As October nears its end, the market is flashing signs of a pullback, especially for certain overbought altcoins. The MVRV ratios for several tokens indicate increased selling pressure as investors look to lock in profits. The recent decline from Bitcoin’s $70,000 psychological resistance has revived market-wide selling momentum, contrasting the typically bullish trend seen in Q4. For risk-averse investors, here are three altcoins to consider selling before further corrections set in.

Top 3 Altcoins to Sell Amid October’s Market Correction

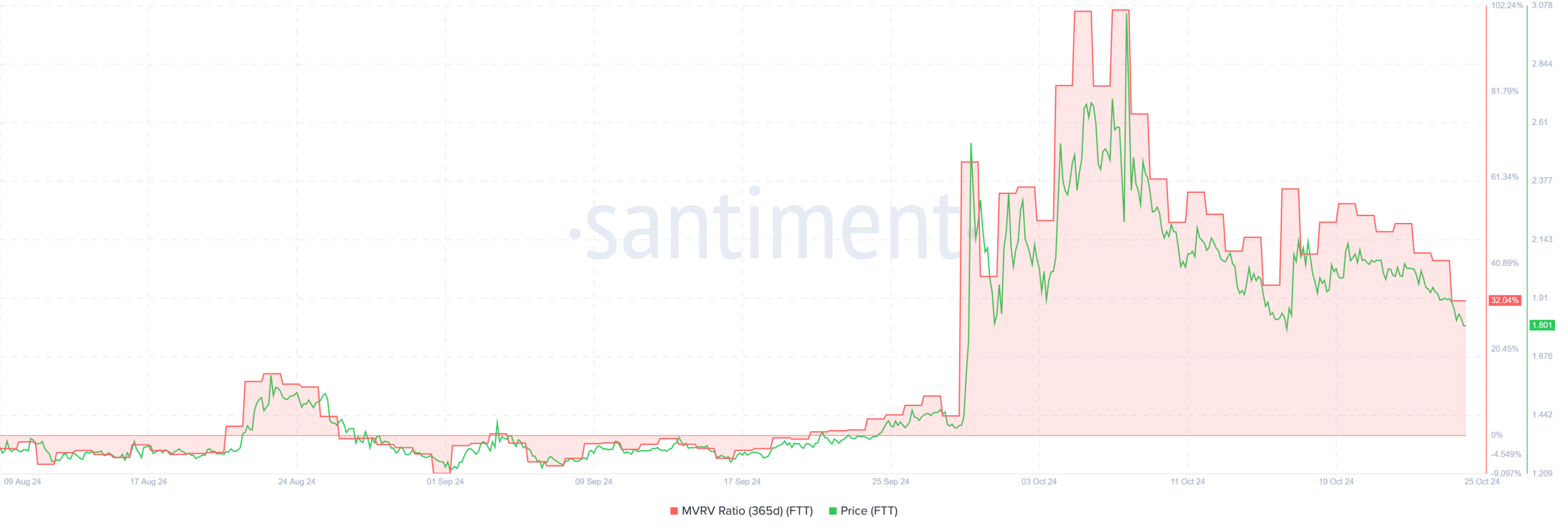

FTX Token (FTT)

FTX Token has shown little movement over the past year, with its price hovering at $1.78 and a market cap of $584.1 million. According to data from Santiment, FTT’s 365-day MVRV ratio has spiked into positive territory, now stable at approximately 32%. Such a high MVRV typically suggests the asset is overbought, prompting some investors to take profits. The recent drop from $3.43 to $1.75 aligns with a decrease in MVRV from 101% to 32%, highlighting FTT’s heightened risk of a prolonged downtrend.

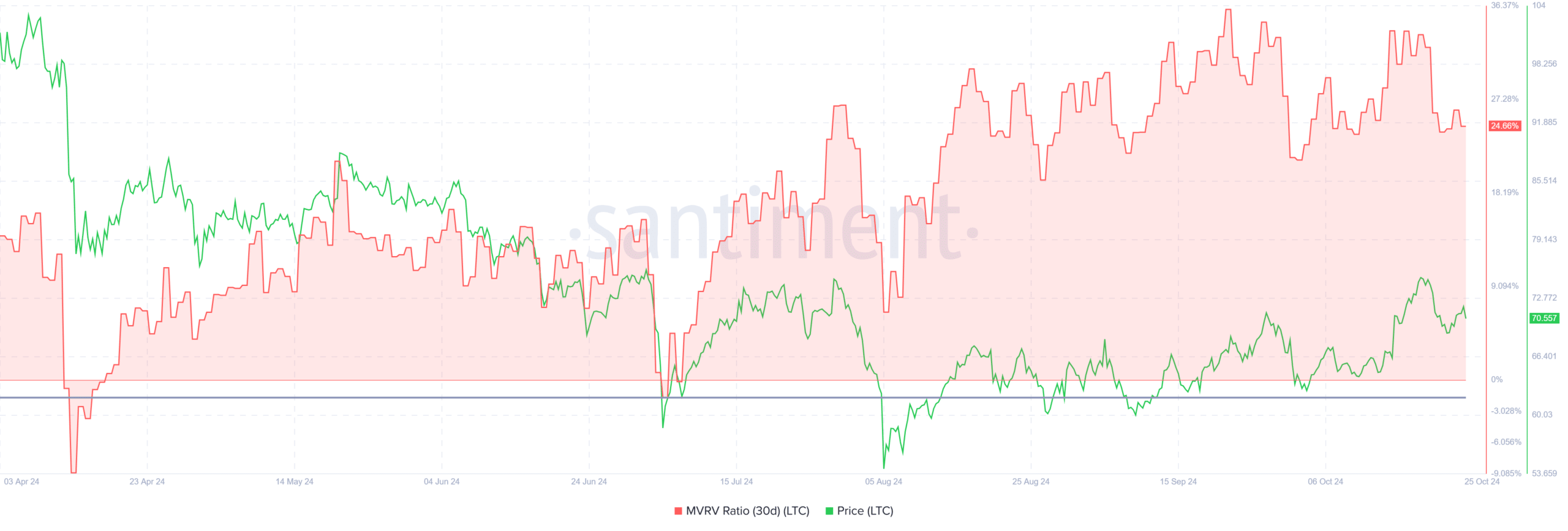

Litecoin (LTC)

Unlike other altcoins, Litecoin has surged over 42% in the past three months, climbing from $49.8 to $70. However, renewed selling pressure around the $76 mark has sparked an 8% pullback, leaving LTC trading at $70.6 with a market valuation of $5.3 billion. Its 30-day MVRV ratio has soared to 24.8%, indicating that short-term investors are in profit and may choose to sell off. This could introduce further price volatility as selling pressure mounts.

Aave (AAVE)

During the latest market adjustment, Aave saw a steep pullback, dropping from $165.8 to $141—a 14.8% loss. This bearish movement signals a shift in market sentiment from buying the dips to selling the rallies. Aave’s 90-day MVRV has climbed to 2.36%, indicating that recent buyers are also in profit, which may lead them to lock in gains, further contributing to selling pressure. While it may be tempting to buy more of these top cryptos in hopes of additional gains, FTX, LTC, and AAVE’s elevated MVRV ratios indicate overbought conditions and a correction risk.

As always, investors should conduct their research, as highlighted by The Bit Journal.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!