As the crypto market regains momentum, XRP is back in the spotlight—this time at a critical price juncture. After reaching $2.08 on April 9, XRP experienced a mild correction before rebounding near $2.24. With bullish hopes rising, analysts are offering mixed perspectives on whether this rally can sustain—or whether a pullback is looming.

Casi Trades: Support Below $2.24 Must Hold

Technical analyst Casi Trades warns that XRP is currently testing the 0.382 Fibonacci retracement level near $2.24. While momentum has shown signs of strength, RSI indicators suggest potential downside pressure. According to Casi, this level could mark a tipping point that defines XRP’s next major trend move.

He highlights two key support zones: $1.90 and $1.55. The $1.90 level could provide a short-term recovery platform, while $1.55 represents a golden Fibonacci ratio that might attract long-term buyers. Notably, these zones also align with second-wave targets outlined by Elliott Wave Theory.

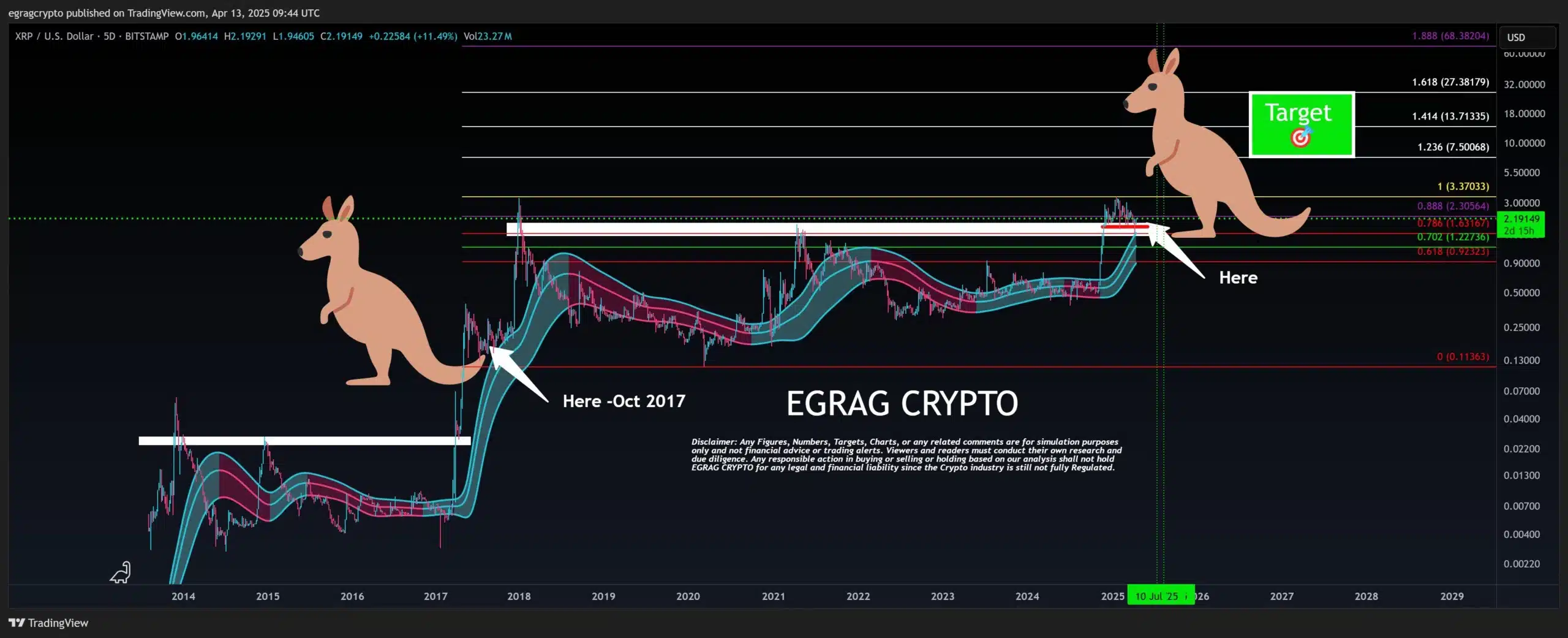

Egrag Crypto: Expect a Dip Before the Breakout

Popular market commentator Egrag Crypto presents a more cautious scenario. He notes that unless XRP can secure a 5-day close above the $2.30–$2.50 range, there is a risk of a downward move toward $1.85.

Despite this near-term bearish outlook, Egrag remains bullish on XRP’s long-term trajectory. He projects potential price targets of $7.50, $13, and even $27, suggesting that any upcoming correction could serve as a healthy reset before a major breakout.

He also emphasized the heightened volatility across the crypto market, stating that rapid liquidation events could shake prices significantly. For investors, he recommends following chart-based strategies and identifying strategic entry points, rather than chasing short-term hype.

Post-Lawsuit Rally May Be Delayed

The SEC vs. Ripple lawsuit remains a focal point for XRP’s narrative. While some community members expect an explosive rally once legal uncertainty clears, others are more reserved. One well-known XRP advocate from the “All Things XRP” group argues that much of the lawsuit’s impact may already be priced in.

The real growth catalyst, they claim, will come after the lawsuit concludes—through Ripple’s strategic roadmap. Key developments such as new institutional partnerships, expanded use cases, and ecosystem adoption will determine whether XRP’s valuation can truly scale new heights.

As The Bit Journal has reported in previous coverage, XRP’s post-trial trajectory may be less about legal headlines and more about sustained adoption and innovation.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!

References & Sources

TradingView – XRP/USD Technical Analysis

https://www.tradingview.com/symbols/XRPUSD/CoinMarketCap – XRP Market Overview

https://coinmarketcap.com/currencies/xrp/Casi Trades (Twitter/X Technical Insights)

https://twitter.com/casitradesEgrag Crypto – XRP Forecast Threads

https://twitter.com/egragcrypto