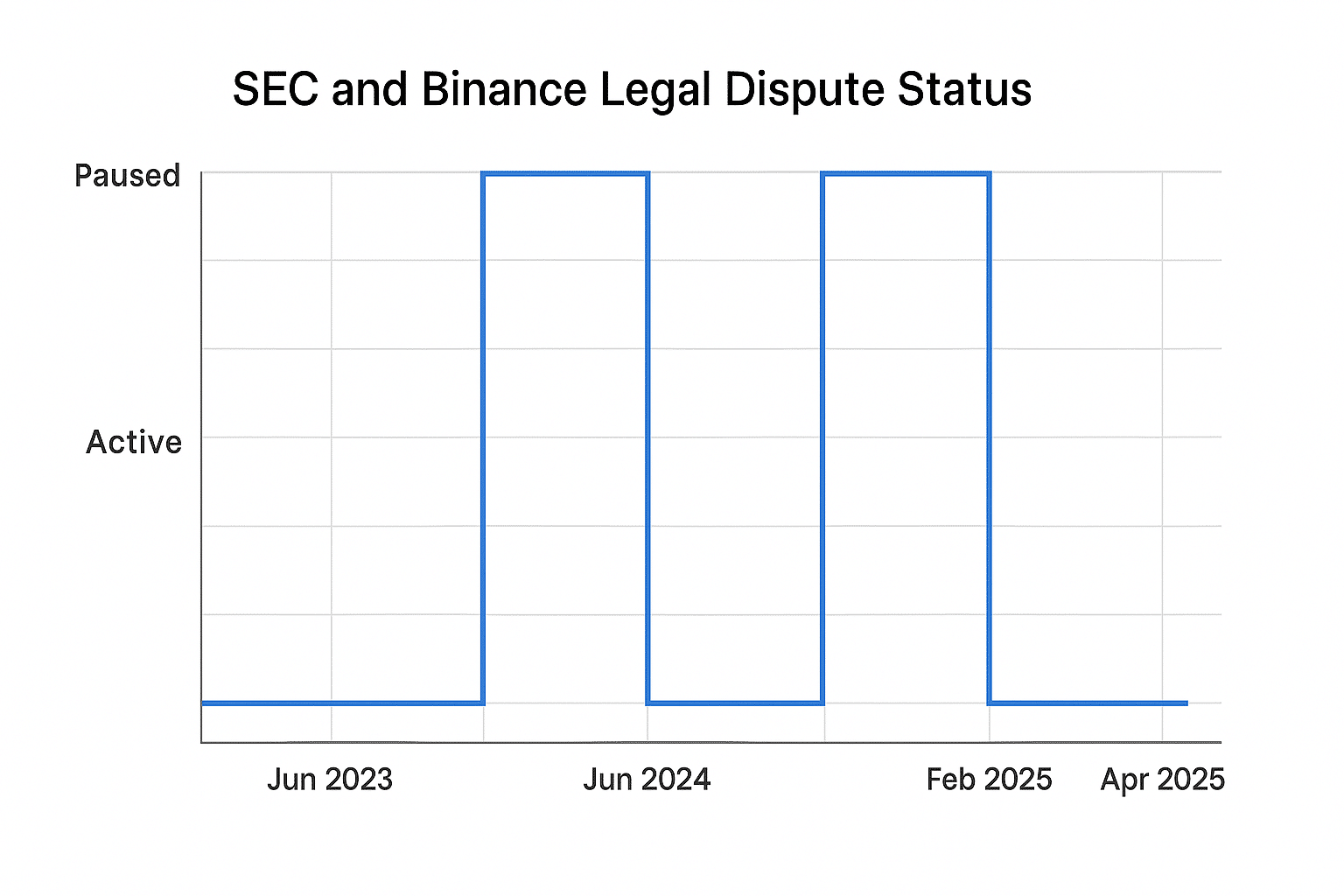

In a joint motion filed, the U.S. Securities and Exchange Commission (SEC) and cryptocurrency exchange Binance have requested a further 60-day pause in their ongoing legal dispute. This marks the second such request this year, following a previous extension granted in February.

The motion, submitted to the U.S. District Court for the District of Columbia, cites “productive discussions” between the parties and the potential impact of the SEC’s newly established Crypto Task Force on the case’s direction. The filing states,

“Since the Court stayed this case, the Parties have been in productive discussions, including discussions concerning how the efforts of the crypto task force may impact the SEC’s claims.”

The SEC initiated the extension request, with Binance agreeing that continuing the stay is appropriate and in the interest of judicial economy. This collaborative approach suggests a shift towards a more conciliatory resolution process.

Background of the Binance and SEC’s Legal Dispute

The SEC’s lawsuit against Binance, filed in June 2023, alleges that the exchange operated as an unregistered securities exchange in the U.S., among other violations. The case has been a focal point in the broader regulatory scrutiny of the cryptocurrency industry.

The recent change in SEC leadership, with Acting Chair Mark Uyeda taking over from Gary Gensler in January 2025, has led to a reevaluation of the agency’s approach to crypto regulation. The formation of the Crypto Task Force aims to clarify regulatory frameworks and foster constructive engagement with the industry.

Strategic Pause or Legal Stalemate?

While the joint motion suggests constructive dialogue, legal analysts argue this pause could also be a strategic move by both parties to reassess their positions amid a shifting regulatory landscape.

The SEC’s evolving stance, especially following leadership changes and the formation of the Crypto Task Force, may indicate a broader pivot toward regulatory clarity instead of courtroom showdowns.

On the other hand, Binance might view this delay as a chance to realign its legal defense and reinforce compliance measures to better negotiate potential outcomes.

“This is more than just a procedural delay,” commented blockchain legal expert Linda Howard. “It could signal a moment of recalibration for both sides, potentially setting the tone for future crypto enforcement actions in the U.S.”

Implications for the Cryptocurrency Industry

The joint request for an extended pause reflects a potential shift in the SEC’s enforcement strategy, moving from aggressive litigation towards collaborative resolution. This development may set a precedent for how the agency handles similar cases in the future, signaling a more nuanced approach to crypto regulation.

Conclusion

The SEC and Binance’s joint motion for a 60-day pause underscores ongoing efforts to resolve complex regulatory issues through dialogue and cooperation. As the Crypto Task Force continues its work, the outcome of this case could have significant implications for the future of cryptocurrency regulation in the United States.

FAQs

What is the SEC’s lawsuit against Binance about?

The SEC alleges that Binance operated as an unregistered securities exchange in the U.S., among other regulatory violations.

Why have the SEC and Binance requested a pause in the legal proceedings?

Both parties cited productive discussions and the potential impact of the SEC’s Crypto Task Force on the case’s direction as reasons for the requested pause.

What is the SEC’s Crypto Task Force?

Established in January 2025, the Crypto Task Force aims to clarify regulatory frameworks and foster constructive engagement with the cryptocurrency industry.

Glossary of Key Terms

SEC (Securities and Exchange Commission): A U.S. federal agency responsible for enforcing laws against market manipulation and protecting investors.

Binance: One of the world’s largest cryptocurrency exchanges, offering a platform for trading various digital assets.

Crypto Task Force: A specialized group within the SEC focused on developing regulatory frameworks for the cryptocurrency industry.

Joint Motion: A legal document filed by both parties in a lawsuit requesting a specific action from the court.

Judicial Economy: A principle aimed at promoting efficient use of judicial resources by avoiding unnecessary litigation.