Avalanche (AVAX) has gained significant traction in the crypto market due to its high-speed transactions, scalable ecosystem, and efficient consensus mechanism. As market conditions fluctuate, traders and investors seek insights into where AVAX’s price is headed in the short term.

In this article, we provide a detailed price prediction for Avalanche (AVAX) for the week of March 10-16, 2025. We analyze technical indicators, market sentiment, and upcoming developments to help investors make informed decisions. This report also highlights support and resistance levels, trading volume trends, and potential risks affecting AVAX’s price action.

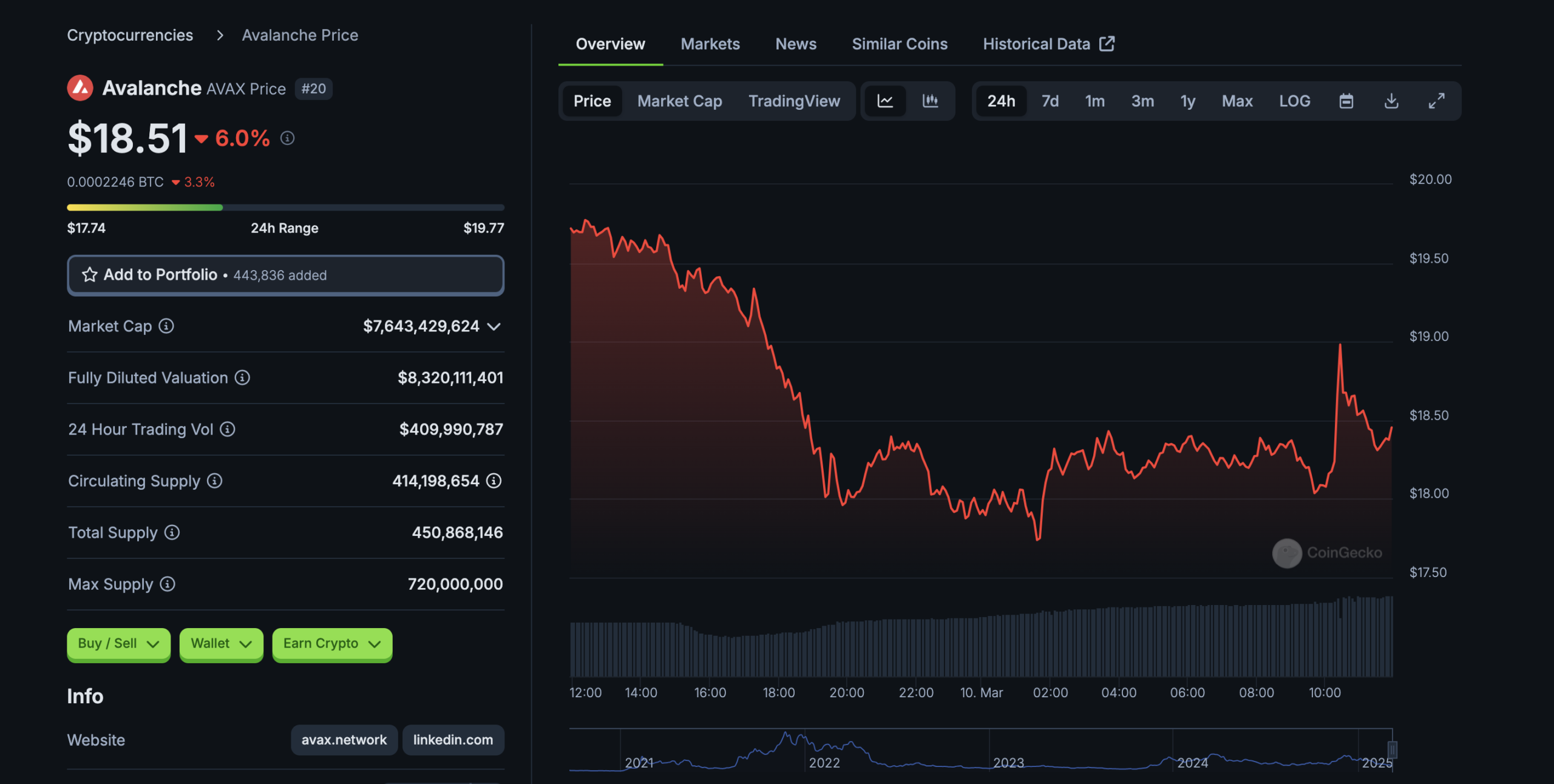

AVAX Weekly Overview (March 10-16, 2025)

| Metric | Value |

| Current Price | $18.51 |

| Predicted Range | $18.30 – $22.00 |

| Resistance Levels | $20.50, $22.00 |

| Support Levels | $18.00, $16.50 |

| Market Sentiment | Neutral to Slightly Bullish |

| Whale Activity | Increased accumulation |

| Key Catalysts | Network upgrades, macroeconomic trends, Bitcoin movement |

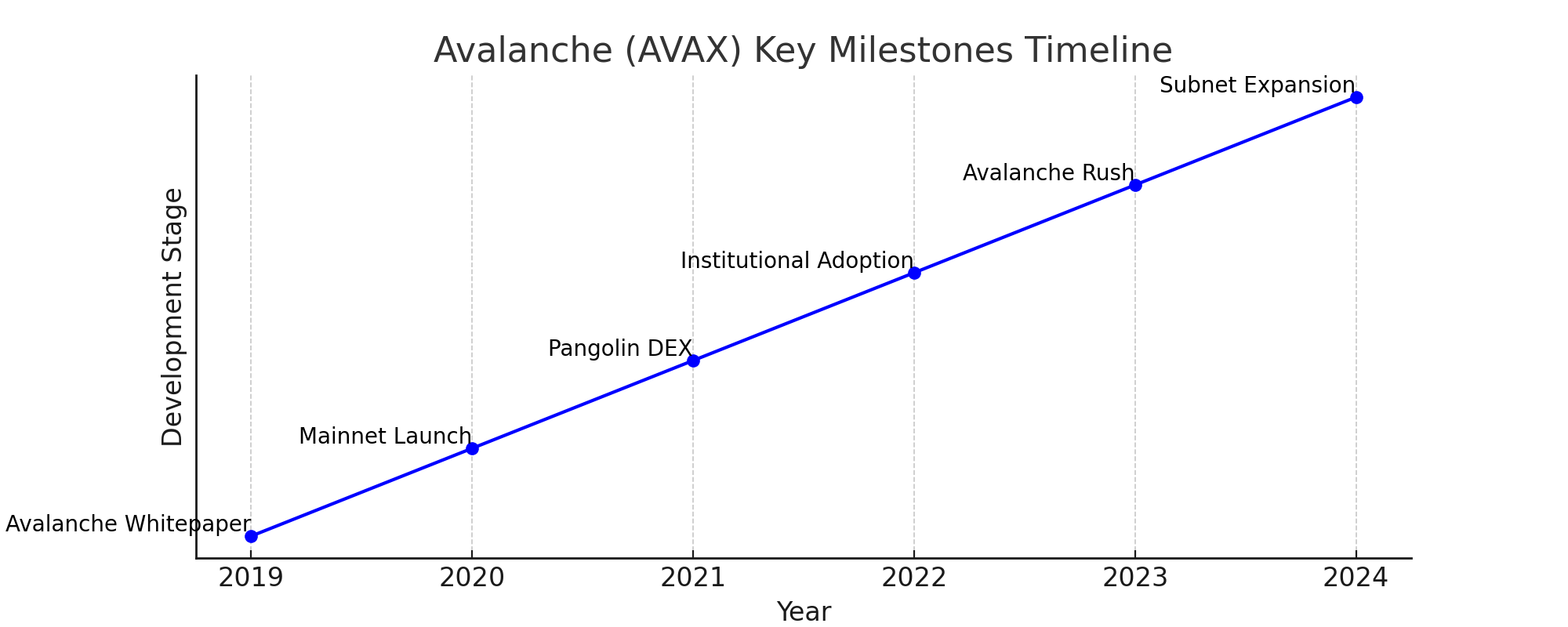

What is Avalanche (AVAX)?

Avalanche (AVAX) is a next-generation Layer-1 blockchain platform designed to offer high-speed transactions, low fees, and seamless interoperability. Launched in 2020 by Ava Labs, it has quickly become one of the leading smart contract platforms, rivaling Ethereum and Solana.

The network is powered by a unique subnet architecture, which allows developers to launch customized blockchains that interact seamlessly with the Avalanche mainnet. This innovation has made it a top choice for DeFi applications, NFT projects, and enterprise solutions.

Key Features:

- High Scalability: Capable of processing 4,500+ transactions per second (TPS)

- Eco-Friendly: Uses Proof-of-Stake (PoS), reducing energy consumption

- Ethereum Compatibility: Supports Ethereum-based dApps via the Avalanche-Ethereum Bridge (AEB)

Recent Developments Impacting Price

Avalanche has continued to expand its ecosystem with key developments that could impact its price movement. Institutional adoption, regulatory approvals, and DeFi integrations are driving increased usage of the Avalanche network. Additionally, strategic partnerships with major blockchain firms and Web3 applications have strengthened its long-term growth potential.

Some of the most recent developments include:

- Avalanche Summit 2025: Announcements of new DeFi and GameFi collaborations.

- Subnet Expansion: Enterprises adopting Avalanche’s subnets for customized blockchain solutions.

- Regulatory Clarity: AVAX has been approved in multiple jurisdictions, increasing investor confidence.

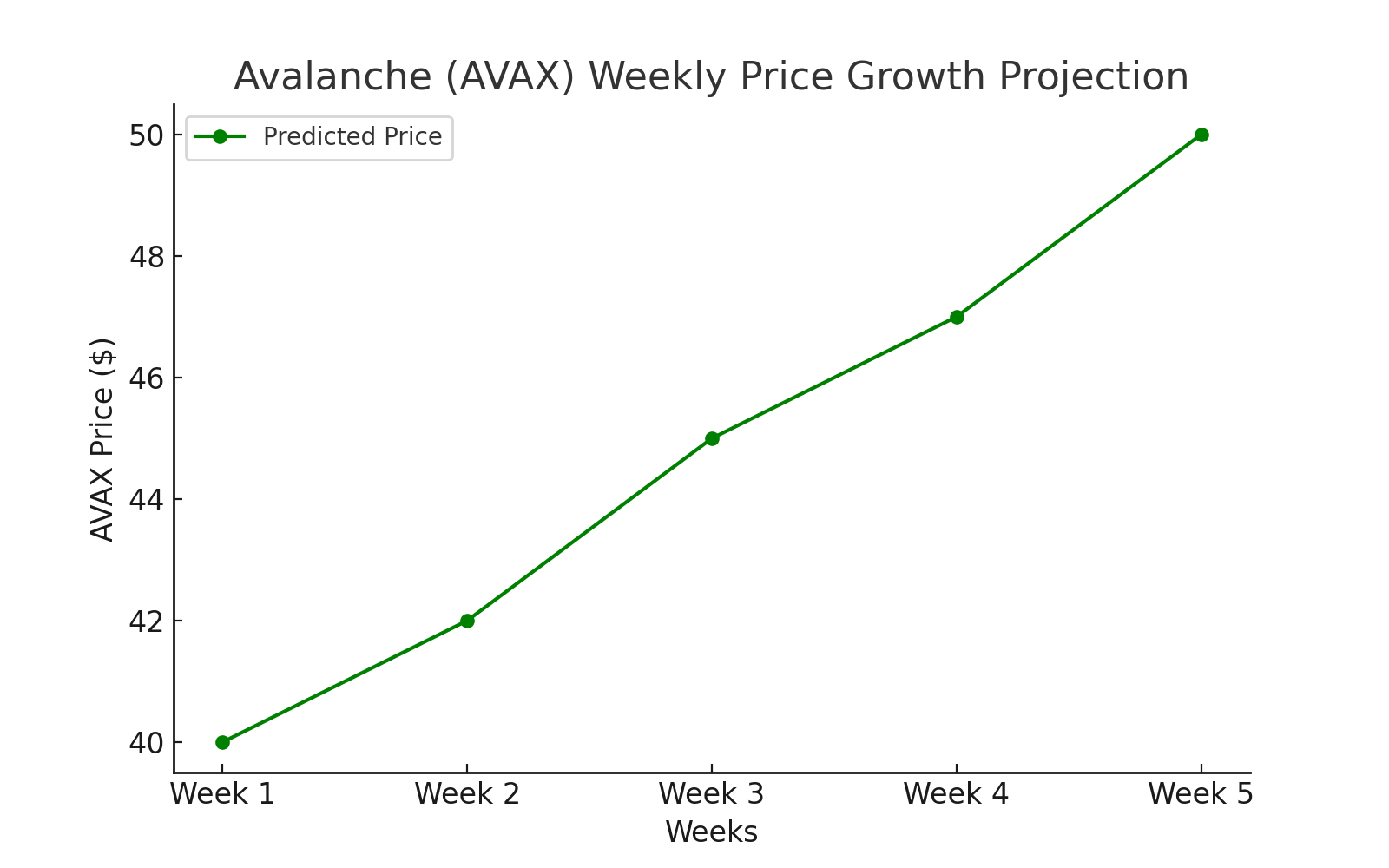

Price Prediction for This Week (March 10-16, 2025)

Short-term price predictions are crucial for traders looking to maximize profits or minimize risks in the crypto market. For the week of March 10-16, 2025, Avalanche (AVAX) is expected to experience moderate price fluctuations due to market sentiment, whale activity, and macroeconomic events. Key resistance and support levels will play a crucial role in determining its trajectory.

By analyzing technical indicators, historical trends, and on-chain data, we estimate AVAX’s weekly price range and highlight the major factors influencing price action. Below is a breakdown of the expected price movements:

| Date | Predicted Price Range | Key Factors Impacting Price |

| March 10 | $18.30 – $19.20 | Market stability, Bitcoin influence |

| March 11 | $18.50 – $20.10 | Increased whale accumulation |

| March 12 | $19.00 – $21.00 | Breakout potential at $20.50 resistance |

| March 13-16 | $19.50 – $22.00 | Higher volatility from macroeconomic data |

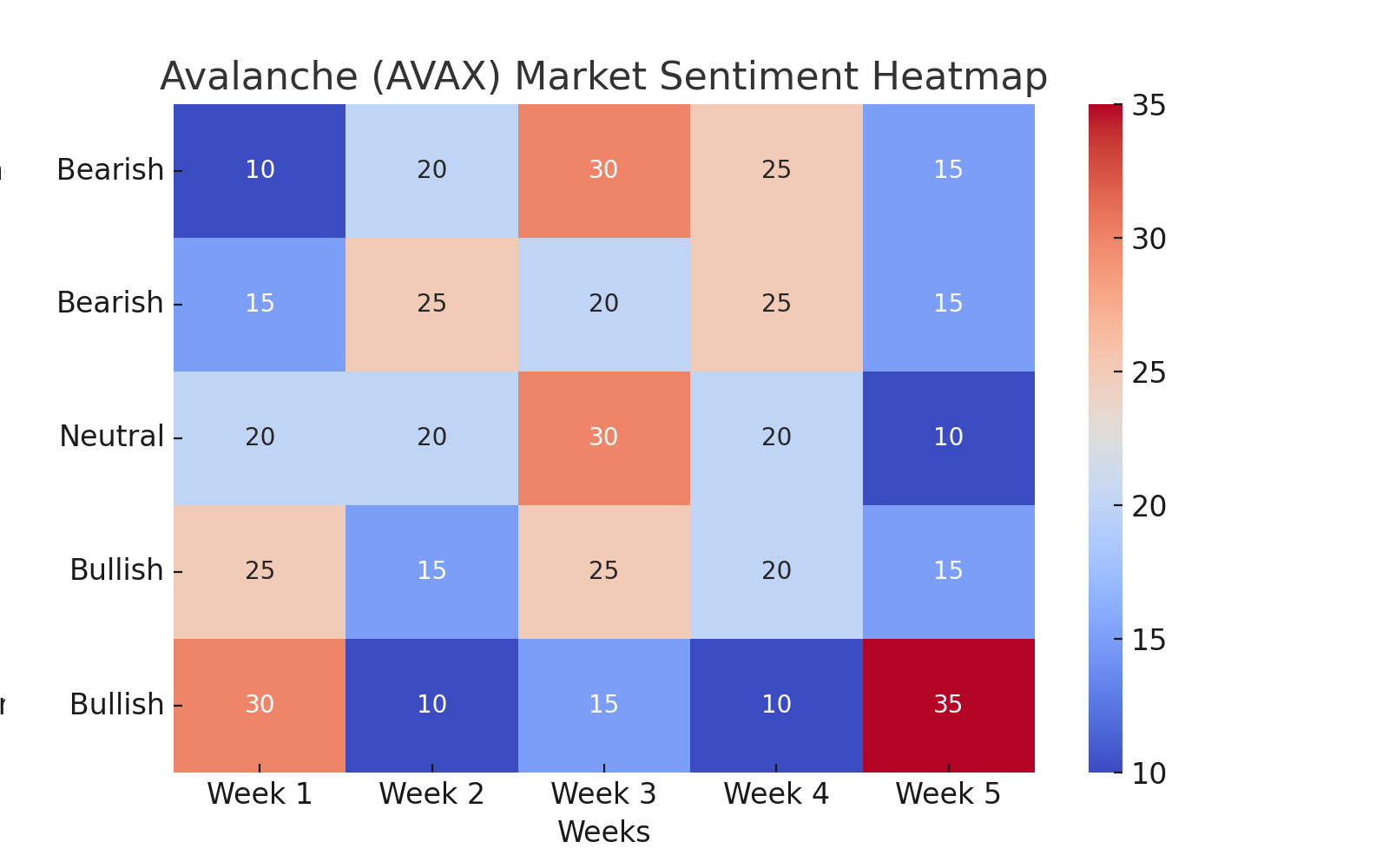

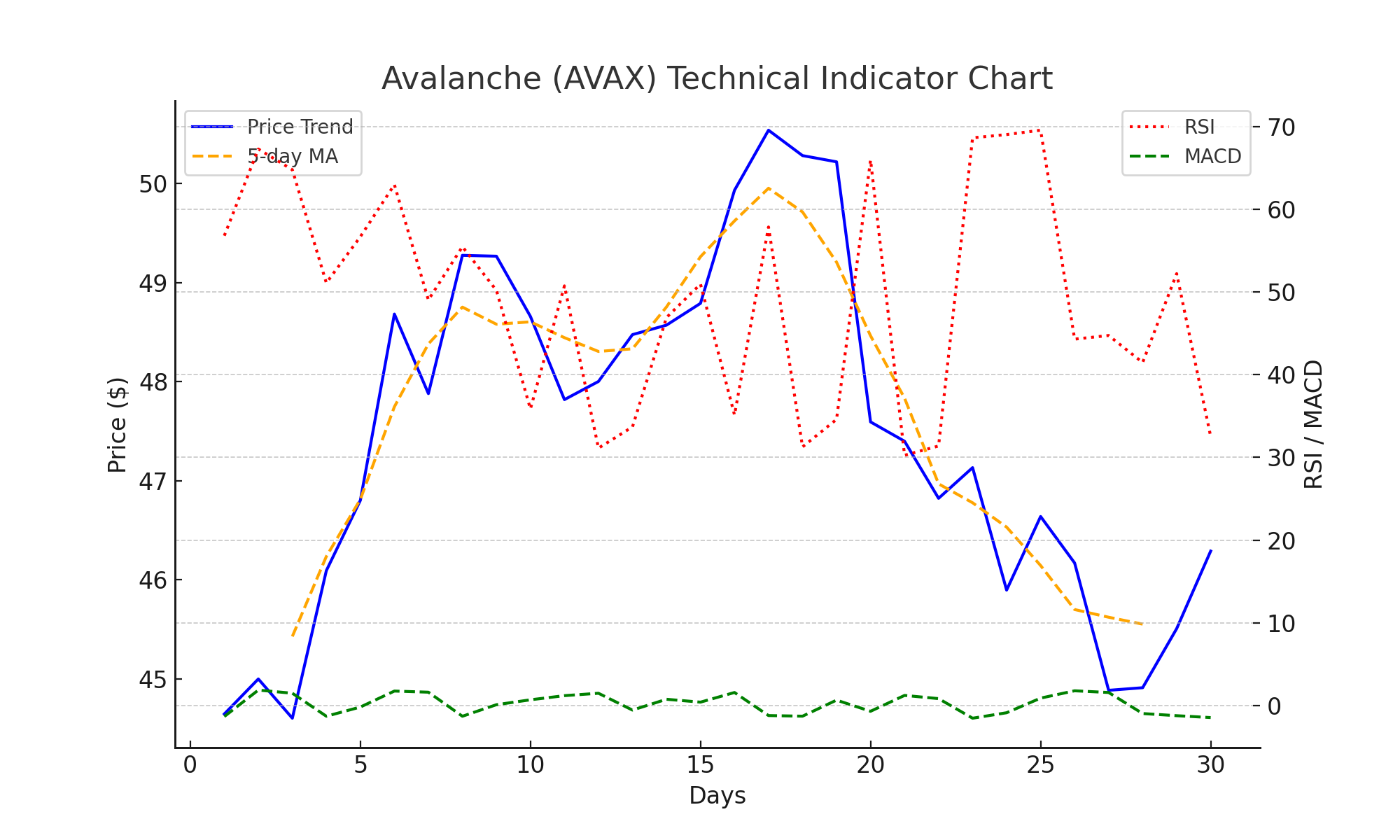

Technical Analysis & Market Sentiment

Understanding Avalanche’s (AVAX) price movements requires a deep dive into technical indicators and market sentiment. By analyzing key metrics like Moving Averages (MA), MACD, and RSI, alongside social sentiment and institutional interest, we can gauge whether AVAX is leaning towards a bullish or bearish trend in the short term.

Key Indicators

Technical analysis plays a crucial role in predicting short-term price movements. For Avalanche (AVAX), key indicators such as Relative Strength Index (RSI), Moving Averages, and Bollinger Bands provide insights into market momentum and volatility.

- RSI: 52 (Neutral) – Indicates neither overbought or oversold conditions.

- Moving Averages: AVAX is trading near the 50-day MA, signaling potential consolidation.

- Trading Volume: Increasing, suggesting accumulation by institutional investors.

Market Sentiment & On-Chain Data

Beyond technical indicators, on-chain data and market sentiment provide a clearer picture of AVAX’s future performance. Whale movements, social media mentions, and DeFi total value locked (TVL) are critical factors in assessing short-term market trends.

- Fear & Greed Index: Neutral (Market is in wait-and-see mode)

- Whale Transactions: Large investors accumulating AVAX on dips.

- DeFi TVL on Avalanche: Growing adoption in DeFi lending and staking.

Conclusion

Avalanche (AVAX) is currently trading in a neutral to slightly bullish range, with potential upside if it breaks through key resistance levels. Based on market trends, technical indicators, and whale activity, AVAX could reach $22.00 this week if bullish momentum strengthens. However, support at $18.00 remains crucial to prevent a price decline.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

1. Can AVAX hit $25 this week?

Unlikely unless AVAX breaks above $22 with strong volume.

2. What factors affect AVAX’s price?

Key factors include Bitcoin’s movement, network upgrades, whale activity, and global economic trends.

3. Is AVAX a good investment for the short term?

AVAX has potential, but traders should watch $20.50 resistance and $18 support.

4. How does Avalanche compare to Solana?

Avalanche and Solana both offer high-speed transactions, but AVAX has better decentralization and customizable subnets, while Solana has higher throughput.

Glossary

Blockchain – A decentralized, distributed ledger technology that records transactions across multiple computers securely.

Consensus Mechanism – A protocol used by blockchain networks to validate transactions (e.g., Proof-of-Stake, Proof-of-Work).

MACD (Moving Average Convergence Divergence) – A trend-following indicator showing the relationship between two moving averages.

RSI (Relative Strength Index) – A momentum oscillator measuring overbought (>70) or oversold (<30) conditions.

DeFi (Decentralized Finance) – Financial services built on blockchain, eliminating intermediaries like banks.

Avalanche Subnets – Customizable blockchain networks operating within Avalanche, optimizing scalability and efficiency.