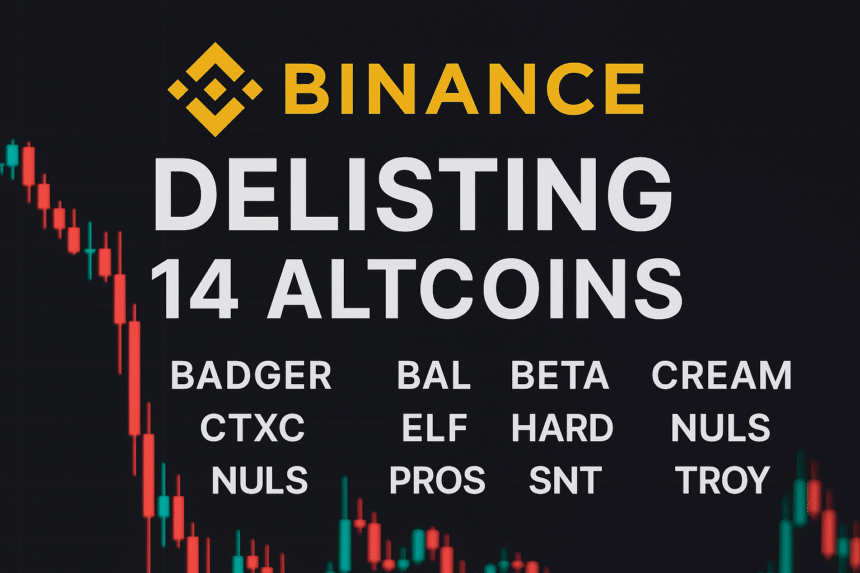

In a stunning announcement that rippled across the cryptocurrency industry, Binance revealed it will delist 14 altcoins from its platform on April 16, 2025. The move comes after a community-driven “Vote to Delist” process, raising questions about the performance, credibility, and long-term viability of the affected tokens.

These 14 Tokens Will Be Removed from Binance

According to Binance’s official statement, the following tokens will be delisted from the spot market:

BADGER, BAL, BETA, CREAM, CTXC, ELF, FIRO, HARD, NULS, PROS, SNT, TROY, UFT, VIDT

All trading pairs involving these tokens will be terminated, marking a significant shift for holders and traders. The delisting follows Binance’s internal assessment of each project’s developer activity, transparency, liquidity, and community engagement.

Why Binance Is Delisting These Tokens

Binance noted that the decision was not made lightly. Key reasons behind the delistings include:

Poor liquidity and trading volume

Lack of ongoing development or community interaction

Potential indicators of fraud or team disengagement

Failure to meet Binance’s listing standards over time

While some projects received higher votes in the poll, such as UFT, HARD, and CTXC, Binance emphasized that internal due diligence outweighed vote counts when determining final outcomes.

Key Dates and Deadlines for Users

The delisting process will be executed in phases, and Binance has issued the following timeline:

April 14, 2025: Margin and futures trading for the affected assets will be suspended

April 15, 2025: Copy trading and related services will be halted

April 16, 2025: All spot trading pairs involving the 14 tokens will be removed

Withdrawals for these assets will remain open until June 9, 2025. After that date, Binance may convert any remaining balances into stablecoins, although this is not guaranteed.

What the Vote Revealed About Market Sentiment

The “Vote to Delist” saw a total of 103,942 votes, with 10,262 deemed invalid. Among the valid ballots, tokens like TROY, PROS, and SNT received significant support for removal, indicating a clear sentiment among users to clean up underperforming assets.

This voting mechanism not only empowers the community but also introduces a layer of democratic oversight into Binance’s listing process.

Risk Warning and Portfolio Impact

In line with its investor protection efforts, Binance has advised users to close open positions such as leverage trades or automated trading bots tied to the delisted assets. The Bit Journal recommends investors reassess their portfolios immediately, particularly those exposed to these 14 tokens.

Price volatility is expected, and the broader market may also see ripple effects as other exchanges observe Binance’s lead.

What Comes Next?

Binance’s decisive move is likely to spark similar evaluations across other platforms. With regulatory scrutiny and investor protection gaining momentum globally, this might be the beginning of a more mature and compliance-driven era for digital asset listings.

Stay tuned to The Bit Journal for real-time updates and in-depth analysis of this developing story.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!

References & Sources

Binance Official Announcement

“Binance Will Delist Multiple Tokens on April 16, 2025”

https://www.binance.com/en/support/announcementCoinDesk

“Binance Delists 14 Tokens Following Community Vote”

https://www.coindesk.com