The Australian Transaction Reports and Analysis Centre (AUSTRAC) has issued a stark warning about the escalating use of cryptocurrencies for criminal activities within Australia. According to AUSTRAC’s latest report on money laundering, there has been a notable surge in the exploitation of digital currencies and related services by criminals seeking to launder illicit funds.

Rising Threat: AUSTRAC’s Findings on Australian Crypto Crimes Surge

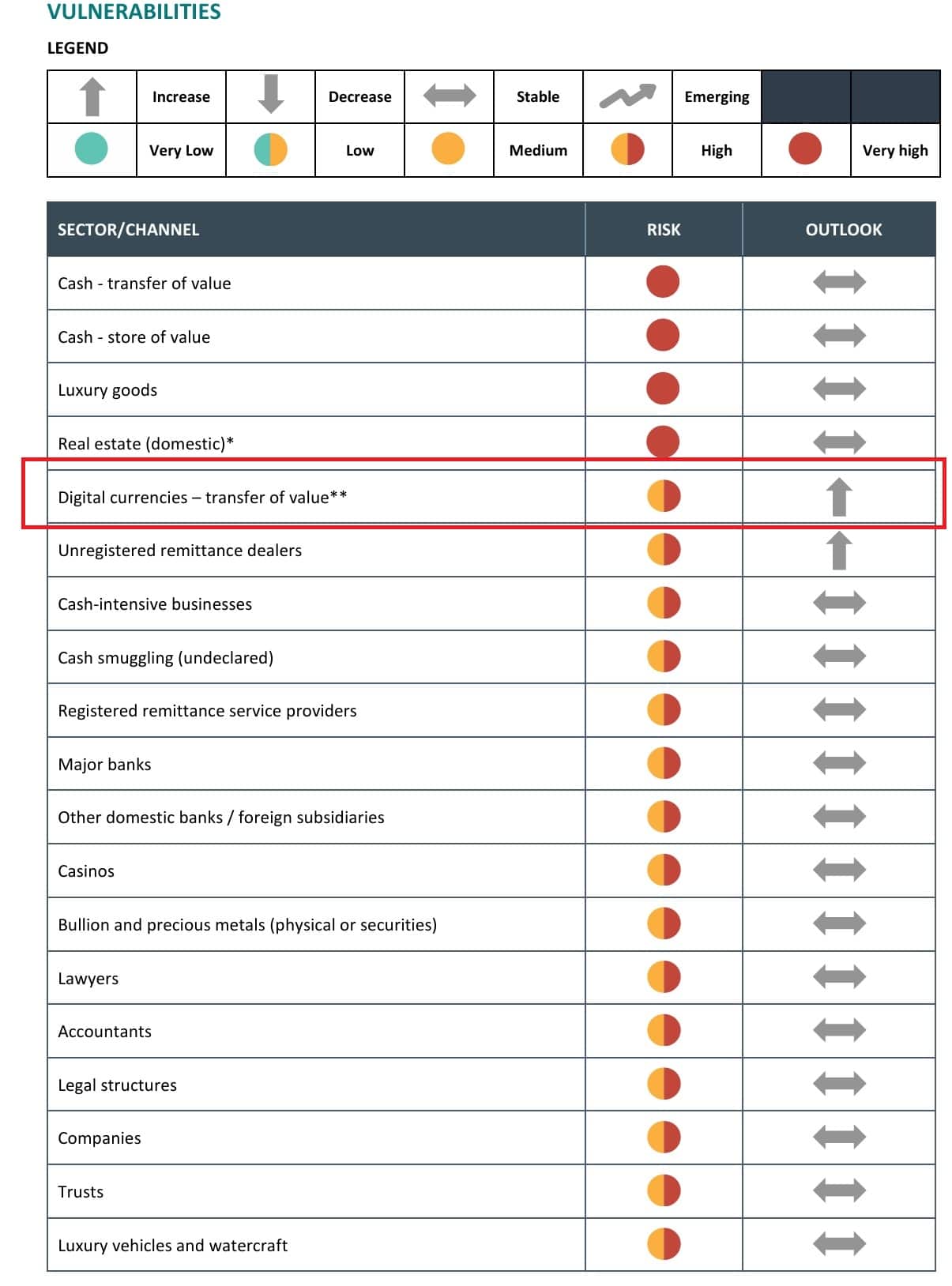

The 2024 AUSTRAC Money Laundering National Risk Assessment reveals a concerning trend. Criminals are increasingly leveraging digital currencies, digital currency exchanges, and unregistered remittance services for money laundering purposes. While traditional methods such as cash, real estate, and luxury goods still dominate illicit financial activities, AUSTRAC’s assessment highlights a shifting landscape where digital currencies are rapidly gaining traction due to their perceived anonymity and speed in transaction processing.

AUSTRAC’s risk assessment categorizes traditional channels as posing a “very high” risk, whereas digital currencies are rated as “high” risk. This distinction underscores the agency’s expectation that criminal exploitation of cryptocurrencies will continue to rise, driven by their technological advantages and evolving usage patterns.

Regulatory Response: Strengthening Oversight of Crypto Exchanges

In response to these findings, AUSTRAC is intensifying its call for enhanced regulatory oversight, recognizing the urgent need to fortify Australia’s defences against the rising tide of crypto-enabled financial crimes. The agency underscores the critical importance of all cryptocurrency exchanges diligently adhering to the registration requirements stipulated under the Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) Act. This legislative framework stands as a pivotal safeguard aimed at mitigating the inherent risks associated with cryptocurrencies being exploited for money laundering purposes.

AUSTRAC’s heightened regulatory stance mandates that cryptocurrency exchanges implement stringent anti-money laundering (AML) measures, thereby bolstering the transparency and integrity of their operations. By enforcing robust compliance standards, AUSTRAC aims to create a more resilient financial ecosystem that can withstand illicit activities orchestrated through digital currencies. This proactive approach seeks to curb criminal behaviours and instils greater investor confidence and trust in Australia’s crypto market.

Impact on Financial Integrity: Balancing Innovation and Security

Looking forward, AUSTRAC’s report anticipates a dual trajectory for digital currencies: expanding legitimate use cases alongside increasing opportunities for criminal exploitation. The agency advocates for continual adaptation of regulatory frameworks and enhanced international cooperation to combat the evolving threats posed by financial crimes involving cryptocurrencies and digital assets effectively. This proactive approach is crucial in safeguarding financial integrity and maintaining trust in the global financial system amid rapid technological advancements.

Recent regulatory actions in Australia underscore the government’s commitment to addressing these challenges head-on. The recent ban on using cryptocurrencies and credit cards for online gambling activities exemplifies Australia’s proactive stance in combating potential avenues for financial crime. Non-compliant entities face significant penalties, reinforcing the seriousness with which these regulations are enforced to protect consumers and uphold financial transparency.

Future Outlook: Addressing Challenges in Australia’s Crypto Landscape

Kai Cantwell, CEO of Responsible Wagering Australia, supports these regulatory measures, emphasizing their role in protecting consumers and promoting responsible gambling behaviour. AUSTRAC’s report serves as a pivotal call to action, urging stakeholders across the crypto ecosystem to collaborate in identifying and mitigating vulnerabilities. It emphasizes the importance of maintaining a delicate balance between fostering innovation and implementing stringent regulatory standards to safeguard against financial misconduct.

As Australia navigates these complexities, the global crypto community closely monitors developments in regulatory policies and enforcement strategies aimed at curbing crypto-enabled financial crimes. The growing concern over illicit activities underscores the urgent need for proactive measures to preserve financial integrity on a global scale.

Conclusion

AUSTRAC’s report highlights the urgent need for robust regulatory measures and international collaboration to address the escalating threat of Australian crypto crimes. It underscores the imperative for stakeholders worldwide to unite in combating illicit activities within the evolving crypto landscape, emphasizing transparency, accountability, and resilience in financial transactions. Stay tuned to The BIT Journal for comprehensive coverage of developments in the cryptocurrency sector, highlighting the evolving regulatory landscape and its impact on financial markets.