The anticipation surrounding Litecoin (LTC) is reaching new heights as analysts suggest it could be the next cryptocurrency to receive ETF approval in the United States. Following the submission of a revised S-1 filing for a Litecoin ETF by Canary Capital, Bloomberg’s Senior ETF Analyst Eric Balchunas believes LTC is a strong contender for approval.

Revised Litecoin ETF Filing Could Gain SEC Approval

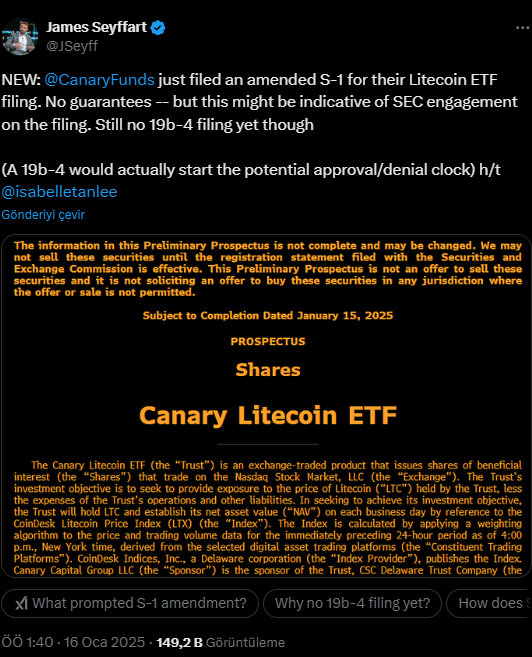

In October 2024, Canary Capital submitted an initial S-1 registration form to the U.S. Securities and Exchange Commission (SEC) for a Litecoin ETF. Earlier this week, the company filed a revised version of this form. According to the filing, U.S. Bancorp Fund Services will act as the ETF administrator, while Coinbase Custody Trust and BitGo will serve as custodians for the Litecoin assets.

This revised filing has sparked optimism among industry observers, including Bloomberg analysts, who interpret the SEC’s engagement with the application as a positive indicator. Another Bloomberg ETF Analyst, James Seyffart, suggested that the changes in the filing might reflect direct feedback from the SEC, though no formal 19b-4 filing—which initiates the rule change process—has been submitted yet.

Leadership Changes at SEC Could Influence Approval Timeline

The approval process for a Litecoin ETF could hinge on upcoming leadership changes within the SEC. Current SEC Chair Gary Gensler is set to step down on Monday, and former SEC Commissioner Paul Atkins has been nominated to take his place. Atkins, known for his supportive stance on the crypto market, could usher in a more favorable regulatory environment. However, his confirmation by the Senate remains pending, leaving the exact timeline uncertain.

Eric Balchunas emphasized in a recent social media post that the revised Litecoin S-1 filing aligns with his earlier prediction that LTC would be the next cryptocurrency ETF approved in the U.S. However, the leadership transition introduces a variable that could impact the timeline.

Litecoin’s Price Surges Amid Optimism

Created in 2011 as a more efficient alternative to Bitcoin, Litecoin is one of the oldest and most reliable blockchain projects. Following the recent announcement, LTC’s price surged by over 18%, trading at $119.46 at the time of writing. Analysts predict that the ongoing rally could push prices past the $130 resistance level, with a potential target of $170 in the near term.

Additionally, open interest in Litecoin rose by 29.58% within 24 hours, reaching $575.39 million. Trading volume also saw a remarkable 277.25% increase, climbing to $1.65 billion. These metrics indicate growing confidence in Litecoin’s future among both retail and institutional investors.

ETF Momentum Grows in the Crypto Space

The recent approvals of Bitcoin and Ethereum spot ETFs have set a precedent for other altcoins, such as Litecoin, Solana, and XRP, to follow. According to a JPMorgan and Hashkey research note, newly approved Solana and XRP ETFs could attract $13.6 billion in fresh capital within six to twelve months of launch. Similarly, the introduction of a Litecoin ETF could significantly boost institutional investment in the crypto sector.

While the revised S-1 filing signals progress, the exact timeline for a Litecoin ETF approval remains uncertain. Canary Capital has yet to provide an indication of when the 19b-4 filing will be submitted, a crucial step for SEC’s decision-making process

Conclusion: A New Era for Litecoin?

The combination of institutional interest, evolving regulatory dynamics, and Litecoin’s historical significance makes it a strong candidate for the next cryptocurrency ETF approval. Investors and enthusiasts alike should stay tuned to The Bit Journal for updates on this rapidly evolving story.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!