In a surprising turn of events, Avalanche (AVAX) has showcased a robust increase in network activity—even as its transaction fees plummeted by an astonishing 96%. According to data visualized and shared on June 12, 2025, the Avalanche C-Chain continues to experience a strong and sustainable uptrend in daily transactions, contradicting conventional expectations that lower fees might weaken network revenue or utility.

Transaction Growth Defies Expectations

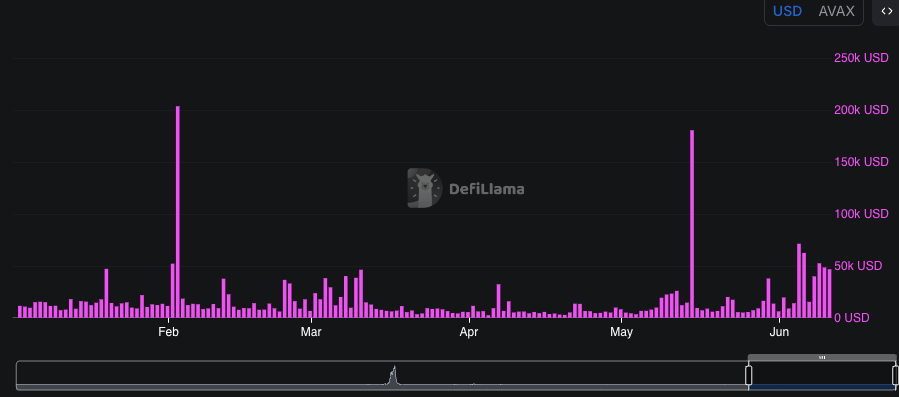

The chart shared on social media reveals a compelling narrative: despite the drastic drop in transaction costs, gas consumption has surged to historic highs. This dynamic illustrates a critical point about Avalanche’s evolving fee model—it is not merely lowering costs, but actively incentivizing broader participation across the ecosystem.

Peak transaction activity was observed in February and May, with volume spikes reaching approximately $250,000 and $150,000 respectively. These jumps can be correlated with key protocol deployments and renewed user interest, reinforcing the idea that lower fees are enabling rather than deterring economic activity on the chain.

Daily Activity Gains Stability

What’s even more telling is the consistent daily transaction volume around the $50,000 mark since early June. This level of sustained interaction signals a growing user base and a maturing blockchain economy. It also supports the theory that reduced gas fees may be enabling higher-frequency and higher-value interactions.

Such consistency points toward a healthier ecosystem that supports not just spikes of interest, but ongoing engagement. The combination of accessibility (via low fees) and demand (via rising use cases) could position Avalanche as a prime hub for DeFi protocols, NFT activity, and blockchain gaming platforms in the coming months.

Looking Ahead: Avalanche’s Growth Trajectory

Given the recent data trends and network dynamics, a climb in daily transaction volumes to the $75,000–$100,000 range seems not only plausible but probable. If Avalanche continues to attract developers and users—particularly from DeFi and GameFi sectors—this growth could accelerate further.

Importantly, the strength of AVAX’s C-Chain and the stickiness of its user activity could have implications for AVAX token value. Assuming no major market disruptions, the increased demand driven by on-chain activity may contribute to upward price momentum for AVAX.

From a technical standpoint, the sustainability of gas usage combined with reduced costs paints an optimistic picture for the Avalanche ecosystem. For investors and developers alike, this marks a key moment to monitor AVAX’s role in the broader blockchain landscape.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!