Binance, the crypto exchange, has stated that it will no longer handle four altcoins: BarnBridge (BOND), Dock (DOCK), Mdex (MDX), and Polkastar (POLS). These altcoins will be delisted on July 22 at 03:00 UTC, resulting in a dramatic decline in market value.

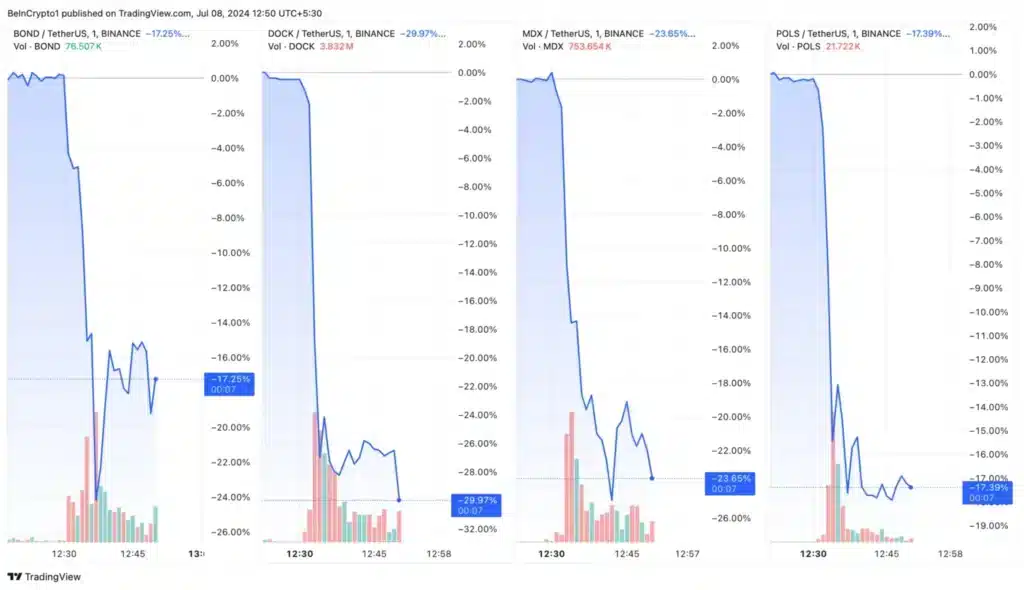

This price action demonstrates the market’s sensitivity to exchange delistings and regulatory measures. Following the news, the concerned tokens experienced huge price drops. DOCK fell nearly 30%, MDX dropped 23.65%, while BOND and POLS both lost more than 17%.

The delistings are part of Binance’s regular reviews. Frequently, it adds tokens to the monitoring tag before delisting them. For example, on July 1, Binance added 11 altcoins to its monitoring tag, including DOCK and POLS.

“At Binance, we periodically review each digital asset we list to ensure that it continues to meet a high level of standard and industry requirements,” Binance explained.

The analysis focuses on numerous crucial elements, including the project team’s dedication, trading volume, liquidity, network security, and responsiveness to due diligence requests.

Trading pairs such as BOND/BTC, BOND/USDT, DOCK/BTC, DOCK/USDT, MDX/USDT, and POLS/USDT will be halted, and any outstanding trade orders will be automatically withdrawn following delisting.

Users must withdraw their tokens by October 22, 2024. If not, Binance may convert the delisted tokens to stablecoins, although this is not guaranteed and will be subject to future notification.

Furthermore, Binance is making changes throughout its services to completely phase out certain cryptocurrencies. These changes include delisting from Binance Simple Earn and Auto-Invest, discontinuing margin trading for these tokens, and removing them from Binance Convert and Binance Pay on specific dates.

Reasons Behind Delisting Remain Unclear

The actual reasons remain unclear, but the information provided by the official statement hints at some of the following. When Binance conducts these reviews, it considers various factors influencing the decision to delist a digital asset. Key factors include the commitment of the team to the project, the level and quality of development activity, trading volume and liquidity, stability, and safety of the network from attacks, as well as network or smart contract stability.

Additionally, they evaluate the level of public communication, responsiveness to periodic due diligence requests, and any evidence of unethical or fraudulent conduct or negligence. New regulatory requirements and the asset’s contribution to a healthy and sustainable crypto ecosystem are also considered.

The Impact On Investors

Investors holding these delisted coins have several options. They can sell their holdings on Binance before the delisting date. Alternatively, they may transfer the delisted coins to a smaller exchange that still supports them, though it is important to research the reputation and security of such platforms beforehand.

Another option is to hold onto the delisted coins with the possibility that the projects behind them might revive and lead to a price increase in the future. However, this strategy carries significant risk and no guarantee of success.

Binance Delists Altcoins: What Next?

The delisting of BarnBridge (BOND), Dock (DOCK), Mdex (MDX), and Polkastar (POLS) from Binance underscores the volatility and regulatory sensitivities within the cryptocurrency market. Investors affected by these changes have multiple options, including selling their assets on Binance before the delisting date, transferring them to other exchanges, or holding onto them with hopes of future revival.

Each choice carries its own set of risks and considerations. Binance’s periodic reviews and subsequent delistings highlight the importance of due diligence and adaptability for both the exchange and its users in navigating the evolving crypto landscape.

As evidenced by this event, diversification is crucial for cryptocurrency investors. Allocating investments across reputable and established coins can reduce exposure to risks linked to specific project setbacks or exchange-related issues.