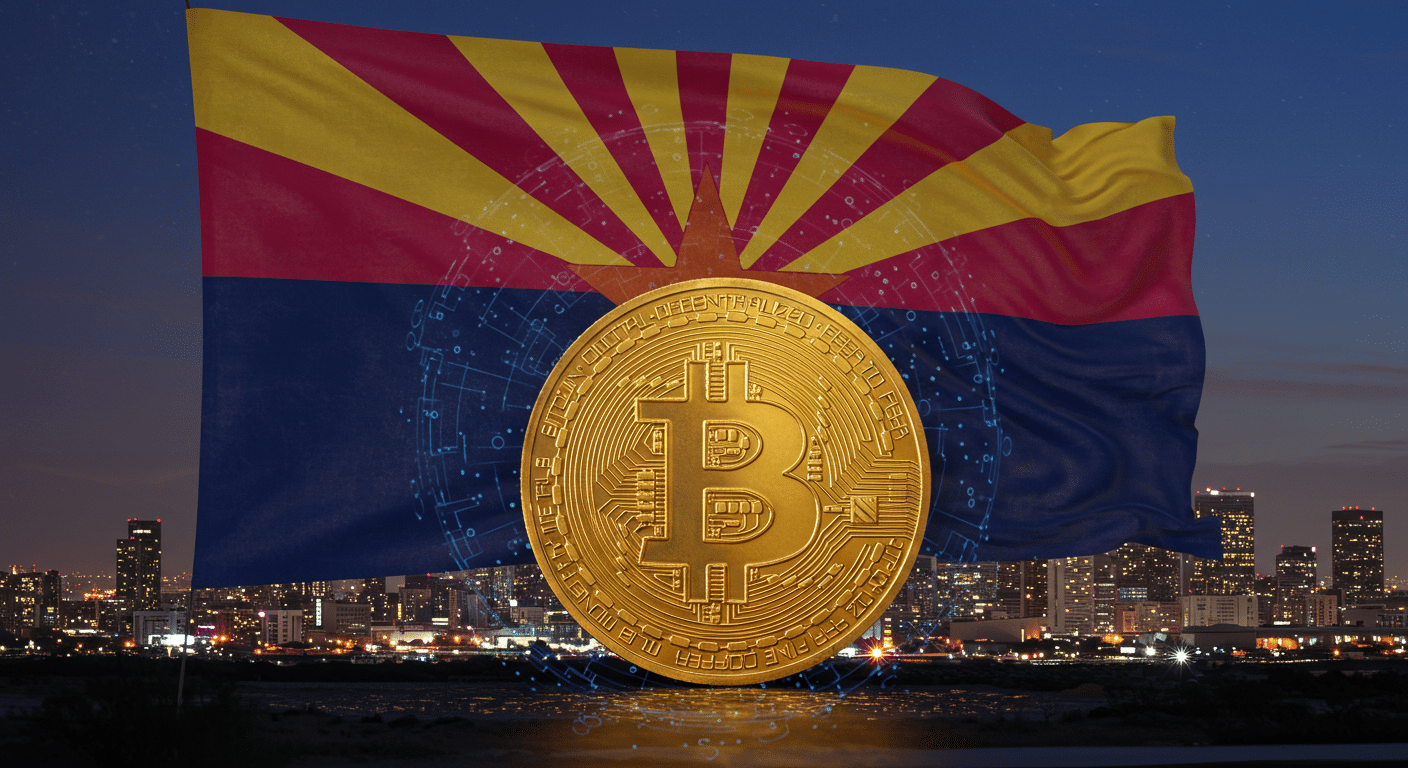

Arizona lawmakers have brought back House Bill 2324 following a failed final vote earlier in the House. The bill proposes creating a Bitcoin Reserve using confiscated digital assets and outlines new regulations for managing them. After the Senate passed it in a narrow 16-14 vote, the bill returns to the House for a fresh vote.

Bill Aims to Establish Bitcoin Reserve Fund

Arizona’s House Bill 2324 outlines the formation of a Bitcoin Reserve to manage seized digital assets securely. The bill allows authorities to seize, store, and sell digital assets tied to criminal cases. It proposes that the Arizona State Treasurer oversee and invest the assets or convert them into ETFs.

🇺🇸 ARIZONA Update:

'Bitcoin Reserve' bill HB2324, which initially failed, has been revived after a 'motion to reconsider'.

The bill would create a fund out of digital assets seized via criminal asset forfeiture.

It passed the Senate today 16-14, and is now in the House. pic.twitter.com/FKmLr8kSmJ

— Bitcoin Laws (@Bitcoin_Laws) June 19, 2025

The bill also details how the state will divide the proceeds from these forfeitures. The first $300,000 goes directly to the Attorney General’s office for operational needs. The rest is split between the Attorney General’s office, the State General Fund, and the Bitcoin Reserve.

Arizona legislators aim to address digital asset crimes and asset storage through this legal framework. The bill permits digital assets to stay in native formats, but mandates secure, state-managed digital wallets. The new system ensures controlled access to prevent theft or unauthorized use of stored cryptocurrencies.

Bitcoin Reserve Faces Previous Veto History

Despite Senate approval, the future of the Bitcoin Reserve bill remains uncertain due to past gubernatorial rejections. Governor Katie Hobbs has previously vetoed three similar measures involving digital asset reserves and cryptocurrency payments, including Senate Bills 1025, 1024, and 1373.

SB 1025 had proposed a direct Bitcoin Reserve, but it failed to secure the governor’s support. SB 1024 aimed to allow payments to state agencies using cryptocurrency. SB 1373 focused on a Digital Assets Strategic Reserve Fund, yet it was also vetoed.

Governor Hobbs defended her position by referencing House Bill 2749, which governs unclaimed digital property. That bill enables the state to claim ownership of digital assets after prolonged owner inactivity. Despite similarities, HB 2324 differs in that it uses confiscated, not unclaimed, assets to fund a Bitcoin Reserve.

Arizona Expands Asset Seizure to Crypto

HB 2324 introduces updates to Arizona’s forfeiture laws, expanding them to include digital currencies and other digital assets. When linked to criminal activity, these assets will now be subject to legal seizure. The bill mandates a transparent process for their storage, liquidation, and eventual distribution.

The legislation includes a protection clause for innocent asset owners unaware of illegal usage. Those individuals may file claims to retrieve their digital property. Authorities must prove criminal links before permanently seizing any asset.

Arizona intends to make its Bitcoin Reserve a secure state-managed account rather than a speculative investment vehicle. Depending on the treasurer’s strategy, the funds could also be converted into ETFs. By creating a formal legal structure, the state plans to reduce misuse and improve financial transparency.

FAQs

What is the purpose of the Bitcoin Reserve?

The Bitcoin Reserve aims to manage confiscated digital assets and allocate their proceeds for public use and crime enforcement.

Who manages the Bitcoin Reserve?

The Arizona State Treasurer is tasked with overseeing the reserve and deciding on its investment strategy.

What digital assets fall under this bill?

The bill includes cryptocurrencies and any other tokenized digital property seized during criminal investigations.

How will the funds be distributed?

After $300,000 goes to the Attorney General, the remaining funds are split among three state-designated uses.

Can citizens recover wrongly seized digital assets?

Yes, the bill provides legal protections and claim options for innocent digital asset holders.

Glossary of Key Terms

Bitcoin Reserve: A state-managed account funded by confiscated digital assets, aimed at secure storage and public benefit.

Digital Assets: Cryptocurrencies or any form of digital property with monetary value.

Forfeiture Laws: Legal provisions allowing the government to seize assets tied to criminal activities.

ETFs (Exchange-Traded Funds): Financial instruments that track the value of assets like Bitcoin, enabling traditional investment.

State Treasurer: The government official responsible for managing state funds, including the new digital reserve under HB 2324.