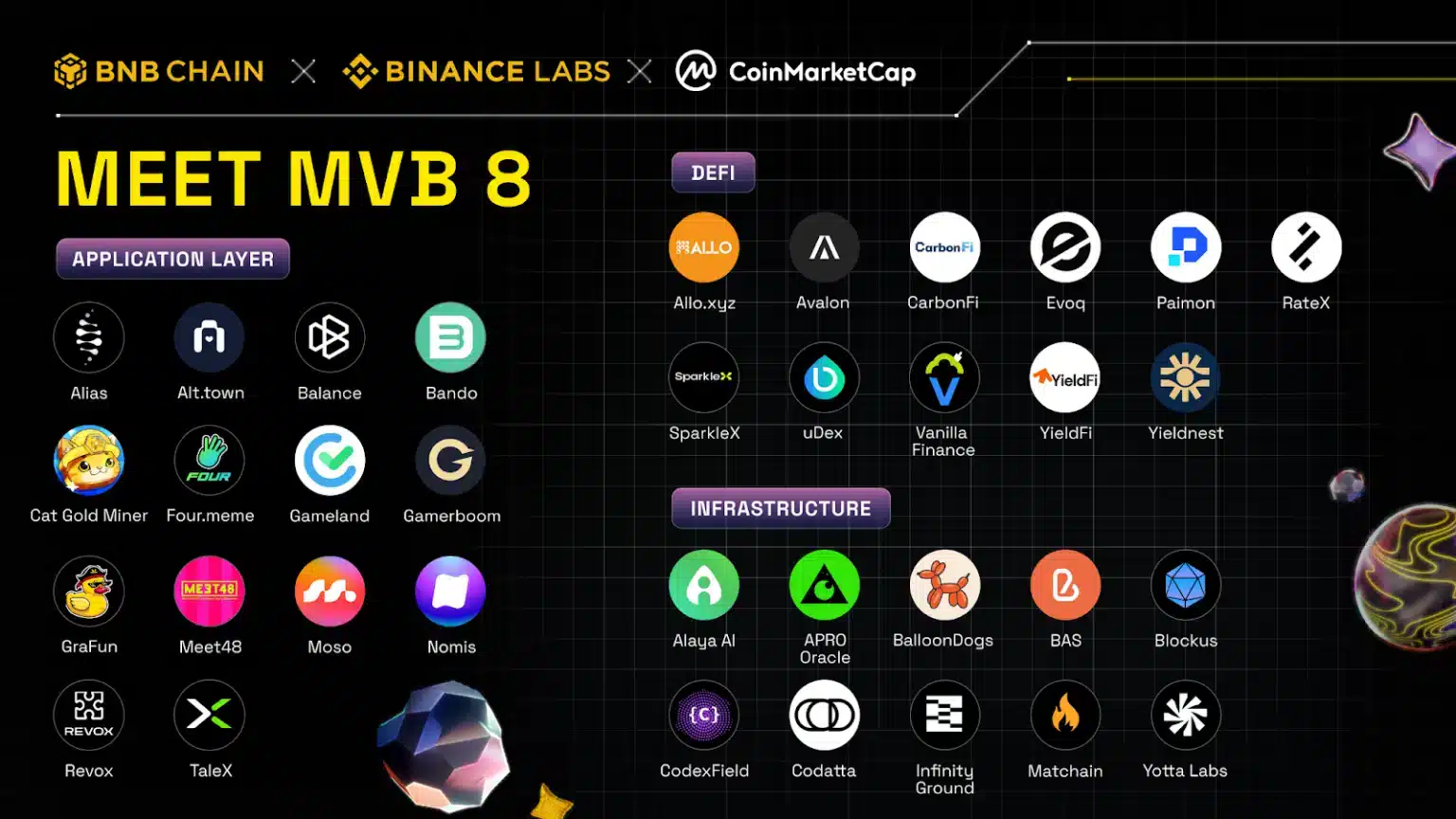

BNB Chain, in partnership with Binance Labs and CMC Labs, has launched the Most Valuable Builder (MVB) program to identify and support potential investment opportunities. Aiming to highlight the most promising projects, Binance has revealed the 35 finalists for the program’s eighth season.

MVB Program Sees High Demand with 35 Finalists Chosen

With over 500 applications, the MVB program continues to draw significant attention. However, only 35 projects made it to the final round. These projects are seen as potential candidates for investment from Binance Labs. BNB Chain has categorized these 35 promising projects into three primary sectors: Application Layer, DeFi, and Infrastructure. One standout feature of MVB Season 8 is the broad application of AI technology across multiple projects. Additionally, categories like meme coins, real-world assets (RWA), and projects leveraging Telegram applications are also prominent this season.

Selected projects will receive comprehensive support, including mentorship, funding opportunities, and technical assistance. They will also have access to a wide network of industry experts and potential partners. After a four-week training program, Binance Labs will review project presentations and decide on potential investments. Gala Wen, BNB Chain Ecosystem Development Director, remarked:

“This season’s expanded curriculum and Binance Labs investment potential equip entrepreneurs with the tools and insights they need to succeed. We’re excited to see how these promising projects evolve and contribute to the growth of the Web3 ecosystem on BNB Chain.”

Previous MVB Program Successes

Looking back at MVB Season 7, there were 700 applications, but only 13 projects were accepted, and just five received investment from Binance Labs. While this season saw a decrease in applications to 500, the emphasis on quality projects over quantity is evident.

Growing Interest in Advanced Projects

Binance Labs Investment Director Alex Odagiu recently highlighted the importance of advanced projects in a crowded market. “Projects with strong technological innovation, solid product-market fit, and sustainable revenue models continue to stand out despite the crowded market,” he explained. According to Cryptorank, Binance Labs has participated in 47 investment rounds this year alone. The firm’s portfolio has a particular focus on sectors like AI (22.22%), restaking (16.7%), and Layer-1 (11.1%).

For more updates on Binance Labs and the crypto investment landscape, stay tuned to The Bit Journal.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!