As the U.S. presidential election draws closer, market uncertainty and speculation around a potential Donald Trump victory could set the stage for significant Bitcoin price movement. Analysts at Bitfinex believe these conditions, combined with historically bullish fourth-quarter trends, could drive BTC to record highs.

Key Expectations for Bitcoin

Analysts point out that Bitcoin markets are seeing increased activity just two weeks ahead of the election. They highlight the combined impact of “election uncertainty,” the “Trump trade” narrative, and fourth-quarter optimism as elements of a “perfect storm” for Bitcoin. “Despite the noise in price fluctuations, the pre-election period offers exciting potential for Bitcoin,” stated Bitfinex analysts in their October 28 market report. Rising geopolitical tensions in the Middle East and ongoing U.S. macroeconomic concerns have amplified Bitcoin’s volatility, though analysts note that BTC has shown resilience as election-driven demand picks up.

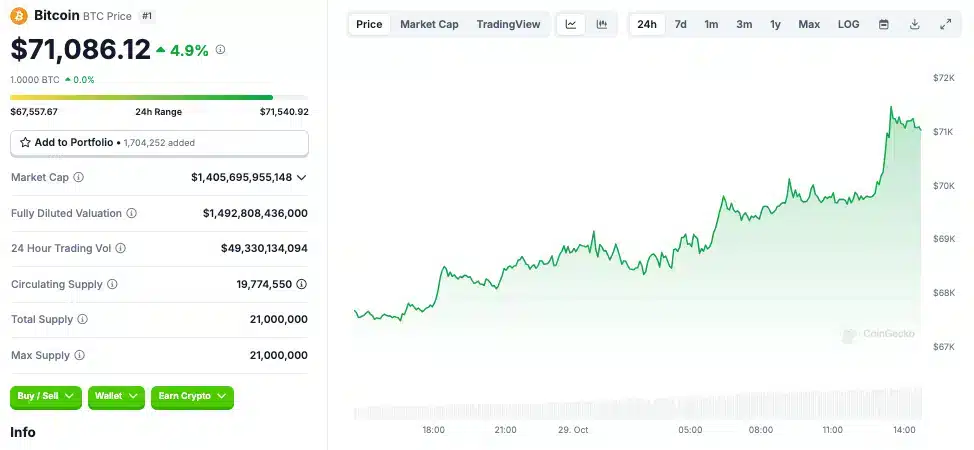

Bitcoin recently rose by 4.9%, trading around $71,086 — its highest level in five months and only 3.4% below its all-time high of $73,700. Analysts expect that a Trump victory could fuel Bitcoin’s price even further, with the “Trump trade” narrative gaining traction as the election approaches.

Trump’s Influence on the Market

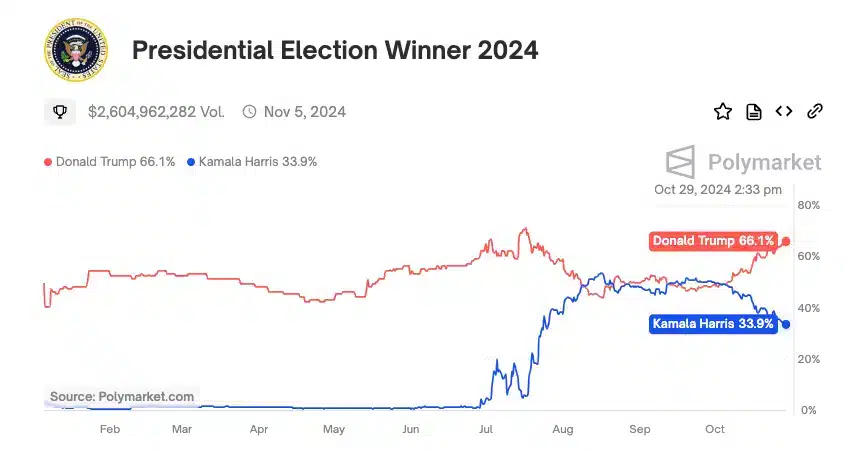

On Polymarket, a decentralized betting platform, Trump leads Kamala Harris by a margin of 30%. Although national polls show Harris with a 1.5% lead over Trump, the diverging opinions in political sentiment are impacting market expectations. If Trump wins, demand for risk assets like Bitcoin may increase. Amid high inflation and economic instability, crypto assets like Bitcoin are seen as a safe-haven investment. Analysts predict that a post-election market rally could push Bitcoin to new highs.

Bitcoin open interest has also reached record levels, hitting $41.7 billion as of October 29, according to CoinGlass. This surge reflects robust investor demand and expectations for substantial post-election price movement. Analysts note a notable accumulation of BTC call options for December, underscoring bullish sentiment in the event of an election rally. If this scenario unfolds, Bitcoin could surpass its all-time high of $73,800 post-election.

Eyes on November 5

As analysts from Bitfinex emphasize, the upcoming U.S. election may heavily influence Bitcoin and the broader crypto market. The anticipation surrounding a potential Trump victory, alongside historical fourth-quarter strength, has investors eagerly awaiting the results. The Bit Journal will continue to monitor market dynamics, as traders prepare for what could be an unprecedented rally.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!