Bitcoin may reach a record high of $150,000 later this year before altcoins go on their own parabolic rallies, billionaire investor and former BitMEX CEO Arthur Hayes said.

In a recent interview at Dubai-based conference Token2049 last week, Hayes spoke of a positive outlook for the flagship cryptocurrency, pointing to expected growth due to continuing measures by U.S. monetary officials.

Hayes Predicts Bitcoin Rally Amid Inflation

The outspoken cryptocurrency tycoon said that sustained inflation and the Federal Reserve’s probable switch back to expansionary monetary policy would be a key driver for Bitcoin and other crypto assets.

Arthur Hayes said on the Crypto Banter YouTube channel, I feel that the setup is just right for a rally on risk assets, just as what happened during the third quarter of 2022 up to early 2025. We are in a similar setup at present. We have much fear, uncertainty, and doubt across the markets. The monetary authorities particularly those from America do not like that, so they’re going to resort to money printing.

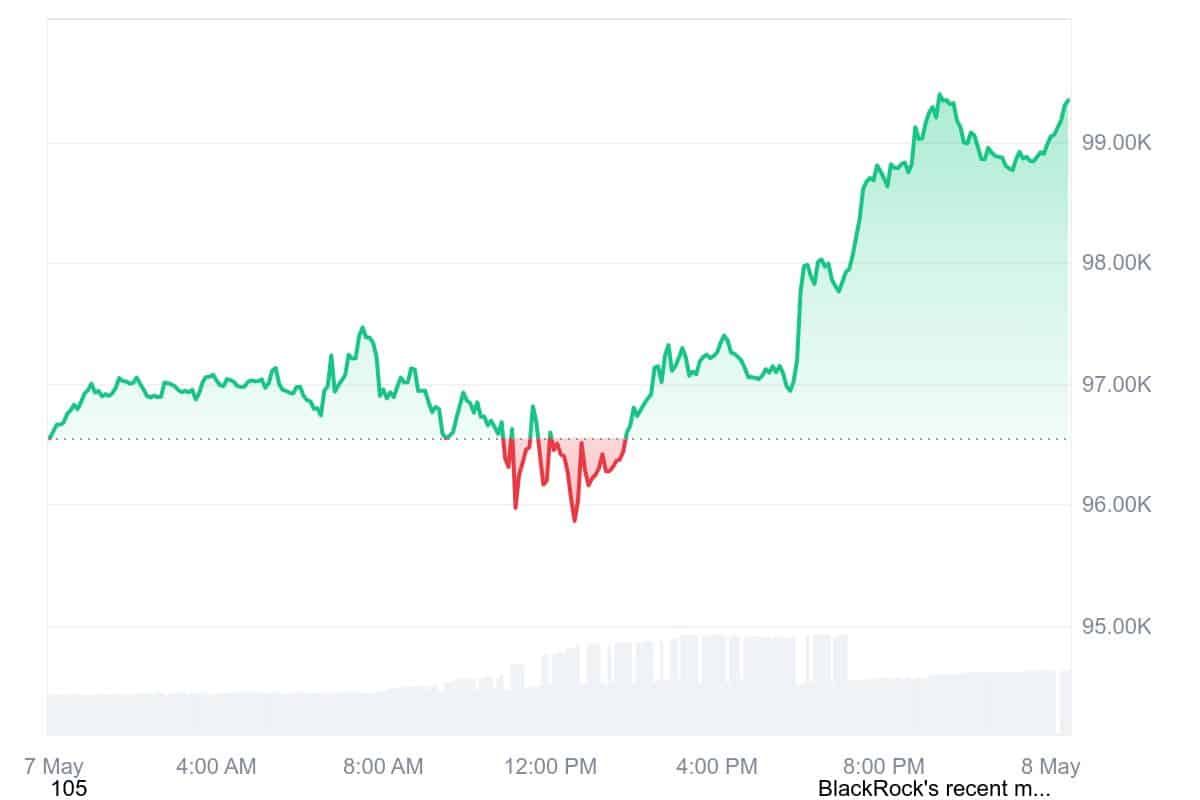

Fed Decision Sparks Modest Bitcoin Jump

Arthur Hayes sentiments mirror a general agreement that exists among crypto advocates who postulate that Bitcoin is a hedge against loose monetary policy and inflation. When central banks, especially the Fed, reduce interest rates or inject liquidity into markets, assets such as Bitcoin usually react with dramatic price surges.

Bitcoin is currently trading at $99,194. When Arthur Hayes made the comment, Bitcoin was at $96,230 1.5% higher over the last 24 hours, based on CoinGecko statistics. The recent jump came after the Federal Reserve on Wednesday left interest rates steady, a move that propagated a small wave of optimism into the markets for virtual assets.

Spot Bitcoin ETFs Fuel Market Strength

Arthur Hayes stated that the recent flow of institutional and retail capital, fueled primarily by the initial approval of spot Bitcoin exchange-traded funds (ETFs) early in 2025, has also helped strengthen the market. These ETFs, which are listed on major exchanges, enable exposure to Bitcoin without necessarily holding the asset, opening up crypto investments to traditional brokerage interfaces.

In addition to Bitcoin, Arthur Hayes also predicted that other top altcoins, such as Ethereum and Solana, would appreciate later on in the year. These tokens were likely to surge after the expected price explosion of Bitcoin due to regained optimism and liquidity for the cryptocurrency market, he said.

Nonetheless, the veteran trader qualified his forecasts with a touch of humility, joking about his own record. That said, Hayes confessed, the accuracy of my short-term market prediction record is ‘pretty shit’ or so take it for what it’s worth.

Trump-Pardoned Hayes Still Makes Waves

Hayes, pardoned by then-President Donald Trump in March, remains an outspoken and, at times, contentious character within the cryptocurrency sphere. His opinions, though they carry weight, have their critics and many of them counsel investors to exercise a healthy dose of suspicion when encountering such optimistic predictions.

Nonetheless, for the time being, Arthur Hayes is still at the camp that believes that Bitcoin and the overall crypto space is bound for new highs pushed not only by innovation within, but by macroeconomic drivers far outside of its control.

Conclusion

Whereas Hayes is hopeful for the future of Bitcoin and the wider crypto industry, he balances optimism with humor and humility. As inflationary pressures rise and central banks make difficult decisions, everyone will be watching for whether or not that potential is realized, whether Arthur Hayes’ aggressive prediction is a speculative swerve or not.

Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

FAQs

Q1: Why does Arthur Hayes think Bitcoin will hit $150K?

He believes inflation and U.S. money printing will drive Bitcoin higher.

Q2: How do Bitcoin ETFs affect the market?

They bring in new capital by allowing easy investor access.

Q3: Which altcoins could rise next?

Hayes expects Ethereum and Solana to rally after Bitcoin.

Glossary Of Key Terms

Bitcoin

A decentralized digital currency and the first cryptocurrency.

Altcoins

Cryptocurrencies other than Bitcoin, like Ethereum and Solana.

Inflation

The rise in prices over time reduces purchasing power.

Monetary Policy

Central bank actions, like adjusting interest rates, to influence the economy.

Spot Bitcoin ETFs

Funds that track Bitcoin’s price are traded on stock exchanges.

Federal Reserve (Fed)

The U.S. central bank manages monetary policy and interest rates.