Amidst intensifying global financial instability, Arthur Hayes, co-founder and former CEO of BitMEX, projects a significant surge in Bitcoin’s market dominance. Hayes anticipates that Bitcoin’s share of the cryptocurrency market could ascend to 70%, propelled by mounting economic turmoil and a retreat from riskier altcoins.

Bitcoin’s Ascendancy in a Volatile Economic Landscape

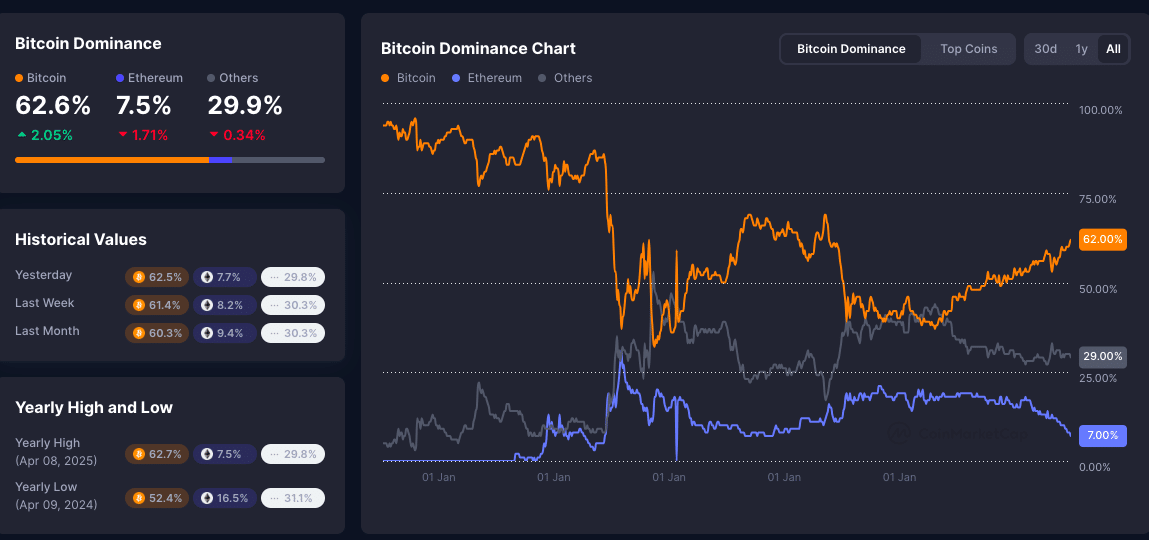

As of this April 2025, Bitcoin’s dominance stands at approximately 63%, marking its highest level in over four years. This metric reflects Bitcoin’s proportion of the total cryptocurrency market capitalization. Arthur Hayes attributes this growing dominance to investors’ preference for Bitcoin as a safer asset amid prevailing financial uncertainties. He suggests that until the Federal Reserve resumes expansionary monetary policies, risk appetite for alternative cryptocurrencies will remain subdued.

The backdrop to Arthur Hayes’ prediction involves significant upheavals in global financial markets, largely triggered by the Trump administration’s recent tariff implementations. On April 5, 2025, President Donald Trump invoked the International Emergency Economic Powers Act of 1977 (IEEPA) to impose a 10% tariff on all imports, with higher tariffs targeting specific countries set to follow.

This aggressive trade policy has led to dramatic declines across major stock indices: Hong Kong’s Hang Seng Index plummeted by 13%, marking its worst performance since 1997. China’s stock market experienced its most significant single-day loss since the 2008 financial crisis. In the United States, the S&P 500 futures dropped by 22%, pushing the market deep into bear territory.

These developments have sparked fears of a global recession, with investors seeking refuge in assets perceived as more stable.

Calls for Policy Reassessment Amid Economic Fallout

The financial community has voiced strong concerns regarding the administration’s tariff strategy. Bill Ackman, billionaire hedge fund manager and Trump supporter, reportedly warned that the U.S. is on the brink of a “self-induced economic nuclear winter.”

According to news sources, Ackman criticized the indiscriminate application of tariffs to both allies and adversaries, arguing that such measures erode trust in the U.S. as a trading partner and investment destination. Officials say he urged President Trump to initiate a pause on tariffs to facilitate the negotiation of more balanced trade agreements.

In this climate of economic uncertainty, Bitcoin is increasingly viewed as a “neutral asset” detached from national economic policies. Arthur Hayes posits that as confidence in traditional financial systems wanes, the demand for decentralized assets like Bitcoin will rise. He suggests that this environment could propel Bitcoin’s price toward $1 million as it assumes a more significant role in the evolving global financial landscape.

Market Reactions and Future Outlook

The cryptocurrency market, however, has responded to these developments with notable volatility. Over the past 24 hours, more than $1.3 billion in crypto positions were liquidated as traders scrambled to adjust their portfolios. Despite this turbulence, analysts believe Bitcoin’s price has shown resilience.

Financial analysts suggest that continued economic instability and restrictive trade policies may further bolster Bitcoin’s appeal as a hedge against traditional market risks. However, they also caution that the cryptocurrency market remains highly volatile and influenced by a myriad of factors, including regulatory developments and macroeconomic trends.

Conclusion

Arthur Hayes’s projection of Bitcoin’s market dominance reaching 70% reveals the shifting dynamics within the cryptocurrency space amid global economic challenges. As traditional financial markets grapple with the repercussions of aggressive trade policies and mounting uncertainties, Bitcoin’s role as a potential safe-haven asset comes into sharper focus.

Investors and market participants will be closely monitoring these trends, evaluating the implications for both the cryptocurrency market and the broader financial ecosystem.

FAQs

What is Bitcoin dominance?

Bitcoin dominance refers to the percentage of the total cryptocurrency market capitalization that is attributed to Bitcoin. It serves as an indicator of Bitcoin’s relative strength compared to the broader cryptocurrency market.

Why is Bitcoin’s dominance increasing?

Bitcoin’s dominance is increasing due to investors perceiving it as a safer asset amid global financial instability. Factors such as aggressive trade policies and market volatility are driving investors toward Bitcoin over riskier altcoins.

How have recent U.S. tariffs impacted global markets?

The recent U.S. tariffs have led to significant declines in global stock markets, including major drops in indices like Hong Kong’s Hang Seng and the S&P 500 futures, raising fears of a global recession.

What are the potential implications of Bitcoin reaching 70% dominance?

If Bitcoin’s dominance reaches 70%, it could indicate a consolidation of investment within the cryptocurrency market toward Bitcoin, potentially leading to reduced liquidity and interest in alternative cryptocurrencies.

Is Bitcoin considered a safe-haven asset?

Bitcoin is viewed as a safe-haven asset due to its decentralized nature and detachment from national economic policies, making it appealing to investors during times of economic uncertainty.

Glossary

Bitcoin Dominance: A metric that measures Bitcoin’s market capitalization relative to the total cryptocurrency market capitalization.

International Emergency Economic Powers Act (IEEPA): A U.S. law that grants the President authority to regulate international commerce during a national emergency.

Altcoins: Cryptocurrencies other than Bitcoin.

Bear Market: A market condition characterized by prolonged price declines.

Safe-Haven Asset: An investment that is expected to retain or increase in value during times of market turbulence.