A major turn for Ripple supporters and crypto investors alike, XRP ETF approval odds have surged to a staggering 95%, according to Bloomberg ETF analysts James Seyffart and Eric Balchunas. This new wave of optimism comes on the heels of growing engagement between the U.S. Securities and Exchange Commission (SEC) and major asset managers pushing for altcoin-based exchange-traded funds.

The crypto market, long plagued by regulatory uncertainty, is now bracing for what could become a historic shift, official recognition of XRP ETF products. This article breaks down the significance of the news, the ripple effect across the industry, and what investors should watch for next.

Why the Odds Have Skyrocketed

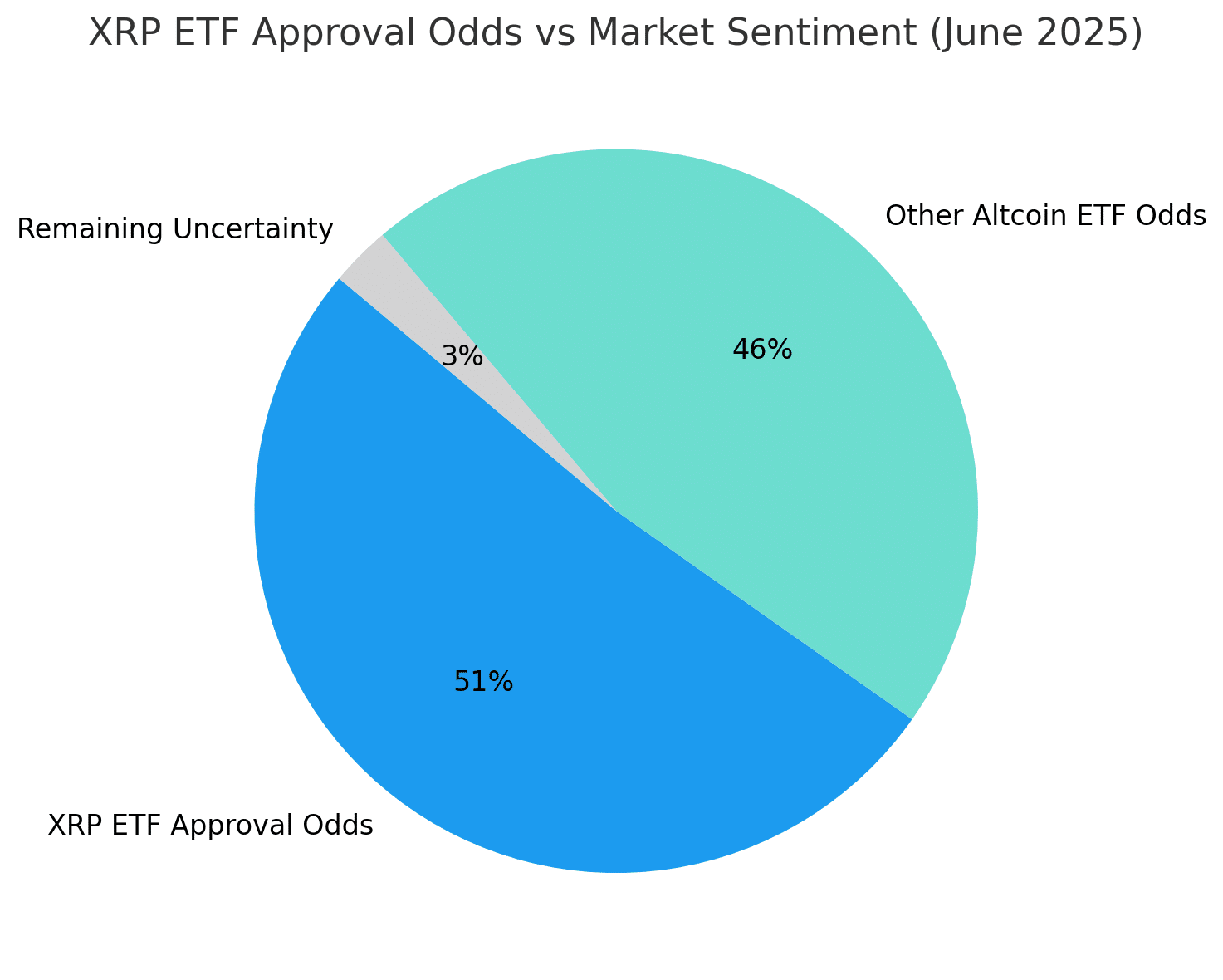

Bloomberg analysts, known for their accurate ETF forecasting, increased the likelihood of XRP ETF approval from 50% to 95% following clear signs of progress between the SEC and issuers. These signs include formal acknowledgment of 19b-4 filings, direct commentary between the SEC and ETF sponsors, and increasing alignment with legal precedents, especially after Ripple’s partial legal victory in 2023 that deemed XRP “not a security” in certain contexts.

This shift is not exclusive to XRP. Other altcoins like Solana (SOL), Litecoin (LTC), and even Cardano (ADA) are witnessing similar approval odds. However, the XRP ETF has a unique edge, as Ripple Labs continues to deepen partnerships across global financial institutions, bolstering the case for XRP’s legitimacy and utility.

What an XRP ETF Could Mean for Crypto

Approval of an XRP ETF would mark a major milestone in crypto adoption. Not only would it open the floodgates for institutional capital, but it would also increase XRP’s accessibility to traditional investors who prefer stock market exposure over direct crypto wallet interaction.

The ETF vehicle is particularly attractive for financial advisors and retirement fund managers who can now offer XRP exposure without regulatory risk or custodial hurdles. As Bitcoin and Ethereum ETFs gain momentum, the XRP ETF stands as the next logical step in broadening the crypto-investment landscape.

Price Implications and Market Sentiment

While the news hasn’t yet triggered a full-blown rally, XRP’s price has seen upward pressure in response. Investor sentiment has improved, whale activity has increased, and trading volumes have picked up across major exchanges.

Here’s how XRP prices may move in the short-to-medium term:

| Month | Projected Low | Projected Avg | Projected High |

|---|---|---|---|

| July 2025 | $0.47 | $0.52 | $0.60 |

| August 2025 | $0.55 | $0.63 | $0.70 |

| September 2025 | $0.65 | $0.72 | $0.80 |

The approval of an XRP ETF could accelerate these projections, potentially pushing XRP above $1.00 by Q4 2025, especially if ETF fund inflows mimic Bitcoin’s historic rise.

How the SEC Is Softening Its Stance

The SEC’s recent behavior reflects a shift from combative to cooperative. This transition likely stems from mounting legal losses, bipartisan political pressure, and the growing influence of crypto-positive institutions and voter bases.

According to reports, the SEC is actively working with issuers to refine their XRP ETF filings, a positive deviation from earlier blanket rejections. If the SEC continues this path, XRP could become the first altcoin after ETH to receive ETF approval in the United States.

XRP ETF Approval Timeline

While no exact date has been set, analysts predict that the XRP ETF decision could arrive as early as Q3 or Q4 2025, with July to November considered a critical window. Market watchers closely track SEC filing updates, amendment requests, and comment periods for signs of imminent action.

Wider Impact: Could This Spark an Altcoin ETF Boom?

A successful XRP ETF would likely open the floodgates for other altcoin ETFs. If XRP clears regulatory hurdles, ETFs for Solana, Avalanche, Chainlink, and even Dogecoin could follow suit. The broader implication is clear: crypto is becoming increasingly institutionalized.

Conclusion: The Tipping Point for XRP?

A 95% approval probability isn’t just optimism, it’s a signal of imminent change. The XRP ETF is now more than speculation; it is fast becoming a probable reality. If and when approval arrives, XRP could see renewed adoption, price growth, and long-awaited recognition from traditional finance.

For crypto investors, the message is clear: the time to pay attention to XRP is now. With institutional gates nearly open, retail investors might soon find themselves on the outside looking in, unless they act early.

Summary:

According to Bloomberg analysts, the odds of an XRP ETF approval have surged to 95%, driven by positive signals from the SEC and increased regulatory engagement. This marks a major step toward institutional adoption of XRP, with potential ETF approval expected between July and November 2025. If approved, the XRP ETF could unlock significant inflows and establish XRP as a leading altcoin in traditional finance.

FAQs

What is an XRP ETF?

An XRP ETF is an exchange-traded fund that tracks the price of XRP, allowing investors to gain exposure to the asset without directly owning it.

When could the XRP ETF be approved?

Analysts suggest the ETF could be approved between July and November 2025, depending on the SEC’s decision timeline.

Why is an XRP ETF important?

It legitimizes XRP in the eyes of traditional investors and opens the asset to billions in institutional inflows.

Glossary of Key Terms

XRP ETF: A financial product that offers XRP exposure through traditional markets.

SEC: U.S. Securities and Exchange Commission, responsible for regulating securities.

ETF: Exchange-traded fund, a marketable security tracking an index or asset.

19b-4 filing: A required SEC document when creating a new exchange-traded product.

Whale activity: Large trades or holdings by institutional investors or high-net-worth individuals.