Axelar (AXL) is a cutting-edge interoperability protocol that enables seamless communication and asset transfers across multiple blockchain networks. As Web3 continues to grow, Axelar’s decentralized approach to inter-blockchain communication positions it as a key player in creating a cohesive and interconnected crypto ecosystem. By leveraging its unique General Message Passing (GMP) technology, Axelar provides secure and efficient cross-chain functionality, fostering innovation and collaboration among developers and decentralized applications (dApps).

The further discussion will explain Axelar (AXL) price predictions for 2025, 2028, and 2030, derived through technical analysis and market insight.

Overview

| Coin Name | Axelar (AXL) |

| Price | $0.6621 |

| Market Cap | $597.68 M |

| Volume(24hrs) | $29.83 M |

| Circulating Supply | 902.68 M AXL |

| All-time High | $2.657 Mar 1, 2024 |

| All-time Low | $0.3135 Oct 26, 2023 |

| 24hr High | $0.6621 |

| 24hr Low | $0.5684 |

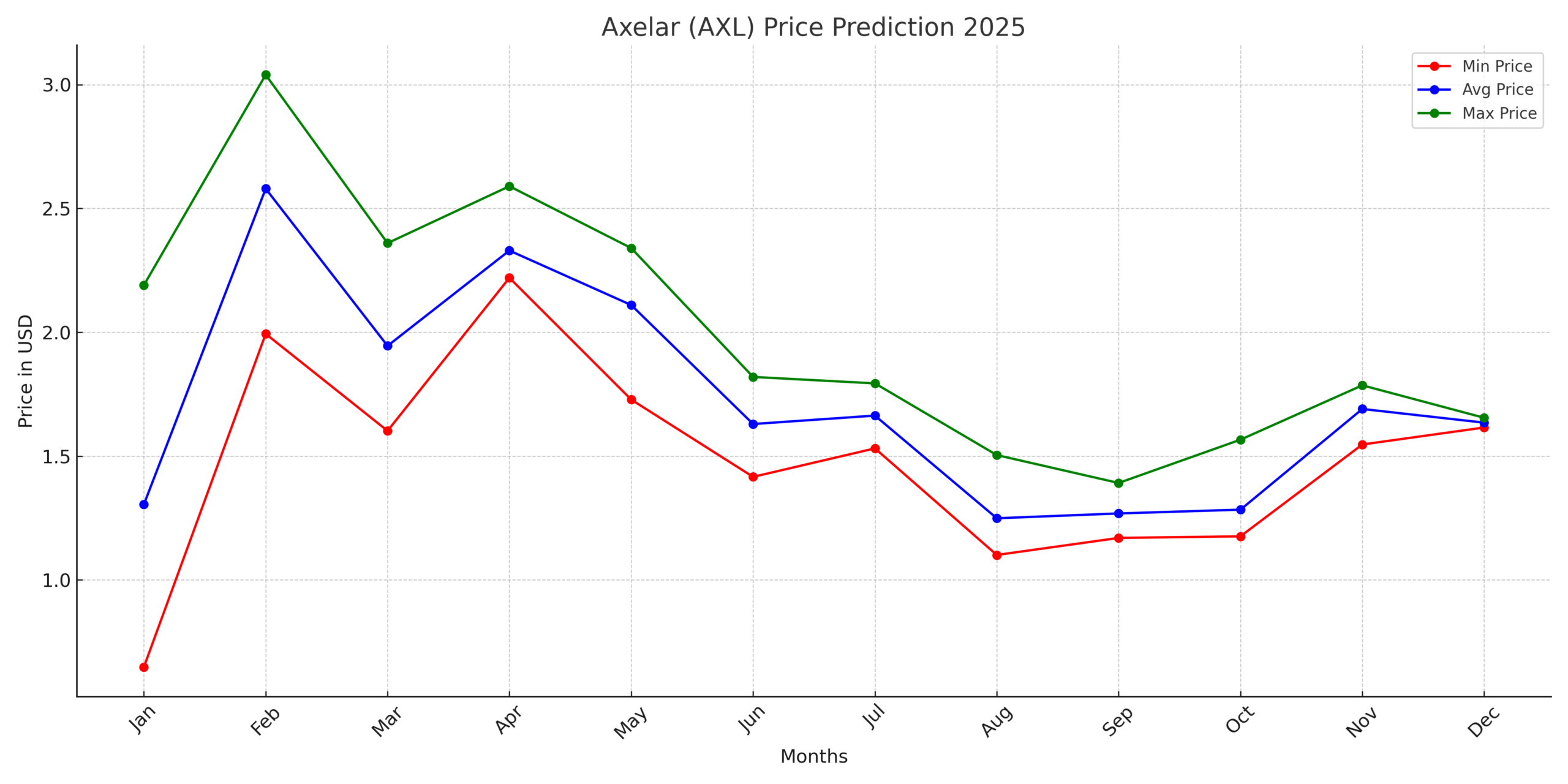

Axelar Price Prediction for 2025

The Axelar token (AXL) is expected to experience notable growth in 2025, fueled by the increasing adoption of Web3 technologies and a demand for interoperability solutions. Analysts predict AXL’s trading range to span between $0.647568 and $3.04, with an average annualized price of $1.724059. This represents a potential return on investment (ROI) of 359.81% compared to its current price of $0.6621.

| Month | Min. Price | Avg. Price | Max. Price |

| Jan 2025 | $ 0.647568 | $ 1.304534 | $ 2.19 |

| Apr 2025 | $ 2.22 | $ 2.33 | $ 2.59 |

| Jul 2025 | $ 1.531019 | $ 1.663381 | $ 1.793606 |

| Oct 2025 | $ 1.175789 | $ 1.283497 | $ 1.566194 |

| Nov 2025 | $ 1.54669 | $ 1.690165 | $ 1.785764 |

| Dec 2025 | $ 1.615346 | $ 1.634901 | $ 1.654569 |

In January, AXL is expected to trade between $0.647568 and $2.19, while December could see a price range of $1.615346 to $1.654569. These fluctuations highlight the token’s potential for growth as it gains momentum throughout the year.

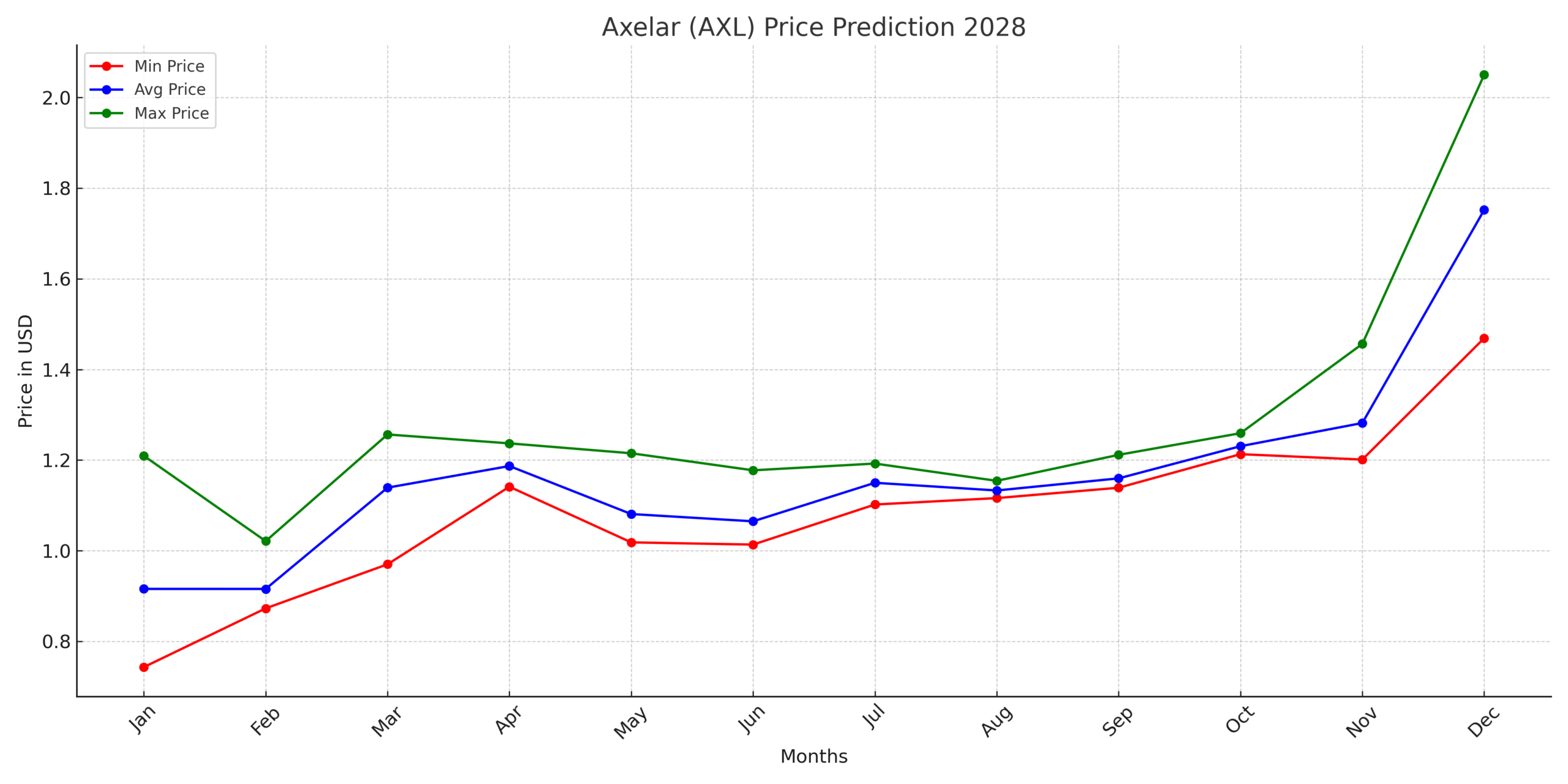

Axelar Price Prediction for 2028

By 2028, Axelar is projected to further solidify its role in the Web3 ecosystem, with a forecasted price range of $0.74326 to $2.05. The average price is expected to hover around $1.167485, marking a potential ROI of 210.21% from current levels.

| Month | Minimum Price | Average Price | Maximum Price |

| January | $ 0.74326 | $ 0.915749 | $ 1.209309 |

| April | $ 1.141223 | $ 1.186835 | $ 1.236843 |

| July | $ 1.101938 | $ 1.149891 | $ 1.192296 |

| October | $ 1.213 | $ 1.23061 | $ 1.259312 |

| November | $ 1.201139 | $ 1.281744 | $ 1.45626 |

| December | $ 1.468908 | $ 1.751781 | $ 2.05 |

Axelar’s price is anticipated to start the year at $0.74326 in January and climb to a maximum of $2.05 by December, driven by sustained adoption and ecosystem growth.

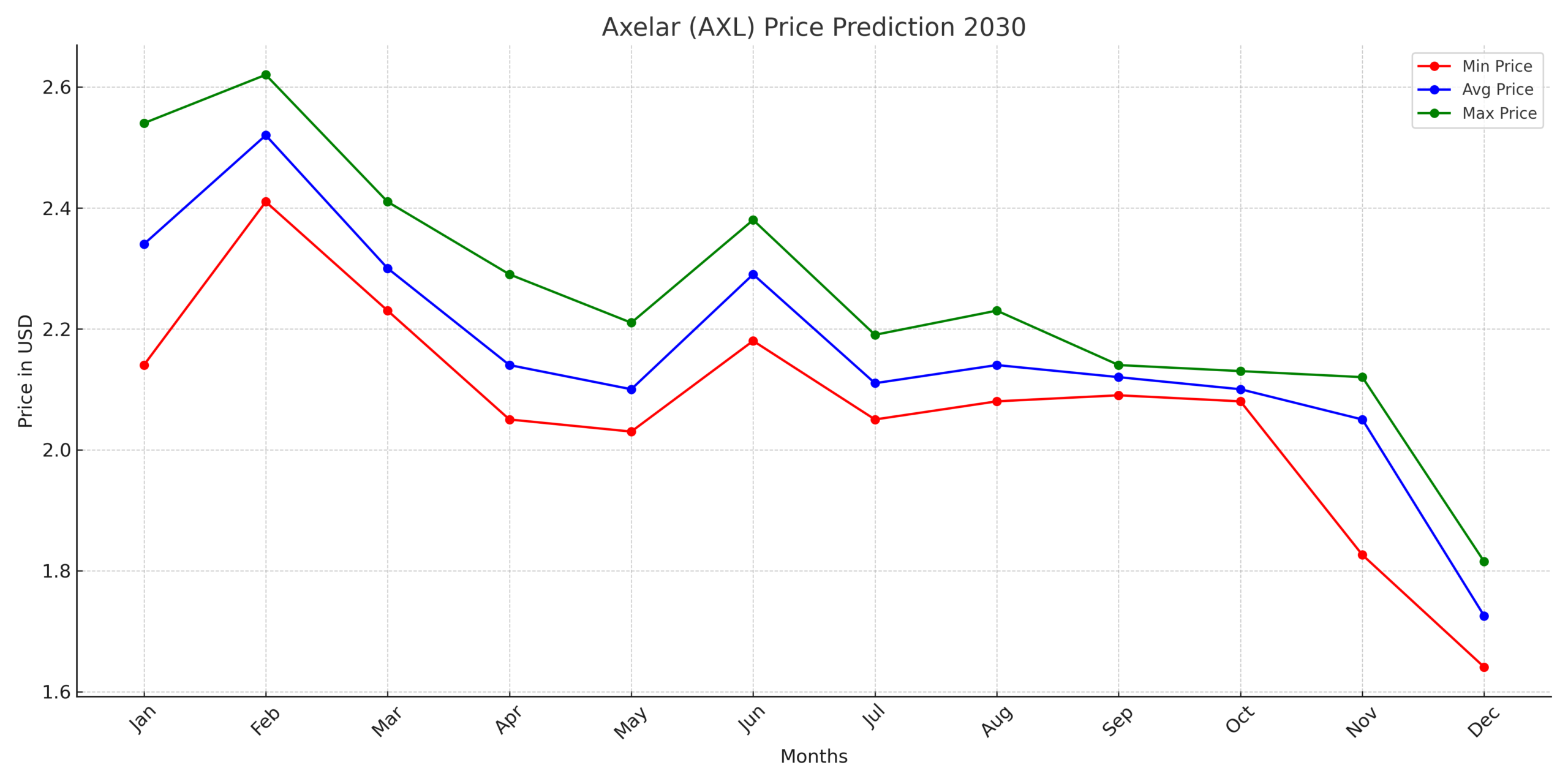

Axelar Price Prediction for 2030

Looking ahead to 2030, Axelar is expected to reach new milestones in adoption and innovation. Forecasts suggest a trading range of $1.640526 to $2.62, with an average price of approximately $2.05. Investors could see a potential ROI of 295.57%, reflecting strong long-term prospects for the protocol.

| Month | Minimum Price | Average Price | Maximum Price |

| January | $ 2.14 | $ 2.34 | $ 2.54 |

| April | $ 2.05 | $ 2.14 | $ 2.29 |

| July | $ 2.05 | $ 2.11 | $ 2.19 |

| October | $ 2.08 | $ 2.10 | $ 2.13 |

| November | $ 1.826109 | $ 2.05 | $ 2.12 |

| December | $ 1.640526 | $ 1.725211 | $ 1.814957 |

January 2030 could see AXL prices between $2.14 and $2.54, while December may witness a range of $1.640526 to $1.814957, indicating the potential for sustained growth despite market volatility.

Technical Analysis

As of January 24, 2025, Axelar’s price sentiment is neutral, with 14 technical indicators signaling bullish trends and 12 indicating bearish trends. Key metrics to watch include:

200-Day SMA: Expected to rise to $0.78338 by February 2025.

50-Day SMA: Projected to reach $1.027159 by the same time.

RSI: Currently at 42.83, indicating a neutral market position for AXL.

Support and resistance levels suggest that Axelar is trading between $0.6038 and $0.7346, with potential upward movement if it breaks past resistance levels at $0.8096 and $0.8998.

Factors influencing AXL’s price

- Scalability Improvements: Axelar’s ability to handle increased network activity while maintaining security and efficiency will attract developers and enterprises.

- Evolving Web3 Landscape: The multichain future envisioned for Web3 will likely require robust interoperability protocols, giving Axelar a competitive edge.

- Partnerships and Integrations: Collaboration with leading blockchain networks such as Ethereum, Avalanche, and Polygon could amplify Axelar’s reach and utility.

- Regulatory Clarity: Favorable regulatory developments around blockchain technology could encourage institutional investment, benefitting projects like Axelar.

- Market Sentiment: The broader crypto market’s performance and investor sentiment toward interoperability-focused projects will also impact AXL’s price trajectory

Conclusion

Axelar’s innovative approach to interoperability positions it as a vital infrastructure in the evolving Web3 ecosystem. As blockchain adoption grows and the demand for seamless communication between networks intensifies, Axelar’s utility and value are expected to rise significantly. While price predictions for 2025, 2028, and 2030 indicate a bullish outlook, factors such as market conditions, technological advancements, and regulatory developments will play crucial roles in determining AXL’s future trajectory.

For investors, Axelar represents an opportunity to participate in the growth of a decentralized, multichain future. However, as with all investments, thorough research and risk assessment are essential before making financial decisions.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

1. What is Axelar (AXL)?

Axelar is a decentralized interoperability protocol that facilitates communication and asset transfers across blockchain networks, enabling a more interconnected crypto ecosystem.

2. What factors influence Axelar’s price?

Key factors include blockchain adoption rates, technological advancements, market sentiment, and regulatory developments.

3. Is Axelar a good long-term investment?

Given its unique position in the Web3 ecosystem and increasing demand for interoperability solutions, Axelar shows strong long-term potential. However, market risks should be carefully considered.

4. How does Axelar’s General Message Passing (GMP) work?

GMP allows secure and efficient communication between blockchains, enabling developers to build dApps that operate seamlessly across multiple networks.