In a strange twist amid soaring equities and cryptocurrency markets, the leveraged bearish ETF targeting MicroStrategy (SMST) is attracting millions of dollars in new capital, despite trading at a record low. Investors, mostly retail and tactical traders, are betting against the tide, indicating rising anxiety about overvaluation and the viability of recent rallies.

Leveraged Bearish ETF Sees Record Inflows Despite Market Highs

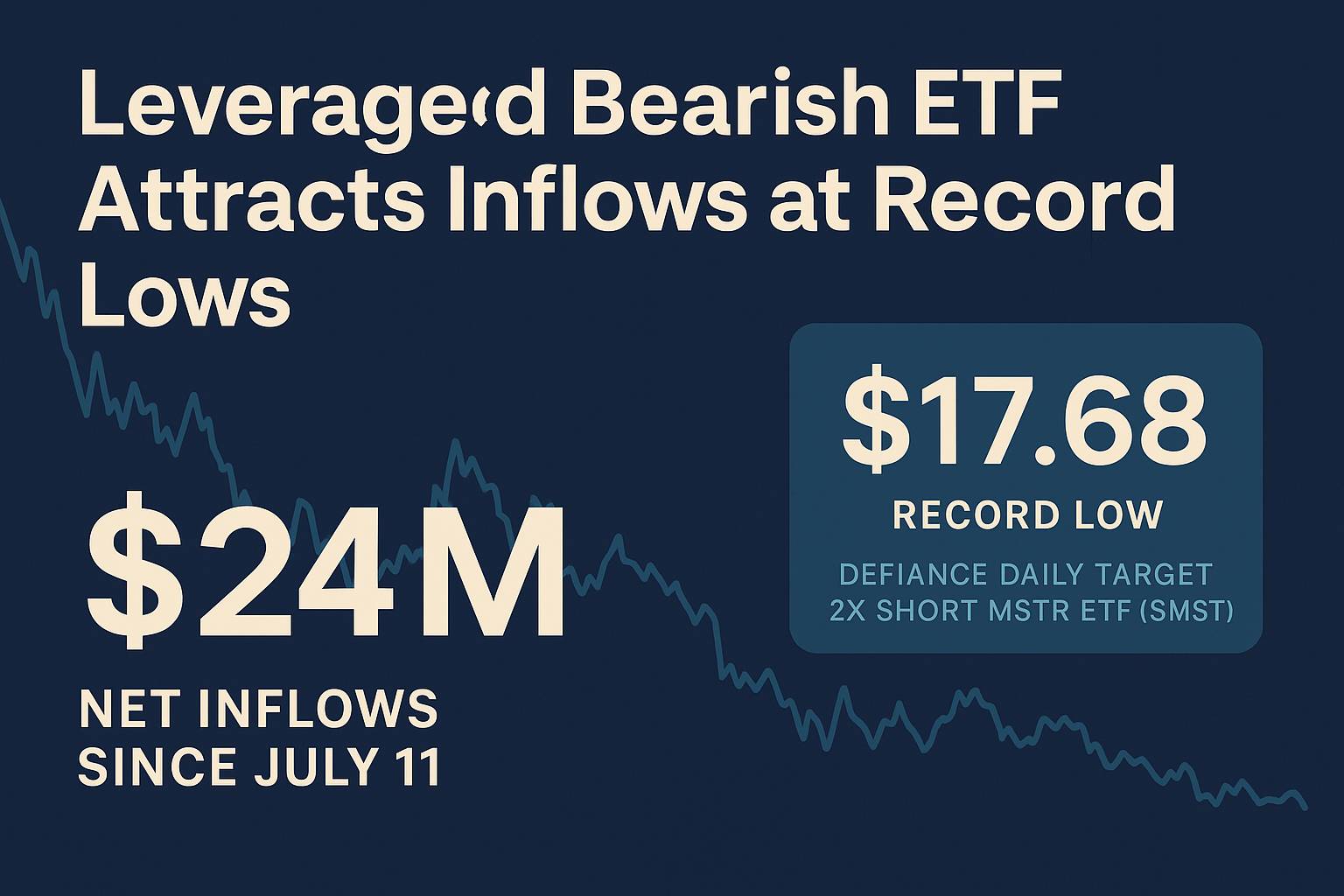

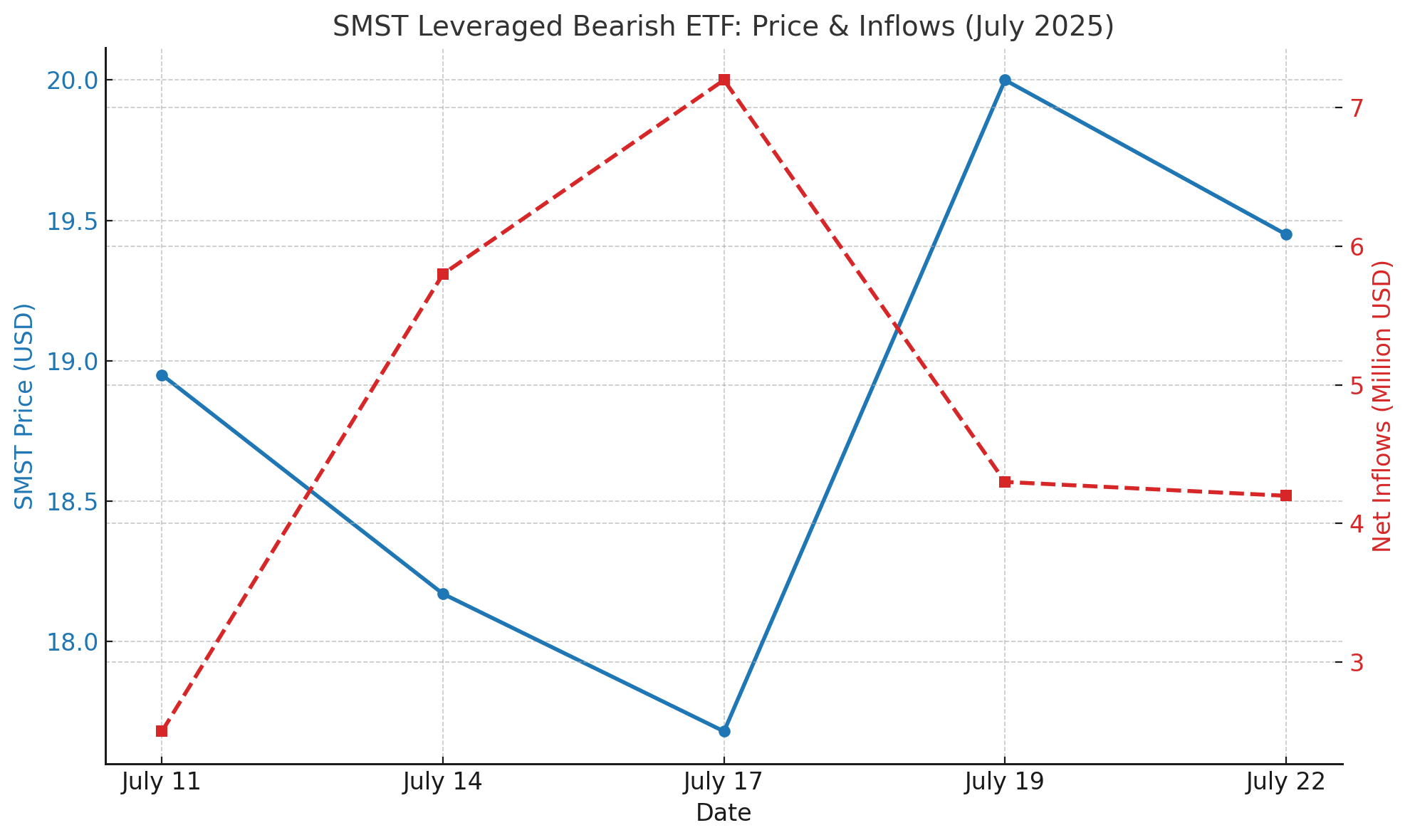

Since July 11, the Defiance Daily Target 2× Short MSTR ETF (SMST) received almost $24 million in net inflows. While the fund remains at record lows of $17.68, its abrupt 12% increase to $20 on July 19 indicated increased investor interest in bearish tactics.

This increased interest in the leveraged bearish ETF category comes as MicroStrategy’s shares and Bitcoin itself are reaching all-time highs. However, others feel a turnaround is imminent.

Retail Bets on Mean Reversion Amid Market Euphoria

Despite the overall optimistic attitude, a sector of the market believes current values are excessive. The leveraged bearish ETF SMST effectively enables traders to gamble against MicroStrategy, a firm whose success is closely tied to Bitcoin owing to its enormous BTC holdings.

As Bitcoin reached $120,000 earlier this month, SMST fell to new lows. However, that low became an entry opportunity for contrarian investors.

“This kind of inflow activity at the bottom reflects more than just speculation, it signals smart money preparing for volatility,” macro expert Alan Greenberg said. He continued: “Retail traders often follow momentum, but these flows show anticipation of a pivot.”

This isn’t a unique incident. Despite the well-known hazards, leveraged ETFs have grown in popularity. These funds double profits (but also losses) by two or three times, making them inherently volatile and best suited for short-term strategies.

Broader ETF Market Trends: Complexity Meets Popularity

The SMST activity is part of a broader trend in the ETF industry. By 2025, the US ETF sector will have over 4,300 products and total assets under management of more than $11.6 trillion. A rising subgroup of these are leveraged and inverse ETFs, which include single-stock options such as Tesla, Nvidia, and MicroStrategy.

According to recent statistics, leveraged products, notably the leveraged bearish ETF SMST, have generated more than $16.7 billion in inflows year to date. These data highlight a paradox: although the market is rallying, a sizable chunk of money is still betting on declines.

The rising complexity has aroused worries among authorities and experts.

“The retail crowd is getting more comfortable with exotic instruments, but many still underestimate how quickly these ETFs can turn against them,” Sarah Liu, an ETF strategist, said.

A Double-Edged Sword: Risk and Strategy in Bearish ETFs

For many, the attractiveness of a leveraged bearish ETF stems from its capacity to benefit from rapid declines. However, long-term ownership of these products often results in capital loss owing to volatility drag and compounding effects.

Investors who bought SMST early this year may still be losing money, despite the current rebound. This highlights the significance of timing and disciplined departure tactics. Those who are unfamiliar with how leveraged ETFs work may experience severe drawdowns, even if they accurately predicted market direction.

However, some traders use SMST strategically, not as a pessimistic bet on MicroStrategy, but as a hedge against the growing crypto exposure in conventional portfolios. In that way, the leveraged bearish ETF functions as a contemporary hedging tool, controversial but unquestionably beneficial.

Conclusion

The increase in inflows to SMST, a MicroStrategy-focused leveraged bearish ETF, reveals an undertone of doubt amid bullish exuberance. While the fund’s recent recovery from record lows has garnered attention, it also highlights the risks associated with using leveraged vehicles in volatile markets.

Investor education is becoming more important as the ETF market grows in complexity and diversity. SMST products, whether employed for tactical bets or macro hedges, are no longer niches; they are essential components of a rapidly changing financial environment.

FAQs

Q1: What is a leveraged bearish ETF?

A leveraged bearish ETF is a financial product that amplifies inverse exposure to an asset, often by 2× or 3×, allowing traders to profit from price declines.

Q2: Why is SMST gaining popularity now?

SMST is attracting inflows due to concerns about overvalued markets and expectations of a near-term pullback in Bitcoin and MicroStrategy stock.

Q3: Are leveraged bearish ETFs safe for long-term holding?

No. These ETFs are typically designed for short-term trades and can lose value over time due to volatility drag.

Q4: Who should use leveraged ETFs?

They are best suited for experienced traders who understand leverage mechanics and have a clear exit strategy.

Glossary

Leveraged ETF – An exchange-traded fund that uses financial derivatives to amplify returns (or losses) relative to an index.

Volatility Drag – A decline in value over time caused by fluctuations in daily returns, especially in leveraged instruments.

Inverse ETF – A fund designed to move in the opposite direction of a given benchmark or asset.

Net Inflows – The total amount of new money added to a fund, indicating investor interest.