According to the sources, Binance Founder Changpeng Zhao has sent a blunt warning to crypto investors in a recent report: very few cryptocurrencies will reach their previous all-time highs (ATHs). He said that most coins would not survive because of long-term values determined and real-world utility with development strength.

It contains a message asking investors to reconsider their decisions and choose assets with a factual fundamental basis rather than speculation-driven hocus pocus.

A Brutal Truth from the Binance Founder

Because in the ever-moving world of crypto, things change quickly, as do investors’ expectations. The message is direct from the Binance Founder. He let it be known: Strong fundamentals are the only things that will ensure coins thrive.

Binance Founder CZ said, “Only very few coins will ever discover a new ATH.” His explanation: Most tokens are founded on short-term trends, weak development companies, or undefined use cases. Coins lose value when excitement dissipates.

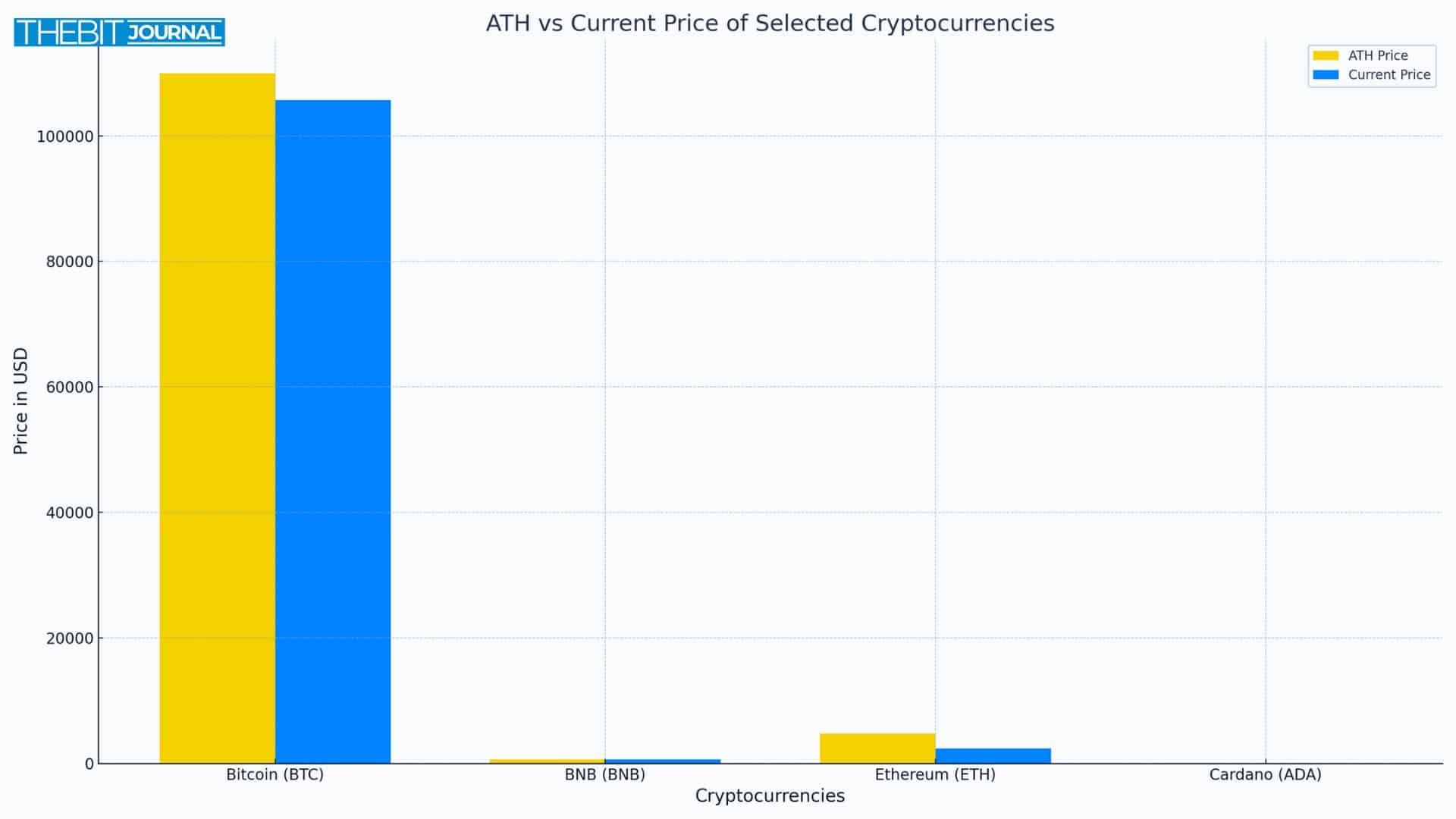

This message is relevant today since the cryptocurrency markets are still trying to recover from recent turmoil. While Bitcoin and BNB are showing some strength, many altcoins are floundering significantly below their previous peaks.

Why ATH Matters in Crypto

ATH(All Time High) is the peak price reached by a cryptocurrency thus far. Investors use ATH to measure past performance and the outlook for the future growth of a coin. If a coin is close to or breaking into an ATH, that implies that strong demand is present, sentiments are positive, or signs of increasing world-level use.

This review shows which coins are near their all-time highs (ATH). Bitcoin and BNB are again closing in on their peaks, while Ethereum and Cardano are far behind.

Watching ATH gaps allows investors to see which projects still hold value and which need momentum to recover. Strong fundamentals and continuous development can increase a coin’s potential to achieve the new ATH.

What Makes a Coin Likely to Reach ATH Again?

Signs of strength, as indicated by the Binance Founder, include:

- Real Use Case: Does the coin solve a real-world problem or power a working ecosystem?

- Active Development: Is a team regularly updating and improving the project?

- Community Support: Does it have users who believe in the long-term vision?

- Market Demand: Is there an apparent reason for people to hold or use the coin?

If a coin lacks these things, the chances of reaching a new ATH are slim.

Lessons from Past Bull Runs

In past bull runs, many coins went up only due to hype or chit-chat. Dogecoin and Shiba Inu attracted a lot of attention but failed to convert their all-time highs.

As Binance founder CZ said, hype cannot work in the long run unless it is backed by real development. Coins may pump, but without progress, they soon fade after a cycle or two.

History has shown that strong projects like BNB, Ethereum, and Bitcoin could hold their market trust in a bear market. CZ himself opines these would likely be the coins to retest their ATHs.

What Should Crypto Investors Do Now?

Binance founder CZ’s comments are a reality check for holders of coins far below their ATH. Instead of hoping for every coin or token to ride back up, analyzing your investments based on functional value and strength would be wiser.

- Research everything and anything behind every project you wish to invest in.

- Look for coins that are aimed at long-term objectives rather than short-term profit-making.

- Never get into a cycle of meme coins.

- Check and see if the coin has a working product or real adoption.

The following actions will increase your chances of holding a coin that can once again reach the ATH or even break it better.

Conclusion

Cryptocurrency may have lots of potential, but an equal measure of risk is involved. As is evident from Binance’s Founder’s latest remarks, this is a stark reality: not every coin will bounce back. Investing in projects with real value, solid backing, and a long-term vision is essential, with the next bull run almost upon us.

Hype seldom pays. From a survival perspective, staying focused on quality instead of quantity makes all the difference between making a profit and losing money. Only complete and strong projects will stand and thrive in this rapidly moving space.

Summary

The article mentions Binance Founder Changpeng Zhao emphasizing a few cryptos returning to their All-Time Highs (ATH). He stated that most tokens do not have real-world use, strong development, or community support.

This further outlines what ATH means, which cryptos are close to ATH, and how investors can identify projects with long-term value. In addition to updating all market prices, there is a checklist to facilitate further making sound investments.

FAQs

Q1: What do you mean by “ATH” regarding crypto?

ATH refers to an all-time high, the highest price a coin has ever achieved.

Q2: Who owns Binance?

Co-founded by Changpeng Zhao, popularly known as CZ, Binance is currently the biggest crypto exchange in the world.

Q3: Why won’t all coins make it back to ATH again?

Most coins weren’t developed with a long-term plan or an actual use-case scenario in mind, so they cannot rebound.

Q4: Which coins are most likely to go ahead and achieve a new lifetime high?

Bitcoin, Ethereum, and BNB have robust ecosystems and healthy demand, making them strong candidates.

Glossary

Binance Founder: A person who created Binance, one of the most significant crypto exchanges.

ATH (All-Time High): It is the maximum price a coin has reached.

Altcoin: Altcoin is any cryptocurrency that is not Bitcoin.

Hype Cycle: Periods of coin surge in price due to news or social trends, usually not underlined with anything real.

Use Case: The real usefulness is a type of service a coin offers.