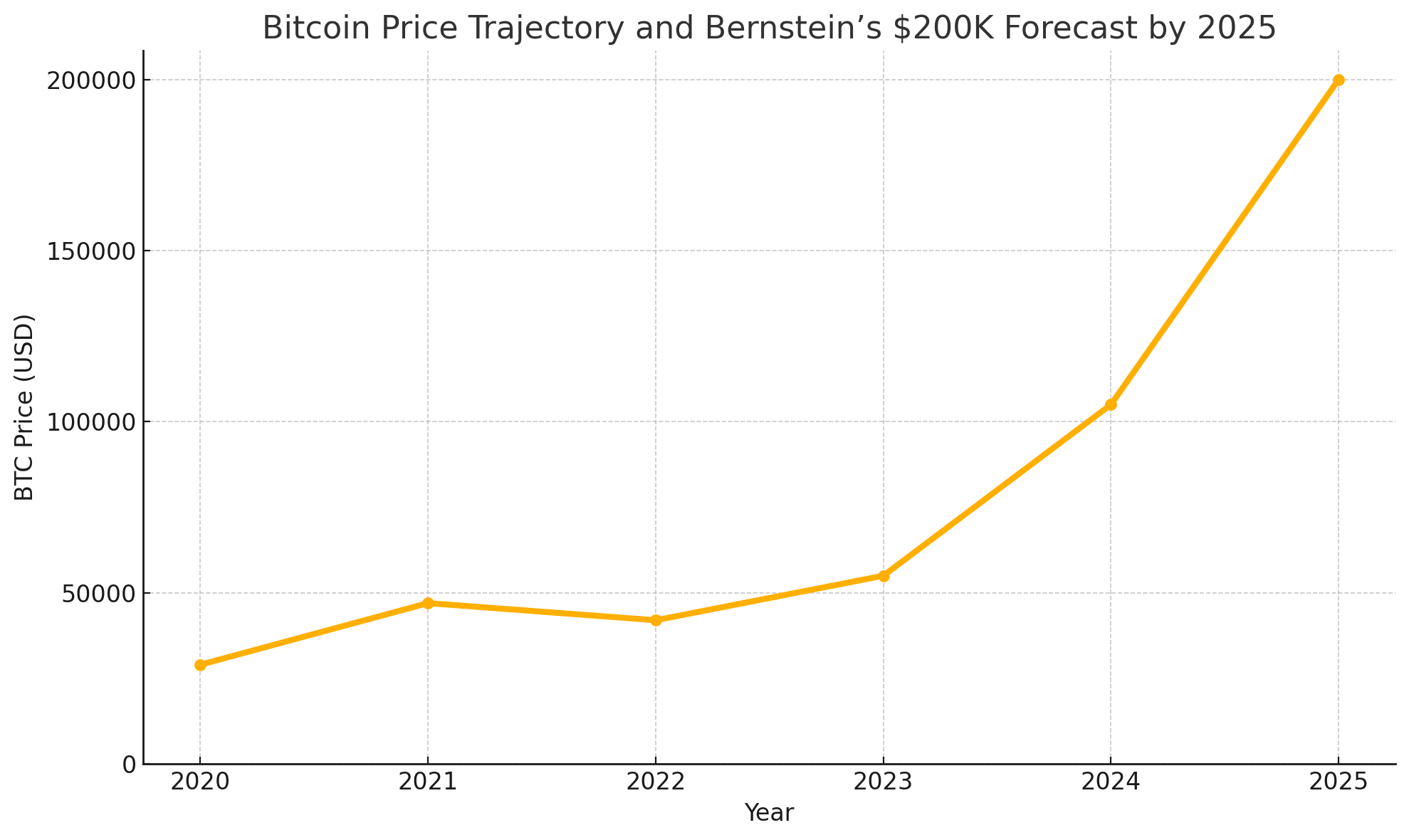

Bitcoin is back in the spotlight with another heavyweight forecast. Global asset manager Bernstein has stunned markets with a fresh price target: $200,000 per BTC by the end of 2025—a figure it calls “conservative.”

At a time when Bitcoin is trading just above $105,000, such a prediction may seem ambitious. But Bernstein’s analysts aren’t alone in this bullish outlook. Backed by robust fundamentals, ranging from explosive ETF demand to supply scarcity post-halving, many institutional voices now echo similar long-term optimism.

ETF Momentum Is Fueling a New Phase of Institutional Demand

According to Bernstein, the rise of U.S.-based spot Bitcoin ETFs has “fundamentally changed the demand curve.” Since their launch in early 2024, spot ETFs have already attracted over $120 billion in assets under management. This influx has come primarily from institutional players, family offices, and high-net-worth investors.

“Bitcoin is no longer just a speculative asset,” the Bernstein report states. “It’s evolving into a globally accepted macro asset class.”

Leading ETFs such as BlackRock’s iShares Bitcoin Trust and Fidelity Wise Origin Bitcoin Fund have seen consistent inflows, even during periods of market consolidation. This reflects a critical shift, Bitcoin is no longer just a retail story.

Halving and the Scarcity Effect

Another cornerstone of Bernstein’s forecast is the 2024 Bitcoin halving, which slashed miner rewards from 6.25 BTC to 3.125 BTC. With daily new supply now sharply reduced, Bitcoin’s inflation rate is lower than that of gold.

This supply compression, paired with institutional demand, creates a compelling long-term outlook. Historically, Bitcoin rallies have followed each halving event, and 2024’s cycle appears to be following suit. Prices doubled from January to May, surpassing the $100K mark for the first time.

Macroeconomic Tailwinds Support the Case

Global macro factors are also aligning in Bitcoin’s favor. Rising national debt levels, monetary debasement, and geopolitical instability have spurred renewed interest in hard assets, and Bitcoin, often called “digital gold,” stands out.

Anthony Scaramucci, founder of SkyBridge Capital, recently told CNBC,

“With continued global monetary expansion and the maturation of crypto infrastructure, I see $200,000 as not just realistic, but probable.”

Bernstein’s report adds that as sovereign and institutional players hedge against inflation and dollar weakness, Bitcoin’s value proposition as a non-correlated, limited-supply asset grows even stronger.

Betting Markets Remain Cautious—For Now

Interestingly, betting platforms like Polymarket place the chances of Bitcoin hitting $200K in 2025 at just 14%. This caution reflects concerns about potential regulatory shifts, macro uncertainty, and typical market volatility.

But analysts say this disconnect between market sentiment and institutional positioning could be the opportunity. Historically, when sentiment lags fundamentals, it often signals the beginning, not the end, of a major trend.

Why Bernstein Calls $200K “Conservative”

The real kicker? Bernstein analysts label $200K a “conservative estimate,” implying their internal models may point to even higher long-term valuations. They argue this level is based on “modest” ETF inflows and no major regulatory breakthroughs, suggesting that if adoption accelerates or new jurisdictions approve Bitcoin funds, the upside could grow exponentially.

Standard Chartered, another global banking giant, has also issued similar guidance, projecting Bitcoin could top $200K by 2025 and potentially reach $500K by 2030.

Bitcoin’s 2025 Trajectory: What Comes Next?

With less than 18 months left until the end of 2025, the stage appears set for a transformative cycle. If current ETF inflows continue, paired with reduced supply and macro support, Bernstein’s $200K prediction may not just be feasible—it could prove understated.

As crypto adoption deepens across Asia, the Middle East, and Latin America, Bitcoin’s global relevance is accelerating. In a world searching for safe havens amid economic uncertainty, Bitcoin’s digital scarcity narrative is gaining unprecedented traction.

Final Thoughts

Whether you view it as a bold bet or a conservative projection, Bernstein’s $200K forecast is more than just a headline—it’s a reflection of how far Bitcoin has come as an asset class.

And if the analysts are right, we may be looking at just the beginning of Bitcoin’s institutional era.

Frequently Asked Questions (FAQs)

Why does Bernstein believe Bitcoin will hit $200K by 2025?

Bernstein cites rising institutional demand from ETFs, the 2024 halving event reducing supply, and global macroeconomic instability as key drivers.

What role do Bitcoin ETFs play in this forecast?

Bitcoin ETFs have unlocked institutional access, with over $120 billion in assets under management, creating consistent demand that supports price growth.

Is $200K a realistic target for Bitcoin by 2025?

While ambitious, multiple institutions, including Bernstein and Standard Chartered, see $200K as attainable, especially given growing global adoption and shrinking supply.

Glossary of Key Terms

Bitcoin ETF: An exchange-traded fund that allows investors to gain exposure to Bitcoin price movements without directly holding the asset.

Bernstein: A global asset management and research firm known for its market analysis and institutional investment insights.

Bitcoin Halving: A programmed event that cuts the reward for mining Bitcoin in half, reducing the rate of new BTC supply approximately every four years.

Institutional Adoption: When large financial entities like banks, hedge funds, and asset managers invest in or use cryptocurrencies.

Macro Tailwinds: Broad economic conditions—such as inflation, high debt levels, and geopolitical tensions—that favor assets like Bitcoin.

Supply Scarcity: A condition where the available supply of an asset decreases while demand remains steady or grows, typically leading to price increases.

Spot Bitcoin ETF: A fund that directly holds Bitcoin as its underlying asset, allowing investors to trade shares that reflect real-time BTC value.