The cryptocurrency market is buzzing with anticipation as Bitcoin (BTC) and Ethereum (ETH) approach critical price levels. Analysts are closely monitoring these developments, as they could signal a significant shift in the market. Will Bitcoin breach the six-figure threshold, and can Ethereum lead a rally for altcoins? Let’s explore the dynamics shaping this pivotal moment.

Ethereum’s Role in the Altcoin Market Surge

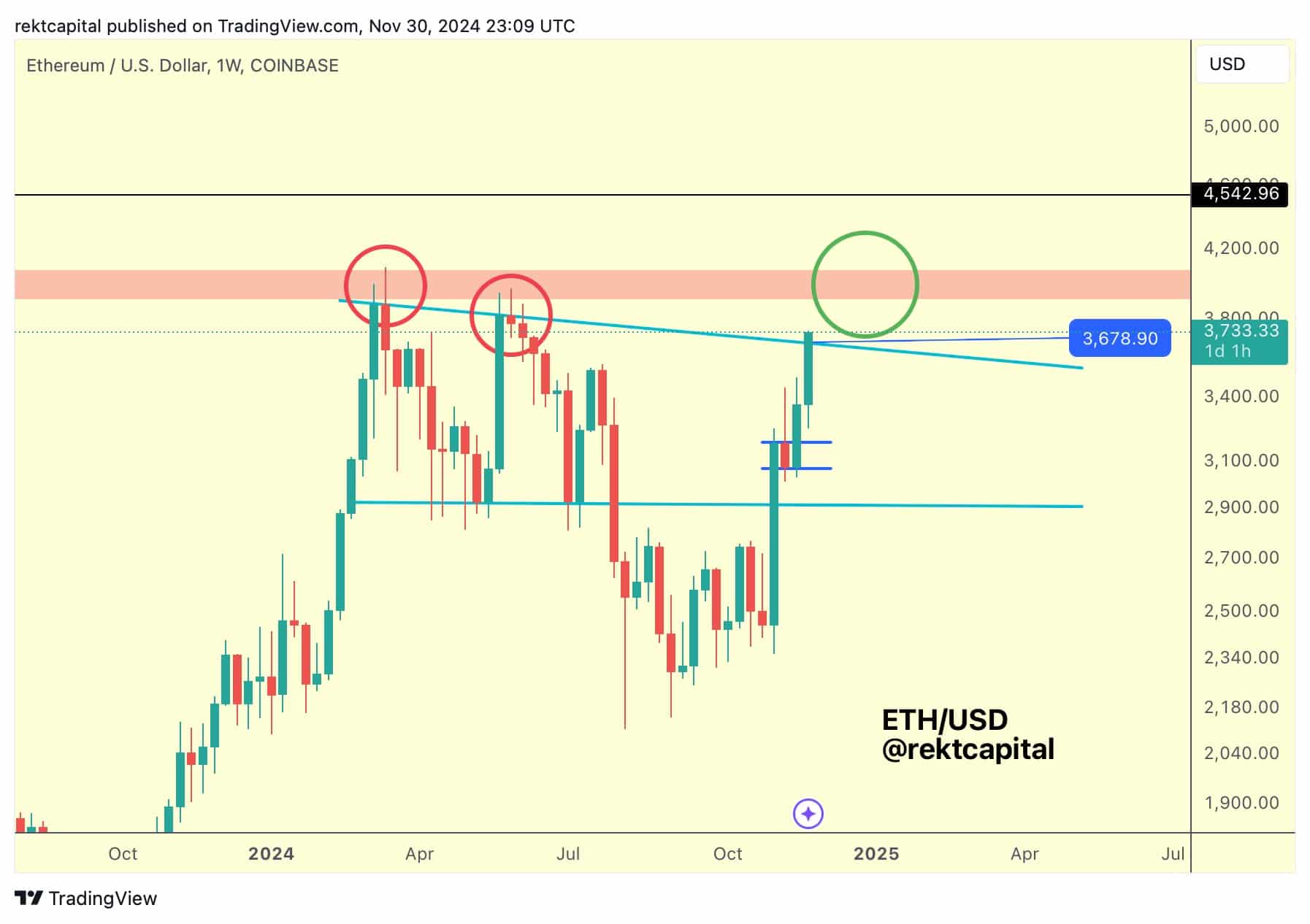

Ethereum has long been a trendsetter for the altcoin market, and its next moves could spark a broader rally. Renowned analyst Rekt Capital emphasizes the importance of Ethereum’s performance at key resistance levels, stating:

“An upward move by ETH will likely trigger the next wave of gains across the altcoin market.”

The $3,700 resistance level stands out as a crucial hurdle for Ethereum. Breaking and sustaining a position above this mark could signify the end of ETH’s prolonged downtrend. Rekt Capital further elaborates:

“If Ethereum secures a weekly close above ~$3,700, it will mark a breakout, potentially ending the 2024 downtrend and paving the way for sustained growth.”

This potential breakout would not only bolster Ethereum’s market position but also create ripples across smaller-cap altcoins, offering fresh opportunities for investors.

Bitcoin Eyes New Highs Amid Optimism

As for Bitcoin, the focus remains on its ability to challenge the elusive $100,000 level. Rekt Capital highlights the $97,450 resistance zone as a critical barrier:

“A daily close above ~$97,450 could reignite the bullish momentum, bringing the psychological $100,000 target within reach.”

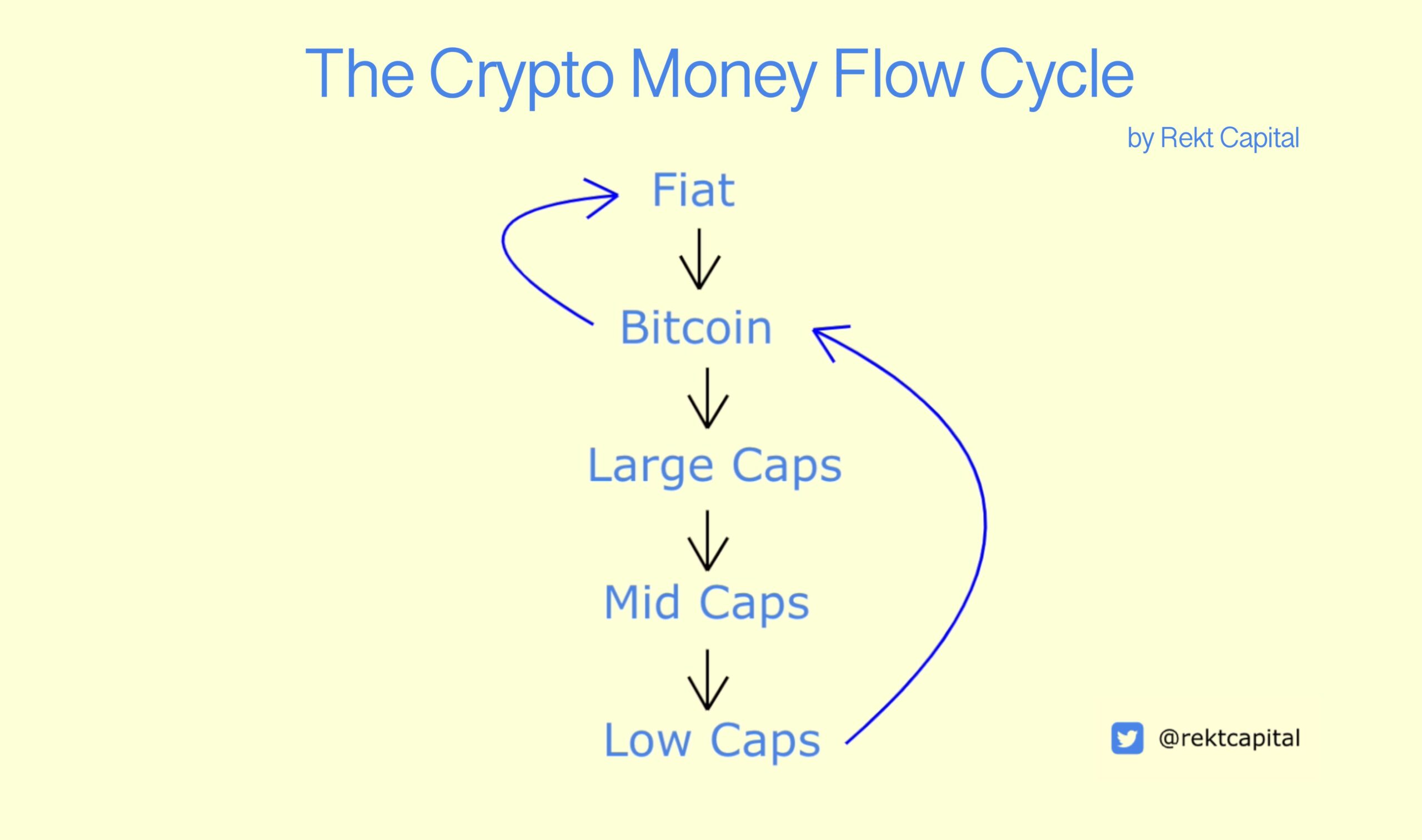

A breakthrough at these levels is likely to inject optimism into the broader market. Moreover, capital rotation from Bitcoin to altcoins could unlock new opportunities for lesser-known projects. This pattern of capital flow has historically marked periods of heightened market activity and investor interest.

Capital Rotation: Ethereum at the Helm

Ethereum’s influence extends beyond its price action, shaping the direction of capital flows within the market. Breaking above $3,100, a notable resistance level, could initiate a new wave of capital rotation, as Rekt Capital explains:

“A weekly close above the diagonal resistance at $3,100 would position ETH to dominate large-cap flows, potentially triggering a cycle of capital shifting towards smaller-cap assets.”

This redistribution of market liquidity is a key factor that could broaden the scope of market movement, providing strategic opportunities for traders and investors.

Key Takeaways for Investors

The cryptocurrency market is at a crossroads. Bitcoin’s battle at the $97,450 resistance level and Ethereum’s potential breakout at $3,700 are pivotal. These developments could define the market trajectory in the coming months. Investors are advised to remain vigilant, conducting thorough analyses and adjusting strategies as these trends unfold.

As The Bit Journal continues to monitor these critical movements, it’s clear that the crypto space is brimming with opportunity for those who act with precision and foresight.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!