Binance, a leading global cryptocurrency exchange, has taken proactive measures by placing monitoring tags on 11 altcoins. This initiative seeks to identify assets exhibiting increased volatility and potential regulatory issues, prompting concerns among investors regarding possible delistings and subsequent market instability.

Tokens Under Monitoring

The newly tagged tokens include Balancer (BAL), Cortex (CTXC), PowerPool (CVP), Convex Finance (CVX), Dock (DOCK), Kava Lend (HARD), IRISnet (IRIS), MovieBloc (MBL), Polkastarter (POLS), Status (SNT), and Sun (SUN). Immediately after the announcement, these tokens experienced varying degrees of price drops, reflecting market apprehensions over their future on the platform.

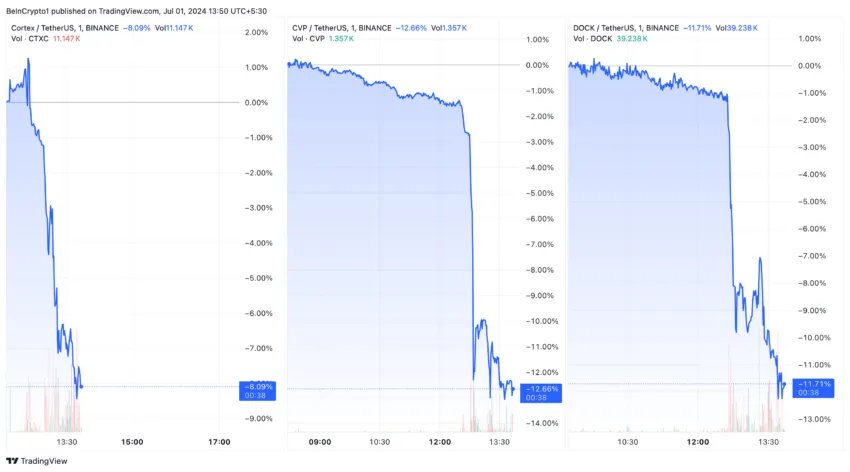

Binance Altcoins Monitoring: Impact on Token Prices

Among the notable declines, Cortex (CTXC) saw a sharp drop of 8.09%, while PowerPool (CVP) and Dock (DOCK) fell by 12.66% and 11.71%, respectively. The introduction of the Monitoring Tag is a cautionary measure from Binance, showing investors the potential risk of these tokens failing to meet the exchange’s stringent listing criteria in the near future.

Why Binance Uses Monitoring Tags

Binance utilizes the Monitoring Tag to identify tokens with higher volatility and potential risks that may no longer meet the exchange’s listing criteria in the future. This tag serves as a precautionary measure to inform investors about tokens that could face delisting.

“Keep in mind that tokens with the Monitoring Tag are at risk of no longer meeting our listing criteria and being delisted from the platform,” Binance warned.

Regulatory Compliance and Project Evaluation

Tokens marked with the Monitoring Tag must undergo periodic assessments, including quizzes every 90 days on the Binance Spot and Binance Margin platforms. This ensures that traders are aware of associated risks and are prepared for potential changes in token status.

The criteria for assessing these tokens include evaluating the project team’s commitment, ongoing development efforts, trading volume, liquidity, and network stability. Additionally, Binance scrutinizes responses to due diligence requests and monitors for any signs of unethical or fraudulent activities within token projects.

Positive Update: Tokens Removed from Monitoring

In a positive update, Binance has removed Enzyme (MLN) and Horizon (ZEN) from the monitoring list, indicating these tokens have demonstrated stability and compliance with Binance’s standards. This removal alleviates immediate concerns about their future on the exchange.

This strategic decision by Binance aims to enhance the tokens’ market visibility and attractiveness to both institutional and retail investors seeking reliable investment opportunities in cryptocurrencies.

Binance Raises Flags: Impact of Monitoring Tags on 11 Altcoins

The announcement of Binance placing monitoring tags on 11 altcoins has immediately impacted the market, with several affected coins experiencing significant price declines. This reflects investor concern and rapid adjustments in trading strategies due to heightened delisting risks. Market participants are closely monitoring these developments amidst evolving global regulatory landscapes.

Binance’s decision to monitor these altcoins aligns with a broader trend towards increased regulatory scrutiny and compliance within the cryptocurrency industry. Exchanges are under growing pressure to ensure listed assets meet strict standards of transparency, security, and regulatory compliance. This proactive stance underscores the importance of adhering to regulatory standards to maintain market trust and stability.

The affected altcoins represent a diverse array of projects, each navigating unique challenges amid evolving regulatory environments. While specific reasons for the monitoring tags are undisclosed, Binance’s actions emphasize its role in protecting investor interests and upholding market integrity.

Industry analysts anticipate increased market volatility following the implementation of these monitoring tags. Investors are advised to proceed with caution, conduct thorough research on the affected altcoins, and remain updated on potential regulatory impacts and market dynamics. This approach is crucial for making informed decisions in volatile market conditions.

Conclusion

In conclusion, Binance’s decision to monitor 11 altcoins for potential delisting underscores the exchange’s commitment to regulatory compliance and market stability. These monitoring tags highlight the cryptocurrency industry’s challenges amidst evolving regulations and investor expectations. By implementing proactive risk management measures, exchanges like Binance bolster the credibility of the digital asset marketplace. Investors should remain vigilant amid dynamic market conditions, staying informed about regulatory changes and exchange policies that could impact their cryptocurrency investments. For more insights and trading strategies, stay tuned to BIT Journal for the latest developments in the cryptocurrency space!