Avalon Labs is shaking things up in the financial world by exploring a Bitcoin-backed public debt fund under the SEC’s Regulation A framework. This could be a game-changer, bringing Bitcoin one step closer to mainstream finance while providing retail investors with new ways to gain exposure to the world’s leading cryptocurrency.

The question is: Can Bitcoin-backed investments coexist with traditional financial structures? Avalon Labs seems to think so. If they pull this off, we could be looking at a major shift in how Bitcoin is used beyond speculation and store-of-value narratives.

Avalon Labs’ Bold Move: Marrying Bitcoin with Traditional Finance

Avalon Labs isn’t just another crypto firm looking to ride the hype wave. The company is positioning itself as a bridge between decentralized finance (DeFi) and traditional investment structures. Their latest move? A structured investment vehicle that leverages Bitcoin as collateral for a regulated public debt fund.

The key ingredient here is Regulation A, often called a “mini-IPO.” This framework allows companies to raise money from both accredited and retail investors—without jumping through all the regulatory hoops of a full SEC registration.

For years, Wall Street has seen Bitcoin as a speculative asset, but Avalon Labs is betting big that it can be much more. By integrating Bitcoin into a structured debt fund, they aim to make it more attractive to institutional and retail investors alike—all within a compliant and regulated setting.

“We see Bitcoin as more than just a store of value. It’s a dynamic financial instrument that can reshape global finance,” Avalon Labs stated on X (formerly Twitter).

Why This Matters: The Rise of Bitcoin-Backed Investments

The idea of using Bitcoin as collateral isn’t new, but bringing it into a regulated debt market is. Imagine being able to borrow against your Bitcoin holdings in a transparent, structured way—without having to sell your BTC.

Avalon Labs has already taken steps in this direction. They’re behind USDa, a Bitcoin-backed stablecoin, which has quietly grown into one of the largest stablecoins in the market. Their broader vision? A full-fledged on-chain financial center for Bitcoin, including:

- BTC-backed lending

- Yield-generating accounts

- A Bitcoin-integrated credit card

By launching a public debt fund backed by Bitcoin, Avalon is creating a bridge between traditional finance and the DeFi space. This move could set a blueprint for other crypto-backed financial products in the future.

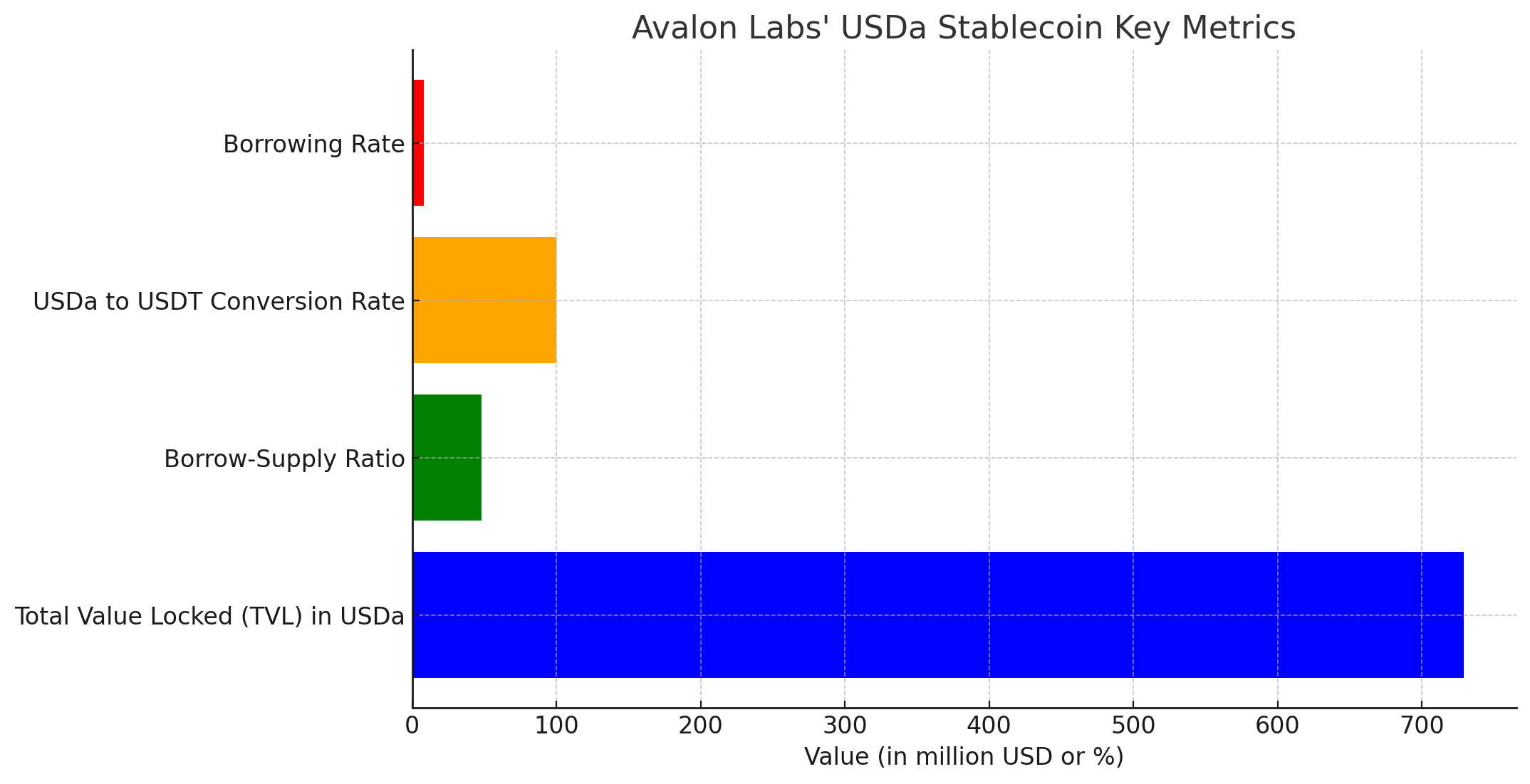

Avalon Labs’ USDa: A Quiet Giant in the Stablecoin World

You may not have heard of USDa, but it’s making serious moves. Currently, USDa is the world’s second-largest collateralized debt position (CDP) project, trailing only MakerDAO’s DAI.

- Total Value Locked (TVL): $729 million

- Borrow-Supply Ratio: 48%

- Conversion Rate: 1:1 with USDT

- Borrowing Rate: 8%

Avalon’s stablecoin model allows Bitcoin holders to borrow USDa against their BTC without selling. This keeps users exposed to Bitcoin’s upside while still having liquidity to spend or invest elsewhere.

With its public debt fund initiative, Avalon is pushing for Bitcoin-backed financial products to become more mainstream.

What’s Next? Potential Challenges and the Path Forward

Regulation is always the elephant in the room when it comes to crypto innovations. The SEC’s stance on Bitcoin-backed debt products remains uncertain, and approval is far from guaranteed.

However, Avalon Labs has a track record of navigating regulations. One of its co-founders, Venus Li, has experience securing SEC approvals for financial products. She remains optimistic, saying:

“We believe in a structured, compliant approach to Bitcoin-backed investments. The SEC has shown they are willing to assess new financial products fairly, and we’re confident in our framework.”

If Avalon’s debt fund gets the green light, it could pave the way for even more Bitcoin-integrated investment products, potentially opening a whole new asset class for retail and institutional investors.

Final Thoughts: Bitcoin Is Going Mainstream, One Step at a Time

Avalon Labs is making a bold bet—that Bitcoin can evolve beyond a speculative asset and become a true financial instrument. If successful, their Bitcoin-backed public debt fund could set a precedent for other firms to follow.

This move signals that Bitcoin-backed lending, structured investments, and even traditional financial products backed by BTC could soon become the norm.

One thing’s for sure: Bitcoin’s role in finance is growing, and Avalon Labs is at the forefront of that change.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

1. What is Avalon Labs?

Avalon Labs is a Bitcoin-focused financial company developing a full suite of on-chain financial products, including BTC-backed lending, stablecoins, and investment vehicles.

2. What is a Bitcoin-backed public debt fund?

It’s a financial product that uses Bitcoin as collateral for issuing debt in a regulated market. Investors can participate in Bitcoin-backed investments without directly holding BTC.

3. What is SEC Regulation A?

Regulation A is a U.S. securities exemption that allows companies to raise funds from retail and accredited investors without full SEC registration, often called a “mini-IPO.”

4. How does Avalon’s USDa stablecoin work?

USDa is a Bitcoin-backed stablecoin that lets BTC holders borrow stablecoins against their Bitcoin without selling it. It has a fixed 8% borrowing rate and can be converted 1:1 with USDT.

Glossary of Key Terms

Bitcoin-backed public debt fund – A financial product that issues debt using Bitcoin as collateral in a regulated environment.

Collateralized Debt Position (CDP) – A method in DeFi where users lock up assets (like Bitcoin) to borrow stablecoins or other assets.

Stablecoin – A cryptocurrency pegged to a stable asset like the U.S. dollar to reduce volatility.

Regulation A – A U.S. SEC framework that allows companies to raise money without a full SEC registration, making it easier for retail investors to participate.

Sources

SEC.gov – Regulation A Explained