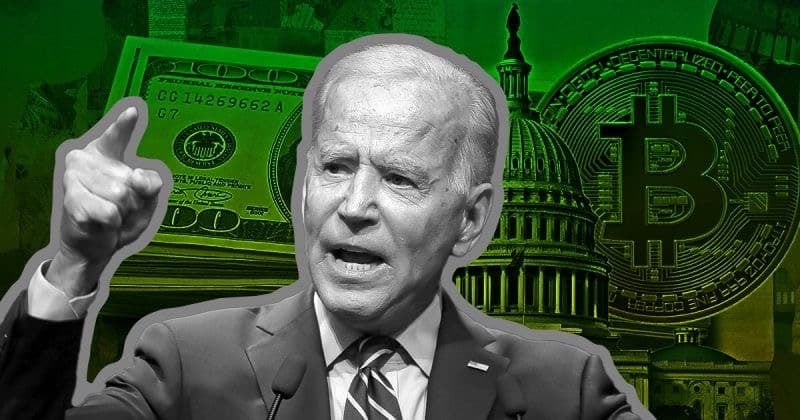

The U.S. House of Representatives might change a decision made by President Joe Biden in the coming days. President Biden didn’t agree with a rule called SAB 121 — a proposed rule requiring companies that handle cryptocurrencies to list these holdings in their financial reports, is on the House’s list of potential legislation for discussion, according to the weekly schedule from House Majority Leader Steve Scalise. The House has put this on their schedule to discuss and vote next week, on either Tuesday, July 9 or Wednesday, July 10.

President Biden vetoed this rule after both the House and the Senate supported it. More than two-thirds of the House and the Senate must agree to change his decision. The support wasn’t enough in May, with only 55.6% in the House and 61.2% in the Senate agreeing. Now, they need even more support, especially from Democrats. Alexander Grieve, who works on government issues at a cryptocurrency investment company, Paradigm, said, “Steep hill to climb but not impossible given how bipartisan the FIT vote was.”

According to news reports, as the 2024 presidential election nears, both President Joe Biden and Donald Trump are ramping up their campaigns. They’re now focusing more on digital assets like cryptocurrencies. Kerri Langlais from Bitcoin miner TeraWulf said this is a “good development” for the industry. She explained, “Albeit to different degrees, both Biden and Trump’s original positions on crypto have shifted favourably our way in the last year. We should continue to build on that progress with our education and political efforts.”

The debate over SAB 121 is important because it could affect how banks and other companies can handle cryptocurrencies. Some people worry that this rule could make it harder for banks to handle these digital currencies on a large scale. They fear it might give more control to companies that aren’t banks, which could lead to risks. But, getting enough votes to overturn President Biden veto is a big challenge. The vote next week will be very important to see what happens with this rule.

Biden SAB 121 Veto: Understanding SAB 121

SAB 121 was designed to make it safer to deal with digital currencies like Bitcoin (BTC) and Ethereum (ETH). These types of money are new and can be risky because their value can change a lot. The law aims to prevent big problems in the financial system that could happen because of these risks.

The idea behind SAB 121 is good—keeping everyone’s investments safe. However, some people worry that these new rules could slow down innovation and growth in the world of digital currencies. Others think it’s a necessary step to ensure that the rise of digital money doesn’t hurt investors or the country’s economy.

Biden SAB 121 Veto: Why This Matters to Regular People

The news about this law isn’t just for people who invest in digital currencies. It affects everyone because it’s about keeping the entire economy stable and secure. Media sources like The BIT Journal play a big role in helping everyone understand what’s going on. They provide updates and explanations on how these decisions might impact everyone, not just the big investors.

Biden SAB 121 Veto: What Happens Next?

The vote next week is very important. If the House decides to overturn the President’s veto, the law could go into effect, but only if two-thirds of both the House and the Senate agree. This is a tough challenge and shows just how much people disagree on this issue.

Biden SAB 121 law is more than just a bunch of rules. It’s about how the U.S. can keep up with new technologies like Bitcoin and Ethereum that are changing how money works. The decisions made now will affect how safe and stable the economy will be in the future.

So, as we wait for the House vote next week, it’s clear that this is about more than just politics. It’s about ensuring the U.S. is ready for the future of money and protecting everyone’s financial safety.