With the start of October, Bitcoin’s price movements are attracting attention. Currently trading between $62,000 and $64,000, Bitcoin remains about 13% below its all-time high of $73,000. However, due to October’s historically positive performance, investors are hopeful for a price surge during what is often referred to as “Uptober.” This article explores the factors influencing Bitcoin’s price movements and the potential market impact of dormant whales becoming active once again.

Bitcoin’s October Outlook

As October begins, Bitcoin has been fluctuating between $62,000 and $64,000 over a 24-hour period. According to CoinGecko, BTC has gained 10% over the past 30 days, but it still trades 13% below its all-time high of $73,000. A report from Bitfinex noted that Bitcoin’s price increased by 26% from its lowest point in September. The report also mentioned that BTC traded within a consolidation range of $50,000 to $68,000. If historical trends continue, Bitcoin could reach new highs in late 2024 or early 2025.

If bitcoin continues following the trajectory of global M2 money supply, it’s heading to $90,000 before the end of the year. pic.twitter.com/Kd3YlDT12H

— Joe Consorti ⚡️ (@JoeConsorti) September 30, 2024

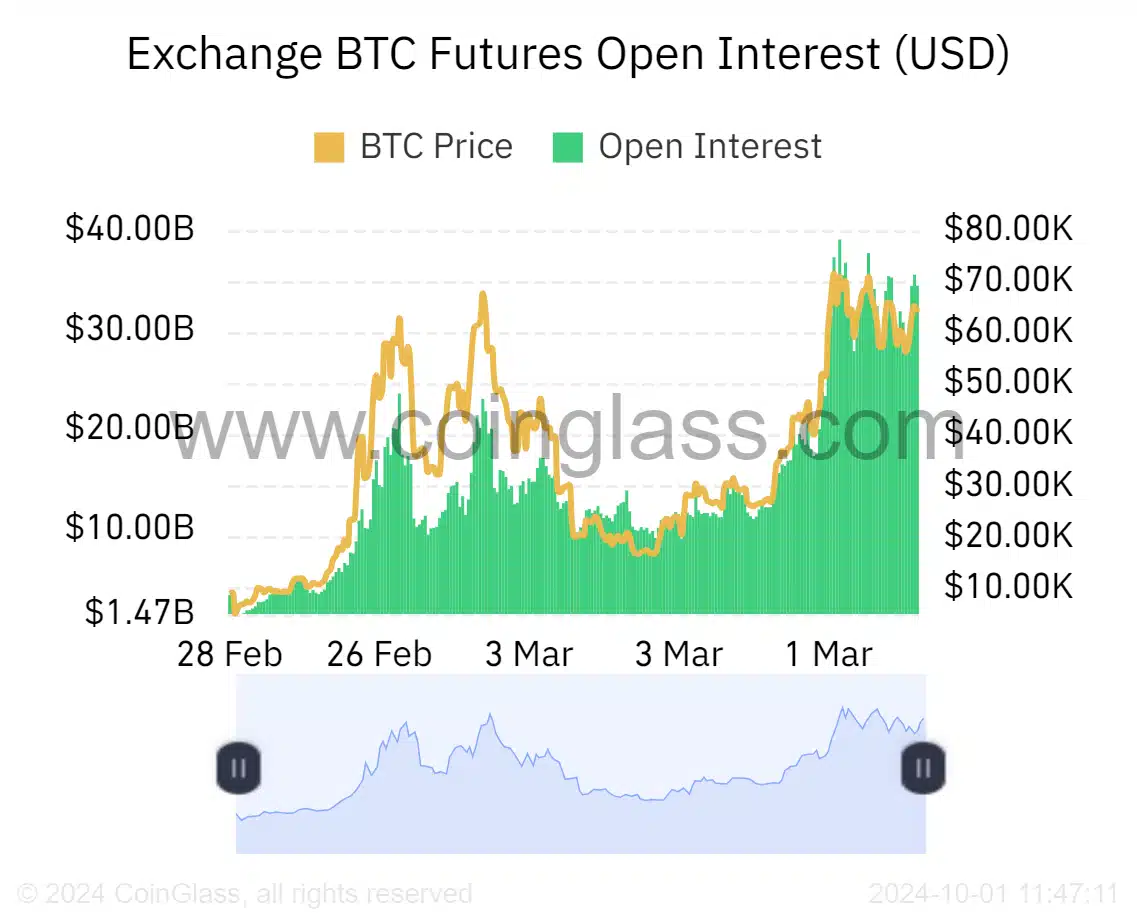

Three key factors are expected to drive this potential surge in Bitcoin’s price. First, the overall market conditions and the state of the U.S. economy will play a crucial role. Since 2013, October has been promising for Bitcoin, with an average 22.9% price increase. However, maintaining this positive trend will require favorable macroeconomic factors. Another important factor is the increase in spot market purchases. While Bitfinex reports that Bitcoin is currently trading above its Short-Term Holder Realized Price (STH-RP), investor appetite is not as strong. Additionally, the rise in futures trading has led to higher leverage in the market. If demand does not increase, volatility could follow. Coinglass data shows that open interest in BTC futures has increased, indicating heightened activity in the derivatives market.

Dormant Whales Reactivate

A notable development in recent days has been the reactivation of a long-dormant Bitcoin whale. According to Whale Alert, an address that had been inactive for 10.7 years holding 41 BTC has become active again. This highlights a trend of old Bitcoin whales reawakening. CryptoQuant CEO Ki Young Ju describes the Bitcoin market cycle in three stages. The first stage is the reactivation of old whales. The second stage involves new whales turning into retail investors, and the final stage is when these retail investors “hodl” their Bitcoin and eventually become whales themselves.

The third key factor affecting Bitcoin’s future price movements is the M2 money supply. M2 measures the amount of money in circulation, including cash and deposits. An increase in M2 signals rising global liquidity. If central banks print more money or lower interest rates, inflationary pressures may arise. During inflation, Bitcoin is often seen as a store of value, which could increase demand. Given the recent developments, investors may expect Bitcoin’s price to rise as October progresses.

💤 A dormant address containing 41 #BTC (2,611,481 USD) has just been activated after 10.7 years!https://t.co/RTOAE6KBcU

— Whale Alert (@whale_alert) September 30, 2024

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!