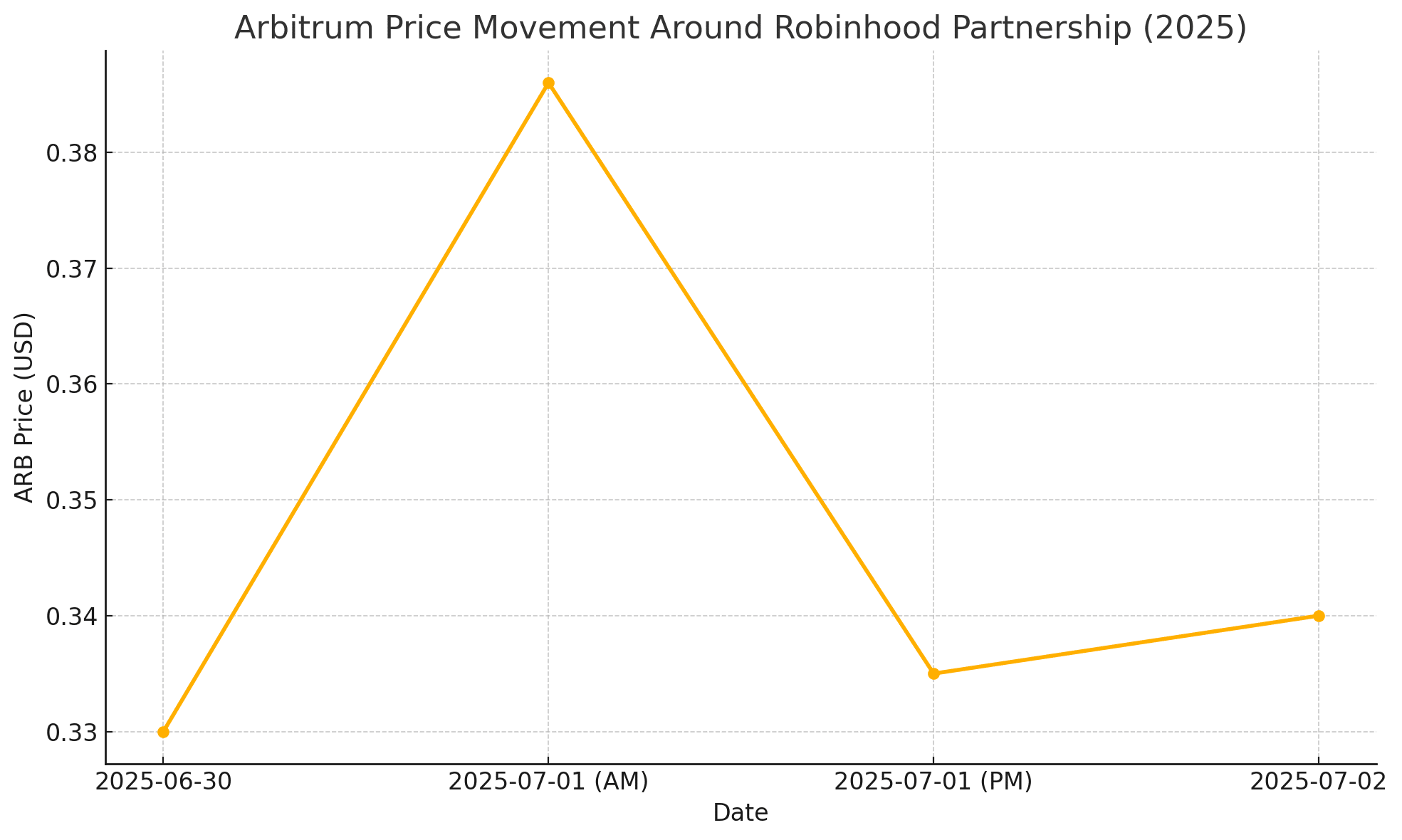

The highly anticipated integration between Robinhood and the Arbitrum network arrived with fireworks, and an equally swift hangover. For three straight sessions the Arbitrum price climbed on rumor alone, peaking at a 17 % intraday gain to $0.386 after Robinhood teased a “Layer-2 surprise” on X. Twelve hours later, as the brokerage formally unveiled tokenized U.S. equities on Arbitrum for its European customers, the Arbitrum price reversed violently, shedding more than 13 % in what traders called a textbook “sell-the-news” flush.

What Robinhood Actually Announced

Tokenized stocks: EU users can now trade over 200 U.S. equities 24/5 as blockchain-based tokens.

Arbitrum integration: The L2 handles settlement, cutting gas to pennies and improving speed.

Future roadmap: Robinhood signaled plans for a proprietary blockchain once volumes justify the leap.

The rollout propelled Robinhood shares to a record $94.24, proving Wall Street’s appetite for tokenization even as crypto investors took profits on the announcement.

Arbitrum Price Action: From Rumor Rally to Reality Check

| Timeframe | High | Low | Move (%) |

|---|---|---|---|

| 30 June (rumor) | $0.33 | $0.29 | +13 % |

| 01 July (teaser) | $0.386 | $0.31 | +17 %, then —13 % |

| 01 July (close) | $0.335 | — | Net +4 % |

Cointelegraph data show the rumor leg added roughly $600 million in market cap before half of that vanished inside one U.S. trading session. CoinSpeaker traced at least $5.8 million in ARB moving from early-stage wallets to exchanges during the downturn, suggesting insiders or seed-round funds locked in gains.

On-Chain Indicators Tell a Deeper Story

While price whiplash grabbed headlines, Glassnode-style metrics painted a more nuanced picture:

Active addresses spiked 25 % to 418 k, showing real users explored Robinhood’s token suite.

DEX volume exceeded $308 million, a three-week high, indicating liquidity providers repositioned rather than abandoned ship.

Perpetual-futures funding flipped positive on Binance and Hyperliquid, evidence that professional desks expect the Arbitrum price to stabilize once weak-hand profit-takers clear out.

Why the Sell-off Was Inevitable

Veteran traders weren’t surprised. When a catalyst is broadcast days in advance, smart money often buys rumor and sells fact. The Arbitrum price had already pierced the falling-wedge resistance at $0.33, a technical level analysts flagged as short-term overheated. CoinCentral chartists still target $0.44 on a successful retest of that breakout, provided $0.31 holds as support.

Fundamental Tailwinds Remain Intact

Despite the knee-jerk drop, Robinhood’s embrace lends Arbitrum what Layer-2s crave most: mainstream throughput. Each tokenized stock trade represents ETH gas that would otherwise be lost to competitors like Polygon. Moreover, tokenized equities expand Arbitrum’s user base beyond crypto-natives, tightening the feedback loop between fee revenue and validator incentives—a dynamic that could buoy the Arbitrum price over the longer arc.

Voices From the Street

“Profits were taken, yes, but network fundamentals only got stronger,”

—Jesse Coghlan, Cointelegraph markets editor cointelegraph.com

“ARB remains a top play on equity tokenization; dips below thirty-three cents look attractive.”

—Parth Dubey, CoinSpeaker analyst coinspeaker.com

These takes echo a broader sentiment that the Arbitrum price may whipsaw in the short term yet benefit from Robinhood’s retail funnel over the next quarters.

Key Risks Investors Must Monitor

Liquidity Exodus: If Robinhood volumes underperform, early whales could continue unloading, dragging the Arbitrum price toward $0.28 support.

Regulatory Crossfire: U.S. lawmakers have yet to opine on tokenized equities. An unfavorable ruling could spook Layer-2 sentiment across the board.

Competition: Polygon, Starknet, and Base are all lobbying fintechs; a future announcement elsewhere might siphon flows.

Outlook: Volatility With a Purpose

Seven-figure liquidity transfers and two-digit intraday swings underscore that Arbitrum is no longer a niche rollup—it is a battleground for the next phase of decentralized finance. The Arbitrum price narrative now hinges on whether tokenized stocks capture sustained order flow or fade as a curiosity. If Robinhood’s EU pilot scales, analysts project weekly Layer-2 fee revenue could double, making today’s volatility a mere blip on a broader adoption curve.

An Overview

The Robinhood partnership proves that big fintech believes in Layer-2 efficiency, but price discovery remains brutal when speculation outruns fundamentals. For traders, the Arbitrum price offers a masterclass in rumor dynamics; for builders, it confirms that real-world assets on-chain are no longer hypothetical. Expect more volatility—yet also more eyes—on the network that just stitched Wall Street’s favorite retail platform to Ethereum’s fastest rollup.

Frequently Asked Questions (FAQs)

Q1. Why did the Arbitrum price drop after the Robinhood partnership?

The price fell due to profit-taking after a rumor-driven rally, a common “sell-the-news” reaction.

Q2. What was Robinhood’s announcement about Arbitrum?

Robinhood launched tokenized U.S. stocks on Arbitrum for EU users, enabling 24/5 trading.

Q3. Did the Robinhood partnership increase network activity on Arbitrum?

Yes. Active addresses and DEX volume spiked, indicating strong user engagement.

Q4. Was the Arbitrum price move purely speculative?

Partly. On-chain activity suggests real adoption, but early investors also took profits.

Q5. Is the Arbitrum price expected to recover soon?

Analysts say if support holds around $0.31, it could target $0.44 in the short term.

Glossary of Key Terms

Arbitrum

A Layer-2 blockchain scaling solution for Ethereum that uses optimistic rollups to reduce gas fees and increase transaction speed.

Tokenized Stocks

Digital representations of real-world equities that can be traded on blockchain networks, often backed 1:1 by real shares.

Sell-the-News

A market pattern where traders sell off an asset after a widely anticipated positive event, causing a price drop.

Perpetual Futures

A type of derivative contract with no expiry date, often used by traders to speculate on price movements with leverage.

Funding Rate

A fee paid between traders in perpetual futures to keep the contract price close to the spot price.

DEX (Decentralized Exchange)

A peer-to-peer trading platform that operates without a central authority, allowing users to swap crypto directly from wallets.