Toncoin price has gained significant market traction because it receives support from the Telegram platform while introducing modern blockchain solutions for scaling and functionality. The article analyzes present market trends alongside predicted future prices, together with external elements that shape Toncoin’s market performance.

Introduction to Toncoin

The blockchain project from Telegram started Toncoin price development before regulatory issues forced the project to transition under community management. The Open Network (TON) racks up advancements through its ongoing development stage that concentrates on achieving quick speeds while targeting large-scale user base adoption along with system scalability.

What is Toncoin?

As the fuel of The Open Network, Toncoin enables smart contract operations and transaction costs and supports both staking mechanisms and network governance. The token functions as a utility token that powers decentralized applications (dApps), storage solutions, and payment systems that integrate within Telegram operations.

Toncoin Price History

| Period | Price Change (USD) | Percentage Change |

| Today | -$0.059895 | -1.83% |

| 30 Days | -$0.679111 | -17.42% |

| 60 Days | -$0.064618 | -1.97% |

| 90 Days | -$1.64849 | -33.87% |

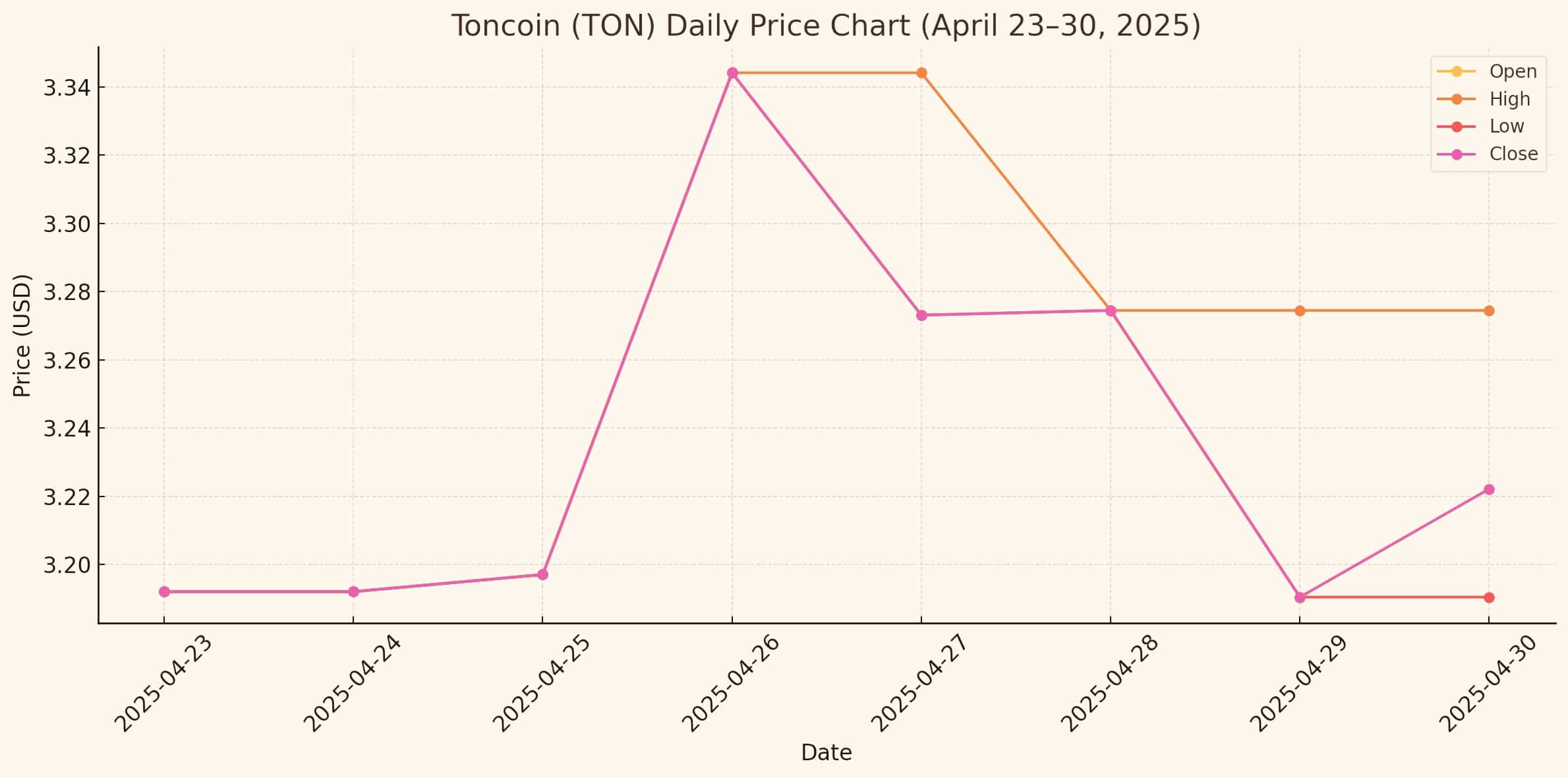

Recent Price Trends

Toncoin price maintains a trading price of $3.23 USD and has established a market cap of more than $8.1 billion at the time of April 30, 2025. Tonicoin experienced substantial price increases during Q1 and Q2 of this year because of:

- The usage of Telegram-based mini applications using TON continues to grow.

- The scrutiny of adjustable Layer 1 blockchain solutions attracts growing investments from market participants.

- Major exchange listings and integration with DeFi platforms.

Toncoin (TON) Market Overview

| Metric | Value |

| Current Price | $3.22 |

| 24h Price Change | -1.57% |

| 24h Trading Volume | $115.95 million |

| Market Capitalization | $8.10 billion |

| Circulating Supply | 2.51 billion TON |

| Total Supply | 5.13 billion TON |

| Market Cap Rank | #18 |

| All-Time High (ATH) | $8.28 (June 15, 2024) |

| All-Time Low (ATL) | $0.39 (September 20, 2021) |

| 7-Day Price Change | +4.37% |

| 30-Day Price Change | -17.27% |

| 1-Year Price Change | -39.32% |

Market Factors Influencing Toncoin

Analyzing what drives Toncoin price value allows us to anticipate its pending price trends.

Adoption within the Telegram Ecosystem

TON benefits from the 900+ million user base of Telegram to achieve widespread adoption. Different mini apps enabled by TON boost transactional utility because they provide functionality to users which increases demand for the token.

Ecosystem Growth and Development

The TON network released DeFi tools, NFT marketplaces, and decentralized DNS solutions in recent times. Structural elements in the ecosystem enhance its overall stability to bring in developers together with users.

Institutional and Retail Investment

TON is emerging as a significant smart contract platform that attracts increased involvement from institutions. The price appreciation of Toncoin gets support from both venture capital funding and institutional staking activities.

Regulatory Environment

While TON has documented legal issues against the SEC in its past these ongoing decentralized operations reduce potential centralization threats. International market regulations will define TON’s presence in the long term.

Toncoin Price Predictions

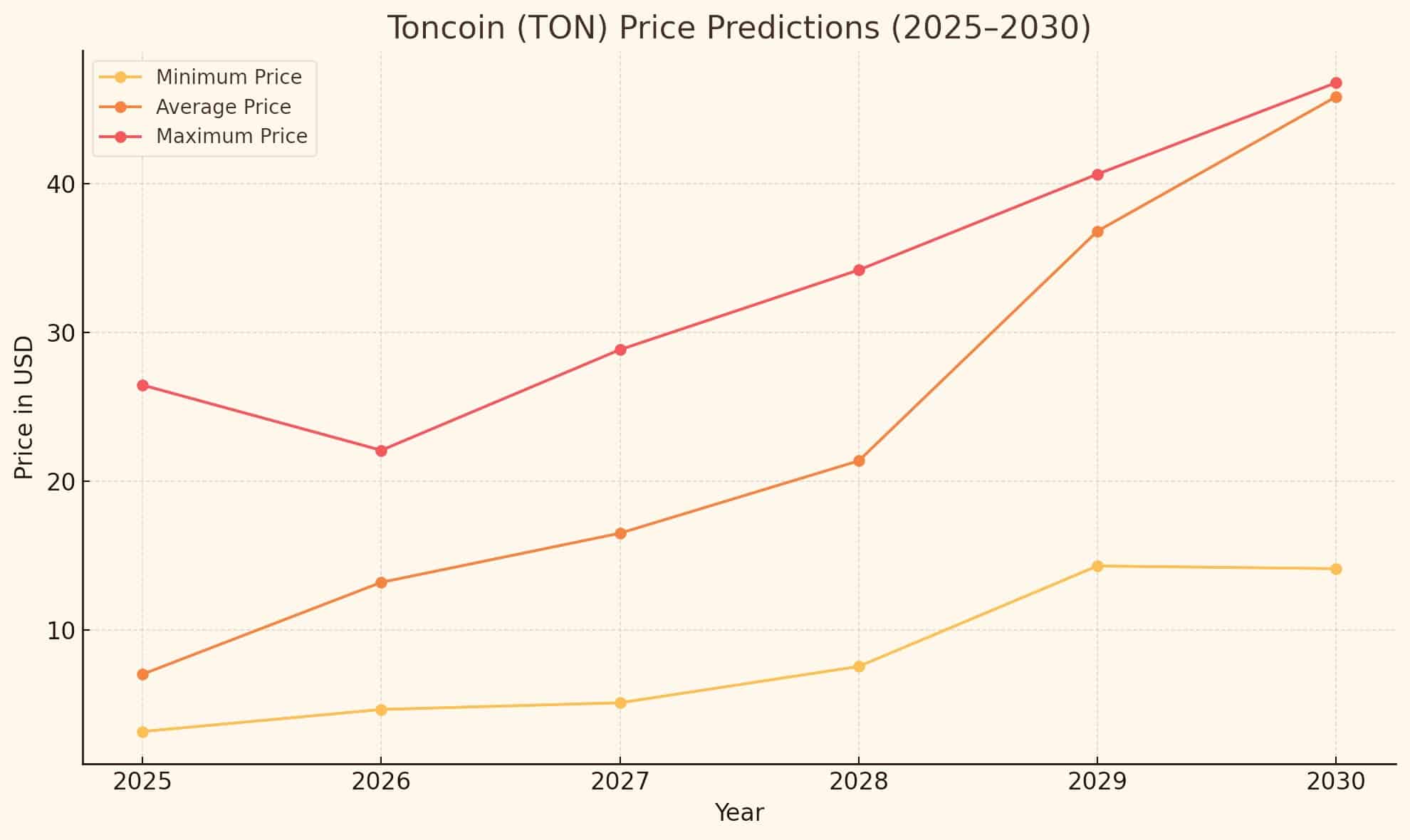

Short-Term Forecast (2025)

Experts predict Toncoin to achieve a value range between $3.9 and $4.4 for the year 2025 based on several key indicators and crypto sources.

The growth momentum of users who utilize Telegram mini applications will persist in the future.

- Integration with more exchanges.

- Bullish crypto market sentiment overall.

The positive performance of Bitcoin and Ethereum, combined with the altcoin market expansion, provides favorable conditions for TON to benefit.

Medium-Term Forecast (2026–2028)

Toncoin price could reach a pricing band of $17 to $34 during 2026-2028 based on three criteria:

TON DeFi protocol total value locked continues to rise at an increased pace.

Fairer market penetration of the TON Virtual Machine occurs as more developers accept its technology.

The Telegram platform enhances the capabilities of its built-in cryptocurrency wallet system.

The value of TON could establish itself at $8–$10 under low-risk circumstances while undergoing sporadic market movements.

Long-Term Forecast (2029–2030)

Long-term forecasts about TON mainly rely on speculation which shows potential for growth. An optimistic forecast for TON by 2030 would lead to cryptocurrency values above $27 if several conditions materialize.

TON will achieve status as the leading Web3 platform that serves mass consumer markets.

- Rivals Ethereum and Solana in dApp usage.

- Maintains strong security and decentralization.

There are two downsides to consider that involve the possibility of slowing user growth and competition from emerging Layer 1 networks.

Toncoin Price Predictions: 2025–2030

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) |

| 2025 | $3.74 | $3.84 | $4.49 |

| 2026 | $5.28 | $5.48 | $6.47 |

| 2027 | $7.76 | $8.03 | $9.10 |

| 2028 | $11.35 | $11.67 | $13.57 |

| 2029 | $16.50 | $16.96 | $19.43 |

| 2030 | $22.86 | $23.71 | $27.88 |

Comparative Analysis: TON vs Competitors

TON vs Solana

TON surpasses Solana because its partnership with Telegram brings millions of users to a single gateway. TON maintains a quickly growing community foundation even though Solana and its developed blockchain infrastructure lead the market at present.

TON vs Ethereum

The smart contract authority remains with Ethereum, but its operational challenges of high gas fees and slow speeds create an opening for TON to fill this opportunity by being faster. TON surpasses Ethereum in terms of efficiency for microtransactions and social media dApps through its design approach.

Investment Considerations and Risks

Advantages of Investing in TON

- Strong user adoption via Telegram.

- Fast and low-cost transactions.

TON maintains an expanding environment that welcomes participation from numerous developers.

Risks and Volatility

- Regulatory uncertainties.

TON maintains a status as a less mature blockchain platform than Ethereum and Solana.

- Potential for centralization due to large validator stakes.

Investors need to spread investments across different assets while reserving their funds only for amounts that they can lose in crypto markets, which show high volatility.

Conclusion

The blockchain innovation of Toncoin price enables it to connect mass adoption technology and decentralized networks. TON shows potential to join the top League of Layer 1 blockchains through Telegram’s support of its launching ecosystem and solid technical infrastructure which should yield influential status by 2030. Investors need to consider each advantage and disadvantage while making their decisions.

FAQs

Q1: Is Toncoin price a good investment in 2025?

You should invest in Toncoin price if you trust the blockchain developments from Telegram and believe in the future growth of the TON network and its related ecosystem.

Q2: Can TON reach $10 in 2025?

The coin has good potential according to analysts who predict its success based on ongoing bullish trends, together with increasing Telegram user adoption.

Q3: Where can I buy Toncoin?

Users can buy TON through major exchanges Binance, OKX, and KuCoin or decentralized platforms operating from the TON blockchain.

Q4: What does TON offer that other Layer 1 projects do not?

The direct connection between TON and Telegram provides exclusive access to substantial user numbers which makes the platform suitable for Web3 mobile applications.

Q5: Is TON secure for long-term storage?

The promising technology faces ongoing regulatory challenges, together with competition issues in the market. Long-term holding of TON requires appropriate risk management measures.

Glossary

Layer 1: The base blockchain network (either Ethereum or TON) of Layer 1 operates as the core element to process and validate transactions.

TVL: The total crypto asset deposits in decentralised finance protocols among blockchain users constitute TVL (Total Value Locked).

Dapp: On blockchain networks, dApp makes reference to decentralized applications that run on such systems.

Proof of Stake: The Proof of Stake consensus principle selects validators from users who possess coins and position those holdings as stakes.

Validator: Within blockchain networks, validators serve as participants who confirm new transactions for blockchain addition.

Smart contracts: Smart contracts work as automatic agreements which programmers embed terms within their programming language.

Sources

The Open Network (TON) Whitepaper

CoinMarketCap – Toncoin Price Data

Telegram’s Announcement on Wallet Integration

Messari Research Reports on Layer 1 Ecosystems

Binance Academy – Guide to TON Blockchain

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!