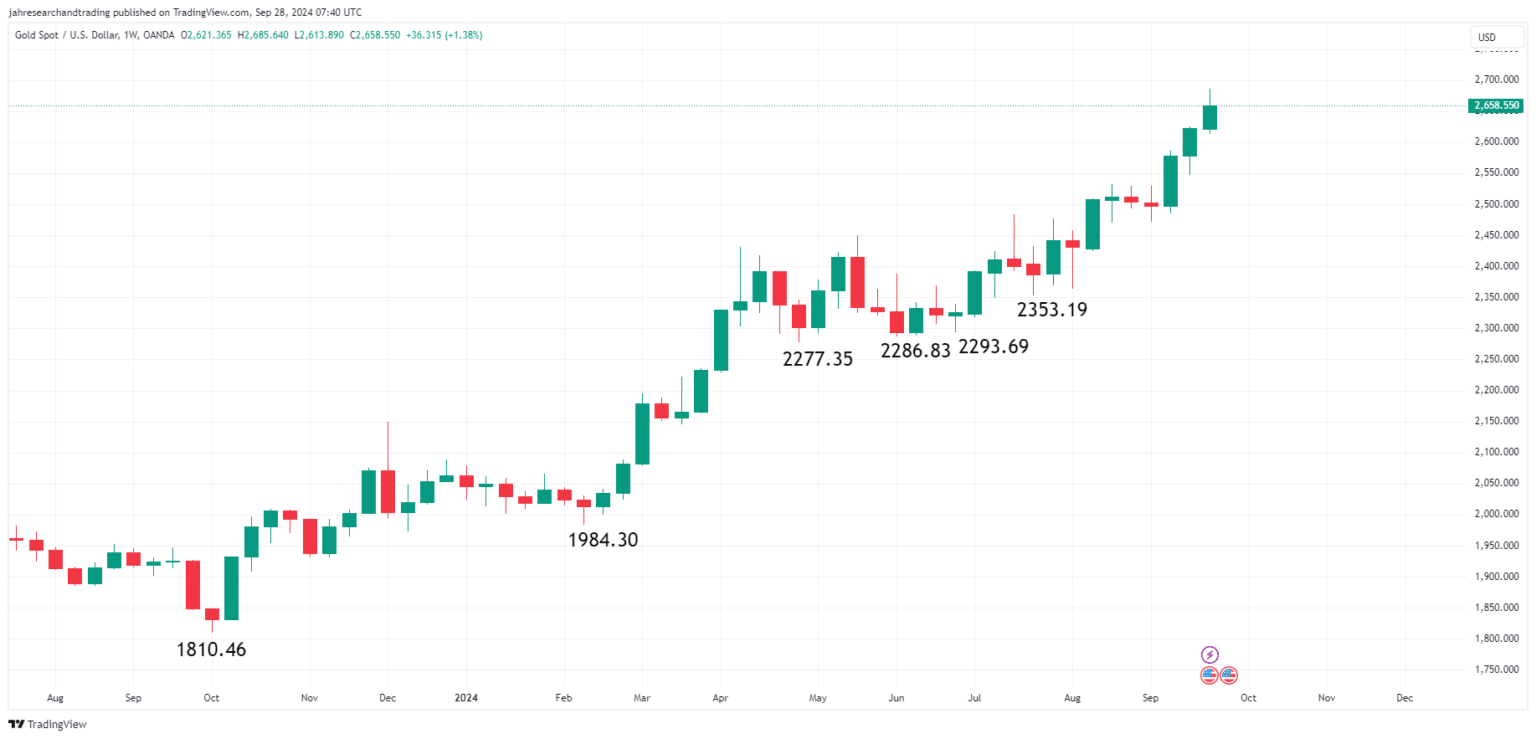

As reported by The Bit Journal, gold prices surged to new highs last week, influenced by the Fed’s dovish monetary policies. On Thursday, the precious metal hit an all-time high of $2,685.64, before pulling back slightly to close the week at $2,658.55, marking a weekly gain of 1.38%. Analysts believe the prospect of further rate cuts and ongoing demand for safe-haven assets will help sustain this momentum, despite some profit-taking along the way.

Last week’s economic data also supported the case for more rate cuts. The Personal Consumption Expenditures (PCE) price index, a key inflation gauge, rose 0.1% month-over-month and 2.2% year-over-year in August, slightly below economists’ expectations. The core PCE, which excludes food and energy, also aligned with forecasts at 2.7% annually. These inflation metrics suggest the Fed could lower rates again by year’s end, which would further support gold prices.

Geopolitical Tensions Drive Safe-Haven Demand

Ongoing geopolitical risks, particularly in the Middle East, have also bolstered gold’s appeal. The escalation of conflict between Israel and Hezbollah, alongside Israeli airstrikes in Lebanon, has heightened risk perceptions. As global instability looms, investors continue to flock to gold, driving up demand. Analysts expect this trend to persist as geopolitical risks remain elevated.

ETF Inflows and Central Bank Demand Support Gold

Another key driver of gold’s recent rally is the return of inflows into gold-backed Exchange-Traded Funds (ETFs). In August, global gold ETFs saw an increase of 28.5 tons, led by North American investors. Central bank demand, particularly from China, also remains robust. Institutional buyers continue to accumulate gold as part of their reserves, further solidifying the metal’s upward trajectory.

Gold Price Forecast: Bullish Outlook Remains

Market analyst James Hyerczyk notes that gold has broken records for four consecutive sessions, with the metal’s momentum pushing it well above key support levels. However, some analysts warn of a potential short-term correction as gold is trading far above its 50-day moving average of $2,499.04, indicating that the market may be overheating.

Despite this, with strong support around $2,353.19 and the prospect of further rate cuts, any pullback is likely to be seen as a buying opportunity. The broader trend remains bullish, with no significant resistance at current levels. Analysts recommend monitoring weekly closing prices for signs of a reversal but anticipate that gold will continue to test new highs, potentially reaching between $2,700 and $2,850 in the coming months if inflation moderates and the Fed maintains its dovish stance.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!